U.S. stocks closed firmly in the red Wednesday, although a late-session rally lifted markets from their early session lows, extending a weekly decline that has mirrored a surge in Treasury bond yields and a lack of risk appetite amongst global investors heading into the final stretch of a deadlocked presidential election.

The S&P 500 finished 53.8 points, or 0.92% lower on the session, with Dow down 409 points and the Nasdaq falling 296 points, or 1.6% amid twin declines for heavyweights Apple and Nvidia.

In the bond market, benchmark 10-year Treasury note yields hit a three-month high of just under 4.25%, but pulled back in the afternoon session to around 4.235%.

"After another run to record highs, the US market has taken a breather so far this week as bond yields jumped," said Daniel Skelly, head of Morgan Stanley's Wealth Management market research and strategy team.

"That shouldn’t be surprising. Despite the possibility of more volatility as we get deeper into earnings season and close in on the November election, the market’s longer-term outlook remains solid," he added. "And even though this week’s move is a reminder that even the strongest trends have setbacks, so far, this has been a run-of-the-mill pullback for the major indexes."

Updated at 12:33 PM EDT

Sour Apple

Apple (AAPL) share moved firmly lower in early afternoon trading after a closely-tracked analyst published a muted outlook for iPhone 16 sales over the coming year.

Taiwan-based Apple analyst Ming-Chi Kuo said orders for the newly launched smartphone have been cut by around 10 million for the fourth quarter of this year and into the first half of 2025, triggering an overall production decline of 4 million units by the world's biggest tech company

"Some market participants are optimistic that Apple Intelligence could dramatically boost iPhone shipments soon," Ming-Chi wrote. "However, Apple’s recent order cuts suggest this optimistic expectation may not materialize in the short term."

"I believe that Apple is best positioned to succeed in on-device AI, and I am confident about the long-term potential for Apple Intelligence to become a popular paid service," he added. "However, significant growth in iPhone shipments will likely require further hardware innovation to accompany this AI development."

Apple shares were marked 2.4% lower in early afternoon trading to change hands at $230.18 each.

Updated at 10:35 AM EDT

Nvidia: 'My bad'

Nvidia shares slipped lower in early trading as CEO Jensen Huang rejected reports of tension between the chipmaker and its key contract supplier, Taiwan Semiconductor (TSM) .

Huang told reporters in Denmark that design flaws in the group's new Blackwell line of chips and processors, which caused a delay in launch times, were entirely the fault of Nvidia engineers and not related to any assembly activist at TSMC.

"It was 100% Nvidia's fault," Huang said during an event launch for his company's new Gefion supercomputer.

"In order to make a Blackwell computer work, seven different types of chips were designed from scratch and had to be ramped into production at the same time," he added. "What TSMC did, was to help us recover from that yield difficulty and resume the manufacturing of Blackwell at an incredible pace."

Nvidia shares were last marked 2.5% lower on the session and changing hands at $140.15 each.

Updated at 9:34 AM EDT

Soft open

The S&P 500 was marked 21 points lower, or 0.36%, in the opening minutes of trading, with the Nasdaq slipping 92 points, or 0.49%.

The Dow, meanwhile, fell 270 points while the mid-cap Russell 2000 fell 10 points, or 0.45%.

Benchmark 10-year Treasury note yields added another 2 basis points to trade at 4.246%, with 2-year notes pegged at 4.054%.

Updated at 8:53 AM EDT

Big Tech on deck

Microsoft (MSFT) shares edged higher in early trading ahead of the tech giant's first quarter earnings, which are set for next week, helped by a pair of bullish notes on the group's AI strategy.

Analysts expect Microsoft to post a bottom line of $3.06 per share for the three months ending in September, up 2.3% from the same period last year, with revenues rising 14.1% to $64.5 billion.

Microsoft shares, which have lagged most of their Mag 7 peers as well as the Nasdaq benchmark over the past six months, were marked 0.9% higher in premarket trading to indicate an opening bell price of $431.29 each.

Related: Analysts update Microsoft stock price targets ahead of Q1 earnings

Updated at 7:45 AM EDT

Boeing legacy

Boeing shares were active after the planemaker posed another big quarterly loss of around $6 billion and its new CEO said addressing quality, safety and debt issues will mean it will 'take time' to return the group to its former legacy.

Boeing reported an adjusted loss of $10.44 per share, just inside the Street's $10.50 forecast, on revenues of around $17.8 billion. The report, which also included an overall backlog of orders worth $511 billion, comes just hours before a crucial vote from its machinists' union on a new labor contract that could end a crippling strike.

"It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again," said CEO Kelly Ortberg. "Going forward, we will be focused on fundamentally changing the culture, stabilizing the business, and improving program execution, while setting the foundation for the future of Boeing."

Boeing shares were marked 0.43% lower in premarket trading to indicate an opening bell price of $159.20 each.

Updated at 6:49 AM EDT

Solid gains

AT&T shares moved lower after the wireless group posted a mixed set of third quarter earnings that included better-than-expected profits a modest miss on revenues.

AT&T also said it added around 403,000 new subscribers, paying a monthly bill, over the September quarter, a tally that came in just ahead of Wall Street forecasts and was powered by the group's offerings of premium high-speed data plans.

“We delivered another strong and consistent quarter, furthering our leadership in converged 5G and fiber connectivity,” said CEO John Stankey. “We are investing at the top of the industry, reducing debt and growing free cash flow year to date. These solid results give us confidence in reiterating our full-year consolidated financial guidance.”

AT&T shares were marked 1.5% lower in premarket trading at $21.18 each, a move that would still leave the stock up more than 23% for the year.

Check back for updates throughout the trading day

Stocks closed mixed over a muted Tuesday session, with the Nasdaq eking out a modest advance and the S&P 500 and the Dow Jones Industrial Average falling for a third consecutive session as investors digested a host of corporate earnings reports and Federal Reserve officials signaled a preference for a slow pace of rate cuts.

Election risks are also starting to affect markets, particularly in Treasury bonds, as investors see policies from both candidates as adding to the nation's near $36 trillion debt burden and potentially stoking inflation as the economy continues to outperform.

“Whilst markets appear to be pricing in a Trump victory, this has so far been painful for US Treasuries, with yields rising on long term bonds as investors worry about the sustainability of the fiscal situation," said Lindsay James, investment manager at Quilter Investors in London.

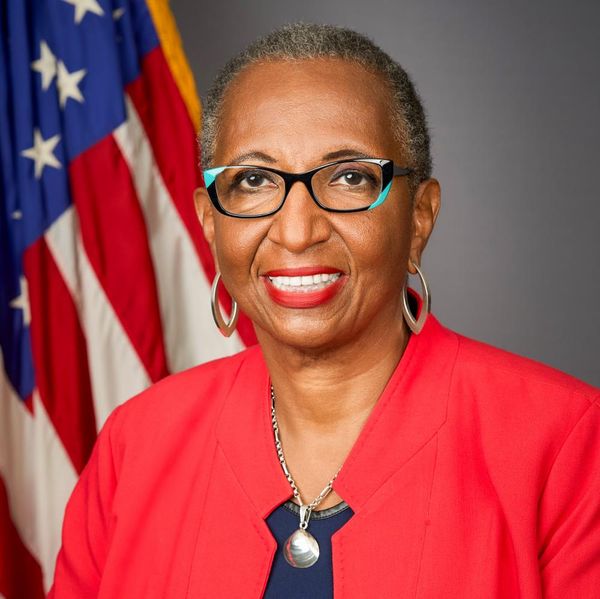

Cheng Xin/Getty Images

"With the Committee for a Responsible Federal Budget having warned that Trump policies could increase government debt by $7.5 trillion, compared to $3.5 trillion for Harris, it is clear that neither candidate is prepared to turn off the tap of spending - but could yet be forced by bond markets to reconsider," she added.

Benchmark 10-year Treasury note yields, which has risen around 60 basis points since the Fed's September rate cut, hit a fresh three month high of 4.231% in overnight trading, while 2-yeat notes pegged at 4.054%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.26% higher 104.351, the highest since late July.

Gold prices were also on the march, notching a fourth consecutive all-time high of $2,757.99 per ounce and putting the bullion on pace for its best year since 1979.

The sharp move higher in Treasury yields, and the surge in bond market volatility, will make this week's round of earnings updates even more difficult to navigate, with Boeing (BA) , T-Mobile (TMUS) , Coca-Cola (KO) and AT&T (T) reporting before the bell and Tesla (TSLA) and IBM (IBM) slated for after the close of trading.

Related: Tesla stock price slides ahead of Q3 earnings

Heading into the start of trading on Wall Street, futures contracts suggest an 11 point opening bell decline, while those linked to the Dow indicate 200 point pullback.

The tech-focused Nasdaq, meanwhile, is called 65 points lower with Tesla, Nvidia (NVDA) and Intel (INTC) trading in the red.

Starbucks (SBUX) shares were a notable early mover, falling 5% to $91.94 each after the world's biggest coffee chain pulled its 2025 profit guidance under new CEO Brian Niccol.

McDonald's (MCD) shares were also deeply in the red, falling 7% to $292.56 each, after an E. coli outbreak lied to the restaurant chain's U.S. operations killed at least one person and triggered serious illness in as many as 50 others.

More Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

In overseas markets, the Stoxx 600 was marked 0.08% lower in early Frankfurt trading amid another active earnings session, with Britain's FTSE 100 falling 0.24% in London.

Overnight in Asia, Japan's Nikkei 225 slipped 0.8% lower into the close of trading while the regional MSCI ex-Japan benchmark rose 0.19%.

Related: Veteran fund manager sees world of pain coming for stocks