Stocks ended mixed Tuesday, as investors braced for a series of top-tier corporate earnings while eyeing the start of the Federal Reserve's two-day policy meeting in Washington.

The Dow Jones Industrial Average gained 203.40 points, or 0.5%, to finish the session at 40,743.33, while the S&P 500 slipped 0.5%, and ended the day at 5,436.44 and the tech-heavy Nasdaq lost 1.28% to close at 17,147.42.

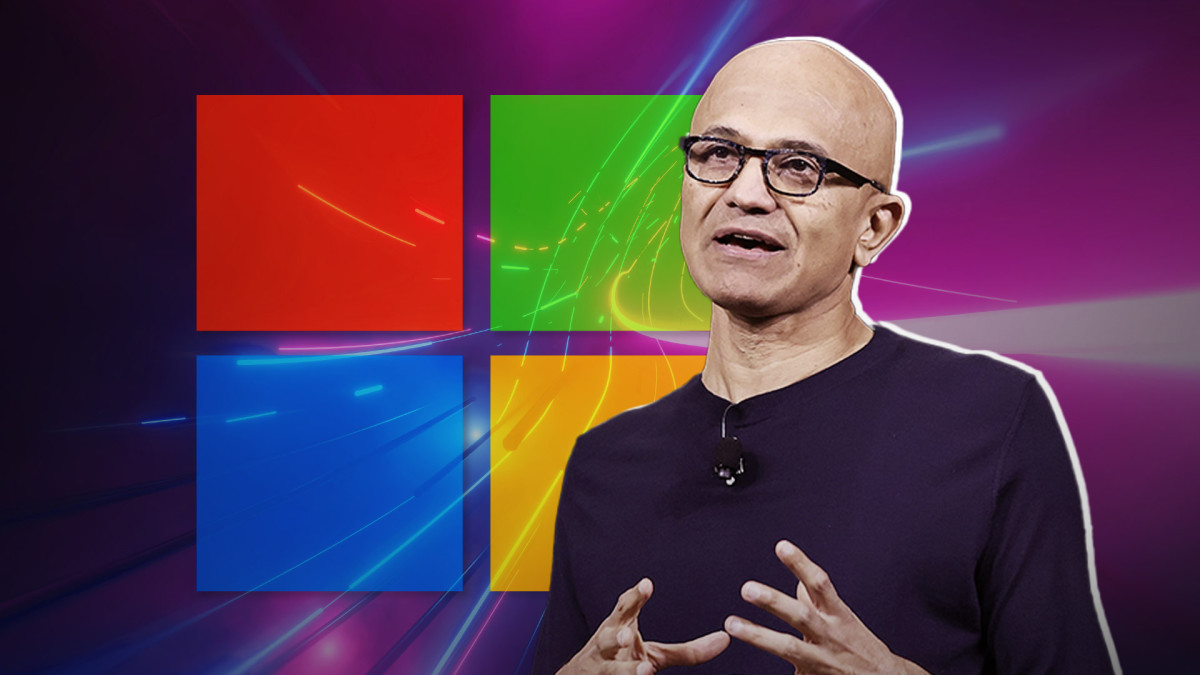

AI heavyweight Nvidia (NVDA) dropped 7%, while Microsoft was falling in after-market trading when the software giant beat Wall Street's earnings and revenue expectations, but came up short on its Intelligent Cloud revenue, which includes its Azure services.

The June Job Openings and Labor Turnover report, better-known as JOLTS, suggested the job market remained tight heading into the summer months.

“The June Quits rate within some lower paying jobs fell as these workers are less likely to voluntarily leave one job in search of another,” said Jeffrey Roach, chief economist for LPL Financial. “This is a sign that the labor market is cooling. However, quits rates continue to rise in professional and business services.”

Updated at 11:18 AM EDT

The biggest of Big Tech

Microsoft shares are moving lower into the tech giant's fourth quarter earnings after the close of trading, with investors focused on AI spending plans and growth in its Azure cloud division.

Microsoft shares were marked 1% lower in early trading to change hands at $422.77 each, a move that would peg the stock's year-to-date gain at around 13%.

Related: Microsoft earnings: Azure growth, AI spending key as big tech wavers

Updated at 10:05 AM EDT

Looking for work

The Labor Department said job opening fell modestly last month, with 8.184 million positions left unfilled, while the so-called quits rate held at 2.1%

The June Job Openings and Labor Turnover report, better-known as JOLTS, suggests the job market remained tight heading into the summer months, adding to concerns that wage pressures continue to feed into Fed inflation forecasts.

Benchmark 10-year Treasury note yields edged higher, to 4.182%, following the data release, with 2-year notes inching higher to 4.402% .

JOLTS openings about steady from May, stronger than estimates. Yields tick up.

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) July 30, 2024

8.184 millionhttps://t.co/p6vi6whLTI pic.twitter.com/H2cQm3c8N1

Updated at 9:39 AM EDT

Solid open

The S&P 500 was marked 20 points, or 0.37% higher in the opening minutes of trading, with the Nasdaq rising 68 points, or 0.39%.

The Dow gained 115 points to start the session, while the Russell 2000 gained 13 points, or 0.6%.

S&P 500 Opening Bell Heatmap (Jul. 30, 2024)$SPY +0.35%🟩$QQQ +0.43% 🟩$DJI +0.31%🟩$IWM +0.77%🟩 pic.twitter.com/rryc0su2RM

— Wall St Engine (@wallstengine) July 30, 2024

Updated at 8:50 AM EDT

Pfizer boost

Pfizer (PFE) shares jumped higher in premarket, and were trading in heavy volume, after the pharma giant lifted its full-year profit forecast as cancer treatment sales offset a slump in Covid vaccine sales.

Pfizer, which posted second quarter revenues of $13.3 billion, now sees full-year earnings in the region of $2.46 to $2.65 per share, a 30 cent improvement from its prior forecast, with around $3.5 billion in expected Paxlovid revenues.

Pfizer shares were last marked 1.7% higher $ 31.23 each in premarket trading, a move that would nudge their 2024 gain to around 5%.

Pfizer $PFE Reports Strong Second-Quarter 2024 Results And Raises 2024 Guidance

— Bertrand Delsuc (@BertrandBio) July 30, 2024

beat top/bottom, guidance raised for both revs & EPShttps://t.co/3BgFc1j7mi pic.twitter.com/WeY0y4xVp3

Updated at 8:03 AM EDT

Merck slide

Merck & Co. (MRK) shares slumped in early trading after the drugmaker cut its full-year profit forecast despite stronger-than-expected second-quarter earnings.

Merck, which saw sales of its blockbuster Keytruda cancer treatment rise 16% from a year earlier to $7.3 billion, sees full-year earnings in the region of $7.94 to $8.04 per share, a 60 cent reduction tied in part to charges linked to its $3 billion purchase of EyeBio.

Merck shares were marked 2.6% lower in premarket trading at $124.50, a move that would trim their 2024 gain to around 10%.

$MRK | Merck & Co Q2 24 Earnings:

— LiveSquawk (@LiveSquawk) July 30, 2024

- Adj EPS: $2.28 (est $2.16)

- Revenue: $16.11B (est $15.88B)

- Animal Health Sales $1.48B (est $1.5B)

- Adj Gross Margin 80.9% (est 80.8%)

- Sees FY Sales $63.4B To $64.4B, Saw $63.1B To $64.3B

Stock Market Today

Stocks finished modestly higher last night, with broader gains from a host of sectors outside the megacap tech names. Markets are easing into a hectic Wall Street week that will include jobs data, tomorrow's Fed rate decision, four megacap tech updates and Friday's crucial July jobs report.

Earnings are likely to take center stage today, however, with a host of blue-chip updates prior to the opening bell and highly anticipated reports from Microsoft (MSFT) and Advanced Micro Devices (AMD) after the close of trading.

Around 171 companies will report this week, the busiest of the season, as analysts look for collective second-quarter profits to rise 12.1% from a year earlier to just over $500 billion.

TheStreet/Shutterstock/Justin Sullivan/Getty Images

In the bond market, yields are holding steady as the Fed kicks off its two-day policy meeting in Washington, with benchmark 10-year notes trading at 4.174% and 2-year notes pegged at 4.396%.

The U.S. dollar index, meanwhile, was marked 0.007% higher against a basket of its global peers and trading at 104.569.

Few traders expect any surprise from the Fed when it unveils its statement at 2 pm Eastern Time tomorrow, but most expect Chairman Jerome Powell and his colleagues to guide the market towards at least two rate cuts between now and the end of the year, the first of which is almost certain to come in September.

The Labor Department will kick off a series of job market data releases today with its June Jolts report, a closely tracked tally of openings, quits and wage gains that the Fed relies on to calibrate its inflation projections.

Economists expect the report to show just over 8 million positions went unfilled last month, down from around 8.14 million in May.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 suggest a modest 10 point opening bell gain, with the Dow Jones Industrial Average called 65 points higher.

Related: Big tech earnings could save market rally or trigger summer slump

The tech-focused Nasdaq, meanwhile, is called 25 points higher, with early declines for Nvidia (NVDA) and Tesla (TSLA) holding down gains.

More Wall Street Analysts:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Analysts prescribe new Walgreens stock price targets after earnings

- Analyst revises Facebook parent stock price target in AI arms race

In Europe, a stronger-than-expected reading for second-quarter GDP, which showed the world's biggest economic bloc expanding at a 0.3% clip, gave regional stocks a boost.

The gains were tempered, however, by a reading that showed its largest economy, Germany, contracted by 0.1% over the three months ending in June.

The regionwide Stoxx 600 was marked 0.3% higher in early trading, with Britain's FTSE 100 slipping 0.25% in London thanks in part to muted global commodity prices.

Overnight in Asia, the Bank of Japan started its two-day policy meeting in Tokyo. Officials there are likely to discuss tapering the central bank's monthly bond purchases, which could signal only its second rate hike in 17 years.

The Nikkei 225 was marked 0.15% higher by the close of trading, with the region-wide MSCI ex-Japan index falling 0.49%.

Related: Veteran fund manager sees world of pain coming for stocks