Stocks finished lower in Thursday trading, as early gains tied to solid earnings from Nvidia were wiped out by uncertainties tied to tariff threats from the Trump administration that linger over global markets.

The Dow Jones Industrial Average fell 193.62 points, or 0.45%, to finish the session at 43,239.50, while the S&P 500 lost 1.59% to close at 5,861.57 and the tech-heavy Nasdaq dropped 2.78%, to end the day at 18,544.42, as AI chipmaker Nvidia tumbled 8.5%.

George Smith, portfolio strategist for LPL Financial, said the latest weekly sentiment survey data from the American Association of Individual Investors released today shows significantly bearish sentiment from investors, marking the fourth consecutive week of predominantly bearish sentiment.

“Concerns of an economic slowdown brought on by potential tariffs, stickier inflation, and the possibility of higher-for-longer interest rates, coupled with a meaningful pullback in the technology sector, namely artificial intelligence (AI) related stocks, has dented sentiment in recent weeks,” Smith said.

Updated at 1:03 PM EST

Bigger declines

The S&P 500 is now down 2 points, or 0.03%, on the session, with the Nasdaq down 153 points, or 0.81% to extends its one-month decline to around 2.2%.

"The longer trend remains positive, but uncertainty is rising as the tariffs loom large," said Louis Navellier of Navellier Calculated Investing.

"There are many factors in the wind from Trump 2.0: tax changes, a potential DOGE refund to taxpayers, and significant shrinkage of government spending," he added. "The fact that the S&P is only 2.8% below its recent all-time high with all these factors in play should be seen as a sign of strength."

$SPX with historical P/E values below. One thing is very clear - the market is very overvalued. $SPY Can it keep going? Yes, of course, but we are due for a correction - it **is** coming. pic.twitter.com/PccBTcnzYl

— dmac (@dana_marlane) February 27, 2025

Updated at 11:06 AM EST

Bear with us

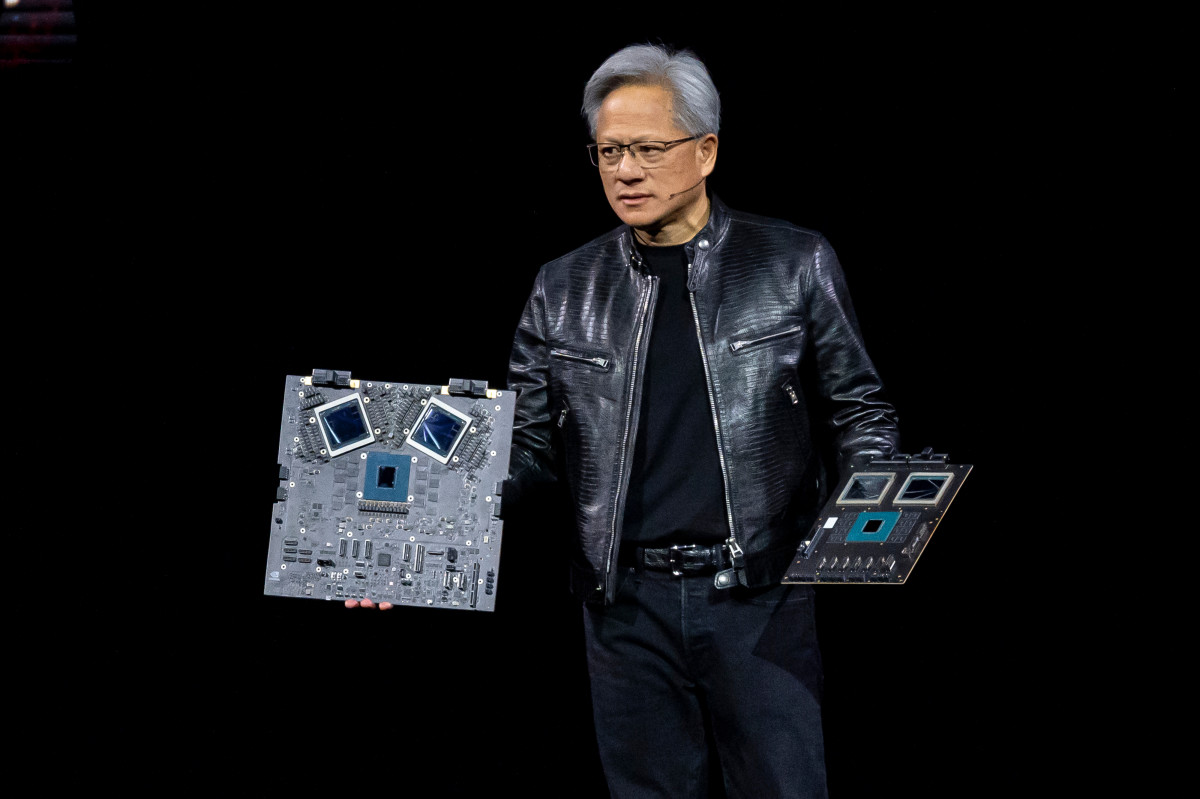

Nvidia shares reversed their earlier gains following a solid set of quarterly earnings that both underscored its dominance in the AI investment thesis and raised questions over the impact of ramping production of its top-of-the-line processors.

Nvidia topped Wall Street forecasts for its January-quarter earnings, the last of its fiscal year, by posting revenues of $39.3 billion a 78% surge compared to last year, and operating income of around $25.52 billion.

Even from those lofty tallies, Nvidia sees current-quarter revenues rising another 10% sequentially, to around $43 billion, amid what the company described as "rapidly rising demand for AI reasoning models and agents."

Nvidia shares were marked 4.06% lower in early Thursday trading to change hands at $126.42 each, a move that would extend the stock's year-to-date decline to around 8.7%.

Related: Analysts overhaul Nvidia stock price targets after Q4 earnings surprise

Updated at 9:38 AM EST

Green open for stocks

The S&P 500 was marked 28 points, or 0.48%, higher in the opening minutes of trading. The Nasdaq advanced 154 points, or 0.34%, with Nvidia gaining 0.66%.

The Dow gained 110 points and the midcap Russell 2000 edged 1 point, or 0.05%, into the green following the GDP, jobs and durable goods data releases.

"With Q4 GDP and Nvidia’s earnings report now in the rearview mirror, investor focus will shift to tomorrow’s PCE results," said Bret Kenwell, U.S. investment analyst at eToro.

"This report will be of particular interest, not just because it’s the Fed’s preferred inflation gauge, but because it comes after a higher-than-expected CPI report earlier this month," he added. "At the very least, if the economy is going to slow, investors will want to see inflation slow down too."

S&P 500 Opening Bell Heatmap (Feb. 27, 2025)$SPY +0.43% 🟩$QQQ +0.74% 🟩$DJI +0.13% 🟩 $IWM flat ⬜ pic.twitter.com/fU0JWQCWmm

— Wall St Engine (@wallstengine) February 27, 2025

Updated at 8:56 AM EST

New tariff threat

President Donald Trump said a 25% tariff on goods from Canada and Mexico would be imposed on March 4, clarifying comments in a cabinet meeting that suggested they could be delayed until April.

The president also said an additional 10% tariff would be applied to goods from China, although it was unclear whether this was a new duty on top of the ones he proposed last month.

Stocks immediately pared gains following the president's comments, with the Dow Jones Industrial Average now called 10 points lower and the S&P 500 priced for an 18 point advance.

45 minutes ago, Hassett told reporters that tariffs would not be implemented until April, and now Trump tweets that they will be in place in March.

— Andreas Steno Larsen (@AndreasSteno) February 27, 2025

Is anyone even in contact with him, or is he just firing off tweets from the hip while on the toilet? pic.twitter.com/36SFXhyJBR

Updated at 8:38 AM EST

Data dump

The U.S. economy grew at a 2.3% clip over the final three months of last year, the Commerce Department reported, an unchanged tally from its prior estimate, which was the weakest of the year.

The Atlanta Fed's GDPNow forecasting tool, which will be updated tomorrow, pegs the current growth rate at 2.3%.

The Labor Department, meanwhile, said jobless claims rose by 22,000 to 242,000 last week, a bigger-than-expected tally and the highest in three months. The total, however, doesn't include changes to the federal workforce from Trump's Doge efforts, as federal employees use a separate compensation program.

January durable goods orders, which are historically volatile on a monthly basis, rose 3.1%, but were unchanged from December once transportation sector orders were stripped away.

Stocks pared some of their gains following the data releases, with the S&P 500 called 32 points higher and the Nasdaq priced for a 146-point opening-bell gain.

Benchmark 10-year Treasury note yields eased 2 basis points to 4.285% and 2-year notes fell 2 basis points to 4.096%.

Initial Claims 4wk moving average jumps to the highest of the year pic.twitter.com/CPWEbgwBOd

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 27, 2025

Updated at 7:45 AM EST

Salesforce slide

Salesforce (CRM) shares pared some of their after-hours declines, but remain firmly in the red, following a muted 2025 revenue forecast from the cloud-focused customer-relations-management software group.

Salesforce, which is betting heavily on demand for its AI-powered platform Agentforce, sees full-year sales in the region of $40.5 billion to $40.9 billion, just behind Wall Street's $41.35 billion forecast. Fourth-quarter revenue also missed Wall Street forecasts.

"The monetization of Agentforce is still in the early stages of playing out and we believe that the company is taking a prudent approach to scaling that will pay off over the long term with the AI Revolution now entering the software phase," said Wedbush analyst Dan Ives.

Salesforce shares were marked 3.14% lower in premarket trading to indicate an opening bell price of $297.68 each.

Today, we announced our $CRM Q4 FY25 results and updated guidance.

— Salesforce (@salesforce) February 26, 2025

Take a look at the full earnings report: https://t.co/vyh8qNJtAT pic.twitter.com/jzX42GhaAK

Stock Market Today

Nvidia (NVDA) , the market's third-biggest stock, posted stronger-than-expected fiscal-fourth-quarter earnings after the close last night, while forecasting solid revenue gains over the coming months, as it continues to capitalize on the surge in AI investments from tech companies worldwide.

Its outlook, however, was only modestly firmer than analysts' estimates, while profit margins were expected to narrow, suggesting Nvidia's days of smashing Wall Street's forecasts may now be behind it.

"The powerful new Blackwell chips are more expensive to produce, and that’s putting pressure on Nvidia’s profit margins," said Kate Leaman, chief market analyst at Dublin-based AvaTrade. "While revenue is soaring, analysts are keeping a close eye on whether this margin squeeze could impact the company’s long-term profitability."

Shares in the group were marked 1.4% higher in premarket trading, but remain in negative territory for the year, while its Magnificent 7 peers notched modest premarket advances.

Markets are likely to shift focus Thursday to a series of data releases over the coming days, including a second look at fourth-quarter GDP growth, weekly jobless claims and Friday's January PCE inflation report, amid signals of a slowdown in the world's biggest economy.

The figures will arrive amid renewed concerns about the impact that tariffs, federal government job cuts and immigration policies will have on growth prospects.

During President Donald Trump's first cabinet meeting yesterday, he reiterated his vow to impose 25% levies on goods from Canada and Mexico, but created some confusion about when they'll be formally put in place. He also repeated his threat to place so-called reciprocal duties on goods arriving from Europe, as well as other major economies, later this spring.

Related: Nvidia earnings can kickstart a comeback for U.S. stocks

"There is growing confusion regarding the timing and extent of the tariffs the US administration will impose," said George Vessey, lead foreign exchange and macro strategist at Convera. "Trump stated that the 25% tariffs on Mexico and Canada would take effect on April 2 instead of the previously mentioned March 4 date."

"It remains unclear whether the president was granting these countries additional time or was confused about a different program," he added. "The series of contradictions has fueled investor skepticism about Trump’s policy agenda."

The U.S. dollar index was marked 0.2% higher against a basket of its global peers at 106.631 in overnight trading following Trump's cabinet meeting. Ten-year Treasury note yields were steady at 4.305% heading into the GDP and jobs data release at 8:30 am Eastern time.

On Wall Street, stocks are set for a solid open to follow-up last night's modest gains, with the S&P 500 priced for a 36 point advance and the Dow Jones Industrial Average called 130 points higher.

The Nasdaq, meanwhile, is priced for a 147 point advance thanks largely to Nvidia and the broader Magnificent 7 gains.

More Wall Street Analysis:

- Analyst revisits Palantir stock forecast after annual report filing

- Veteran analyst sounds the alarm on Google and Mag 7

- Veteran stock analyst delivers blunt 3-word message on tariffs

In overseas markets, Europe's Stoxx 600 fell 0.39% from yesterday's all-time highs amid the renewed tariff threats from the Trump administration, while a weaker pound helped the export-focused FTSE 100 rise 0.1% in midday London trading.

Overnight in Asia, Japan's Nikkei 225 rose 0.3% from the four-month low it touched earlier this week, while the regional MSCI ex-Japan benchmark gained 0.73% into the close of trading.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast