Stocks pared earlier losses to finished higher Wednesday, after investors picked through details of a crucial August inflation report prior to the start of trading.

The Dow Jones Industrial Average gained 124.75 points, 0.31%, to end the session at 40,861.71, while the S&P 500 rose 1.07% to 5,554.13 and the tech-heavy Nasdaq advanced 2.17% to finish the day at 17,395.53.

Stocks initially fell after the core reading on the consumer price index, which strips out volatile food and energy categories, rose slightly more than expected, dampening hopes for a half-point rate cut from the Federal Reserve.

"Inflation trends will give the Fed opportunity to pivot toward the employment mandate for the rest this year," said Jeffrey Roach, chief economist for LPL Financial.

"Given the stickiness of services inflation, the Fed will likely cut by 25 basis points in the upcoming meeting and reserve the potential for more aggressive action later this year if we have further deterioration in the job market," Roach added.

Updated at 1:17 PM EDT

Bond boost for homebuyers

The bond market's long summer rally, which has dragged 2-year note yields to the lowest levels in more than two years, is having a big impact on mortgage rates, as well, and could be precursor to the stimulative impact of Federal Reserve rate cuts.

The Mortgage Bankers' Association said 30-year mortgage rates fell to the lowest level since February of last year, and, at 6.29%, are now nearly a full percentage point lower than their late April peak.

"Treasury yields have been responding to data showing a picture of cooling inflation, a slowing job market, and the anticipated first rate cut from the Federal Reserve later this month,” said Joel Kan, the MBA’s vice president and deputy chief economist.

Benchmark 10-year Treasury note yields were last seen trading at 3.667% following a solid auction of $39 billion in new notes, while 2-year paper was pegged at 3.648%.

Related: Mortgage rates make a huge move as bonds surge

Updated at 11:12 AM EDT

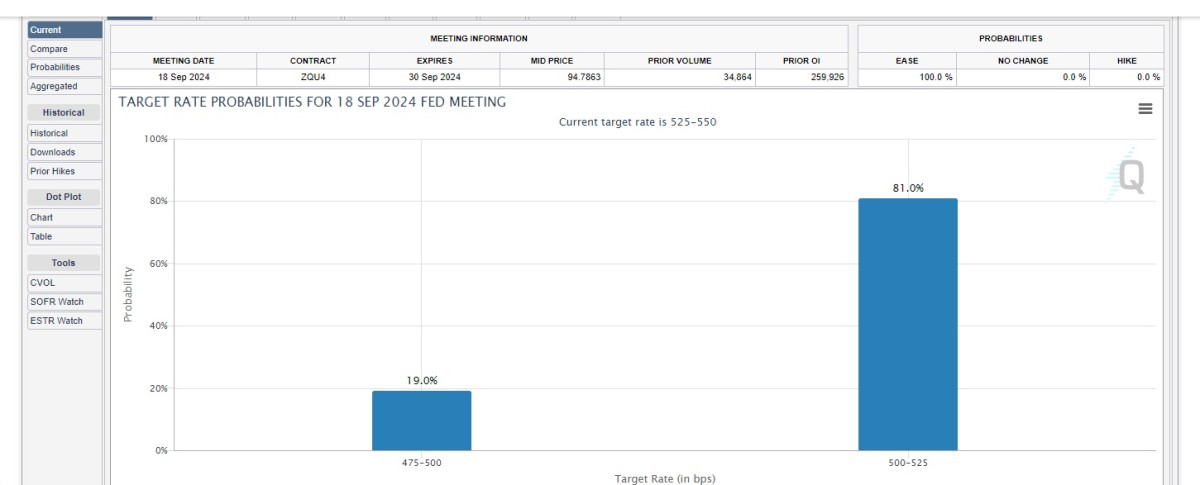

Goodbye 50 basis points

The hotter-than-expected reading for core inflation in August, as well as the ongoing surge in housing and shelter costs, is erasing bets on a big Fed rate cut next week and pulling stocks sharply lower into the mid-day session.

The S&P 500 was last marked 70 points lower, taking the benchmark's September decline to around 4.2%, with the Dow tumbling 613 points amid the ongoing pullback in bank stocks.

The Nasdaq, meanwhile, was last marked 150 points lower, or 0.89%, taking its month-to-date decline to around 4.7%.

"We think prospects for a gradual – rather than aggressive – rate cutting cycle should be embraced by investors," said Elyse Ausenbaugh, head of investment strategy at J.P. Morgan Wealth Management. "That would reflect broader economic health, and a normalization of activity as the vestiges of pandemic-era distortions fizzle away."

"With consensus fully embracing the direction of travel, we’re encouraging investors to focus on what can be done to limit reinvestment risk in portfolios as cash yields head lower," she added. "From here, our energy might be better spent debating what the neutral or terminal rate might be in a soft landing scenario rather than the pace at which we get there."

Updated at 9:50 AM EDT

Soft open

The S&P 500 was marked 28 points lower, or 0.52% in the opening minutes of trading, with the Nasdaq edging 13 points, or 0.07%, into the red following the muted August inflation report.

The Dow was marked 432 points lower while the small cap Russell 2000 fell 14 points, or 0.68%.

"This is the last major piece of data the Fed will have ahead of its rate decision next week," said Jason Pride of Glenmede. "Although the top-line figures were a little hotter than expected, they are unlikely to knock the Fed off its path to a rate cut next week."

"However, this CPI report may be another reason for the Fed to take it slow with a 25 basis point cut rather than a 50 basis point cut," he added.

S&P 500 Opening Bell Heatmap (Sept. 11, 2024)$SPY -0.43%🟥$QQQ -0.06%🟥$DJI -0.88%🟥$IWM -0.90%🟥 pic.twitter.com/wjXrXJqCeg

— Wall St Engine (@wallstengine) September 11, 2024

Updated at 8:45 AM EDT

Pump the brakes

U.S. inflation pressures eased notably last month but stubborn core price pressures are likely to blunt bets on a big Fed rate cut next week in Washington.

Headline inflation slowed to 2.5% last month, the lowest since February of 2021, but the annual core reading held at 3.2% and was up 0.3% on the month.

U.S. stocks extended declines following the data release, with futures tied to the S&P 500 indicating an opening bell fall of around 22 points while those tied to the Dow Jones Industrial Average are priced for a 230 point pullback.

The tech-focused Nasdaq, meanwhile, was called 80 points lower.

Benchmark 2-year Treasury note yields jumped 8 basis points to 3.652% while 10-year notes were pegged at 3.668%.

Price changes over last year (August CPI report)

— Charlie Bilello (@charliebilello) September 11, 2024

Transportation: +7.9%

Shelter: +5.2%

Food away from home: +4.0%

Electricity: +3.9%

Medical Care: +3.2%

Overall CPI: +2.5%

Food at home: +0.9%

Gas Utilities: -0.1%

New Cars: -1.2%

Gasoline: -10.3%

Used Cars: -10.4%

Fuel Oil: -12.1%

Stock Market Today

Stocks ended mixed following a back-and-forth session on Tuesday, with tech stocks powering a modest afternoon advance in the S&P 500 and the Nasdaq following a notable pullback in Treasury yields and a slump in global oil prices.

The moves reflected growing concern about the fate of the U.S. economy, which has avoided recession despite one of the most aggressive cycles of Federal Reserve interest-rate hikes on record, heading into the final months of the year and beyond.

Stocks Wednesday will likely focus on the August Consumer Price Index inflation report, which is expected to show a notable decline in the headline reading. Core prices, which strip away food and energy costs, are seen holding steading at 3.2%.

The report, the last major data release prior to next week's Fed policy meeting, is likely to clarify market bets on near-term rate cuts.

Investors are also likely to adjust their risk appetite on the basis of last night's presidential debate, which saw Vice President Kamala Harris put in a strong performance against her rival, former President Donald Trump. In a sharp-elbowed contest, the candidates touched on the economy, foreign policy and their domestic agendas.

Related: Bond market sends startling signal for stocks

Heading into the start of the trading day, futures contracts tied to the S&P 500 suggest a 17-point opening-bell decline, with those tied to the Dow Jones Industrial Average priced for a pullback of around 162 points.

The tech-focused Nasdaq, meanwhile, is called 60 points lower, with Nvidia (NVDA) , Tesla (TSLA) and Apple (AAPL) all trading in the red.

Other stocks on the move include Trump Media & Technology Group (DJT) , the owner of former President Trump's Truth Social website, which tumbled 14.9% following last night's debate.

Bank of America (BAC) shares extended their recent run of declines, falling another 0.97% in premarket. The move followed another share sale by the billionaire investor Warren Buffett, who has shed more than 7.1 billion in shares of the lender since mid-July.

JP Morgan Chase (JPM) shares were trading in the red as well, falling another 0.5% in the premarket following yesterday's 5.2% slump, which was tied to a muted near-term outlook presented at a banking event yesterday in New York.

In the bond market, benchmark 2-year-note yields hit the lowest levels in more than two years in overnight trading and were last changing hands at 3.561% ahead of today's inflation report.

Benchmark 10-year notes, meanwhile, slipped to 3.607% ahead of a $39 billion auction of new notes later in the session.

More Wall Street Analysts:

- Analyst says Intel should drop a key business to survive

- Analysts adjust Bookings.com stock price target on travel market

- Analysts place bets on Las Vegas strip casino stocks

In overseas markets, Europe's Stoxx 600 was marked 0.12% higher in early Frankfurt trading ahead of tomorrow's European Central Bank rate decision, with the FTSE 100 down 0.05% in London.

Overnight in Asia, the regional MSCI ex-Japan benchmark slipped 0.29% into the close of trading, while the Nikkei 225 closed 1.49% lower in Tokyo.

Related: Veteran fund manager sees world of pain coming for stocks