Stocks finished mixed Tuesday as the Dow fell and the Nasdaq bounced back from its biggest single-day decline in more than two months.

The Dow Jones Industrial Average lost 300 points, or 0.76%, to end at 39,112.16, while the S&P 500 gained 1.26% to finish at 5,469.30, and the tech-heavy Nasdaq advanced 1.26% to 17,717.65.

Nvidia shares climbed out of their slump to finish up nearly 7% to $126.09. On Monday, the AI chipmaker posted its biggest one-day slide since April 19.

Meanwhile, General Motors’ (GM) Cruise autonomous vehicle unit announced former Amazon (AMZN) and Microsoft (MSFT) executive Marc Whitten as its new CEO effective July 16.

Whitten was a founding engineer at Xbox and Xbox Live and while at Amazon, he was general manager and vice president across several of entertainment devices and services, including Fire TV, Kindle, and Amazon apps and entertainment services, Cruise said in a statement.

He comes onboard nearly nine months after one of the service's robotaxis dragged a pedestrian — who had just been struck by a vehicle driven by a human — across a street in San Francisco before coming to a stop.

Updated at 1:04 PM EDT

Solid bond auction

The Treasury sold $69 billion in new 2-year notes Tuesday in the first of three coupon auctions that will ultimately raise around $183 billion.

Demand for the sale was solid, with investors placing total bids of around $190 billion, generating a so-called bid-to-cover ratio of 2.75, well ahead of the 2.41 level recorded in May and the six auction average of 2.60.

Foreign investors, the Treasury said, took down 65.6% of the sale, up from 57.9% last month and the six month average of around 63.7%.

US 2-Year Note Sale:

— LiveSquawk (@LiveSquawk) June 25, 2024

- High Yield Rate: 4.706% (prev 4.917%)

- Bid-Cover Ratio: 2.75 (prev 2.41)

- Direct Accepted: 20.9% (prev 25.5%)

- Indirect Accepted: 65.6% (prev 57.9%)

- WI: 4.706%

Updated at 12:42 PM EDT

Cook on cuts

Fed Governor Lisa Cook put her hat in the dovish ring of central bank policymakers during a speech to the Economic Club of New York Tuesday, during which she suggested the likely need for a rate cut as inflation pressures ease and the labor market loosens.

“With significant progress on inflation and the labor market cooling gradually, at some point it will be appropriate to reduce the level of policy restriction to maintain a healthy balance in the economy,” Cook said.

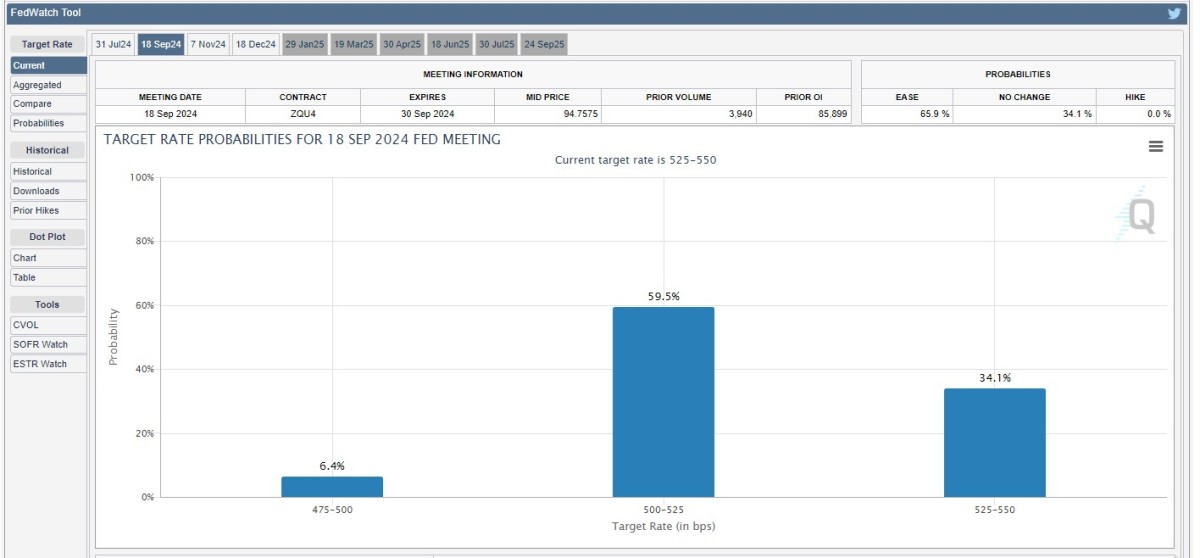

The CME Group's FedWatch still pegs the odds of a quarter point reduction in September at around 60%, with the chances of a follow-on cut before the end of the year just under 50%.

Rivian Leap

Rivian (RIVN) shares jumped higher in early trading following a bullish first note from Guggenheim that set a price target on the EV truckmaker of $18 per share.

Rivian shares were last seen 4.5% higher on the session at $11.50each, a move that still leaves the stock down more than 40% for the year.

Related: Analysts starts Rivian coverage with bullish stock price outlook

Updated at 10:09 AM EDT

Early boost

The Conference Board's benchmark reading of June consumer confidence slipped from the prior month's tally, but came in modestly ahead of forecasts at 100.4.

"Strength in current labor market views continued to outweigh concerns about the future. said chief economist Dana Peterson. "However, if material weaknesses in the labor market appear, Confidence could weaken as the year progresses."

US CB CONSUMER CONFIDENCE JUNE REPORT https://t.co/ihIc2X8AIn

— FinancialJuice (@financialjuice) June 25, 2024

Updated at 9:42 AM EDT

Early boost

The S&P 500 was marked 8 points, or 0.15% higher in the opening minutes of trading, with the Nasdaq rising 78 points, or 0.45%, thanks in part to an early 2.3% boost from Nvidia. The Dow, meanwhile, slipped 40 points.

S&P 500 Opening Bell Heatmap (Jun. 25, 2024)$SPY +0.14%🟩$QQQ +0.42%🟩$DJI -0.18%🟥$IWM -0.62%🟥 pic.twitter.com/aq3CDBXbCd

— Wall St Engine (@wallstengine) June 25, 2024

Updated at 8:00 AM EDT

The Spirit of Boeing

Boeing (BA) shares extended their monthly slump in early trading, falling another 1.3% on the back of a Bloomberg report that suggests the planemaker is looking to buy its fuselage supplier, Spirit Aerosystems (SPR) , for around $4 billion.

Reports have tied Boeing to Spirit for much of the past four months as the troubled planemaker looks to shore-up its supply chain and quality issues following a 737 Max door incident in January, but any deal could be delayed by EU objections that it would effect deliveries at state-backed Airbus.

$BA -1.17%, $SPR -3.45% [Boeing has offered to acquire Spirit AeroSystems in a deal funded mostly by stock that values its 737 fuselage supplier at about $35 per share — Bloomberg] https://t.co/qPWSeKa8rb

— notreload (@thudderwicks) June 25, 2024

Stock Market Today

Stocks ended lower on the Monday session, with Nvidia (NVDA) extending its three-day decline to around 13%, as investors took profits from high-flying chip stocks heading into the final days of a solid second quarter.

The Dow Jones Industrial Average, meanwhile, ended 260 points to the upside, to its highest level in a month, as investors rotated to industrial and financial names and exited some of the bigger tech and chip stocks.

Much of that interplay is likely to be repeated over the coming days, as portfolios are 'window-dressed' into the close of the quarter to best reflect performance over the past three months.

Investors also continue to focus on a key inflation reading Friday to close out the week.

Related: Nvidia stock pullback has markets on edge for S&P 500 correction

Tuesday's trading focus is likely to fall on Nvidia, which has lost more than $430 billion in value over the past three trading sessions, to determine whether its recent correction will have broader implications for the current record-setting rally.

Shutterstock

In the bond market, investors will eye the results of a $69 billion auction of new 2-year notes later in the session, as well as another slate of Federal Reserve speakers including Governor Lisa Cook.

Benchmark 10-year note yields were last seen little changed at 4.226% with 2-year notes pegged at 4.738%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.02% higher at 105.497 as the yen continues to test the 160 mark in overnight currency trading.

On Wall Street, futures contracts tied to the S&P 500 suggest an opening bell gain of around 13 points, with the Nasdaq called 95 points higher thank in part to early gains for Nvidia, Micron Technology (MU) and Apple (AAPL) .

Related: Analysts revisit Micron stock price targets ahead of Q3 earnings

Nvidia shares were last marked 3% higher in premarket trading to indicate an opening-bell price of $121.75.

The Dow, meanwhile, is set for a 20 point pullback. Microsoft (MSFT) was down 0.32% after European regulators said the tech giant was breaching antitrust rules by packaging its Teams app with its Office software.

More Economic Analysis:

- Stocks’ record setting rally may be on fumes

- Consumers tapping out amid sticky inflation and slowing job market

- Fed rate-cut timing shifts after retail sales data

In Europe, stocks were drifting lower following last night's selling on Wall Street, with the Stoxx 600 marked 0.32% to the downside and Britain's FTSE 100 sliding 0.18% in early London trading.

Overnight in Asia, the follow-on from Wall Street pulled the regional MSCI ex-Japan benchmark 0.4% lower into the close of trading, while the weakening yen gave more support to the Nikkei, which closed 0.95% higher in Tokyo.

Related: Veteran fund manager picks favorite stocks for 2024