Stocks finished lower Friday after the White House said President Donald Trump will impose 25% tariffs on imports from Canada and Mexico starting Feb. 1.

The Dow Jones Industrial Average fell 337.47 points, or 0.75%, to finish the session at 44,544.66, while the S&P 500 lost 0.50% to close at 6,040.53 and the tech-heavy Nasdaq gave up 0.28% to end the day at 19,627.44.

For the week, the S&P 500 and Dow finished 1% lower and 0.3% higher, respectively, according to CNBC, while the Nasdaq lost 1.6%.

The S&P 500 rose 2.7% in January, the Nasdaq advanced 1.6%, and the Dow gained 4.7%.

"I have to say that I did not expect President Trump to put a 25% tariff on two of our biggest trading partners," said Louis Navellier, chairman and founder of Navellier & Associates, "namely Canada and Mexico since I thought this was just a threat to get them to secure their borders."

"I now suspect that representatives from both Canada and Mexico will be in Washington, D.C., negotiating until the tariff threat is resolved." he added.

In addition to all the border security that Trump demanded, Navellier said that he suspects the president is going to now want some U.S. companies to “onshore” their manufacturing from Canada and Mexico.

Onshoring is a business practice that involves moving operations back to a company's home country

"So, if this is how President Trump treats our neighbors, I suspect that China, Europe, and other trading partners are even more nervous than Canada and Mexico, so more onshoring plans, like VW Group is investigating, may be underway," he said.

Updated at 2:52 PM EST

Friday decline

Stocks are moving lower into the close of the month, with the S&P 500 last marked 0.4% in the red, and around 80 points south of its intra-day peak, following President Trump decision to impose tariffs on goods from Canada, Mexico and China.

"I have to say that I did not expect President Trump to put a 25% tariff on two of our biggest trading partners, namely Canada and Mexico since I thought this was just a threat to get them to secure their borders," said Louis Navellier of Navellier Calculated Investing.

"I now suspect that representatives from both Canada and Mexico will be in Washington, D.C., negotiating until the tariff threat is resolved," he added.

Trump announces massive tariffs at 1:00 today. pic.twitter.com/epMObXm34w

— Ron Filipkowski (@RonFilipkowski) January 31, 2025

Updated at 1:30 PM EST

White House hits back

The White House has responded to Reuters' report of tariff delay, saying in a statement that levies of 25% will be placed on goods imported from China and Mexico, with a 10% duty placed on goods coming from China.

Tariffs are paid by the U.S.-based company that is importing the goods, not by the exporting country or company.

Stocks pared earlier gains following the White House statement, with the Dow Jones Industrial Average slipping into negative territory, and last marked 135 points lower on the session, and the S&P 500 shaving its advance to 0.27%.

Trump spox denies Reuters report on tariffs. "False." Says tariffs are still scheduled to be announced in 24 hours -- 25% on Canada and Mexico, 10% on China.

— Alexander Panetta (@Alex_Panetta) January 31, 2025

“These are promises made and promises kept by the president.”

Will oil be exempted? She says: “Those tariffs will be…

Updated at 1:09 PM EST

The levies of March?

President Trump is set to delay imposing tariffs on goods imported from Canada and Mexico until March 1, Reuters reported, to allow for both countries to negotiate exceptions from the 25% levy.

Citing people familiar with the White House plans, the report said any exemptions would be "few and far between" but noted the situation was "fluid" heading into tomorrow's Feb. 1 deadline.

Stocks were little-changed following the report, with the S&P 500 last marked 0.7% higher on the session and the Nasdaq riding solid gains from megacap tech stocks to a 1.28% advance.

New from @greenhousenyt: Pres. Trump claims his tariffs will boost the economy, but most economists disagree. They warn the tariffs could spike inflation, slow growth, hurt workers, and leave consumers paying the price.

— The Century Foundation (@TCFdotorg) January 31, 2025

“Virtually all economists think the impact will be very bad… pic.twitter.com/G4f4OhjALM

Updated at 11:11 AM EST

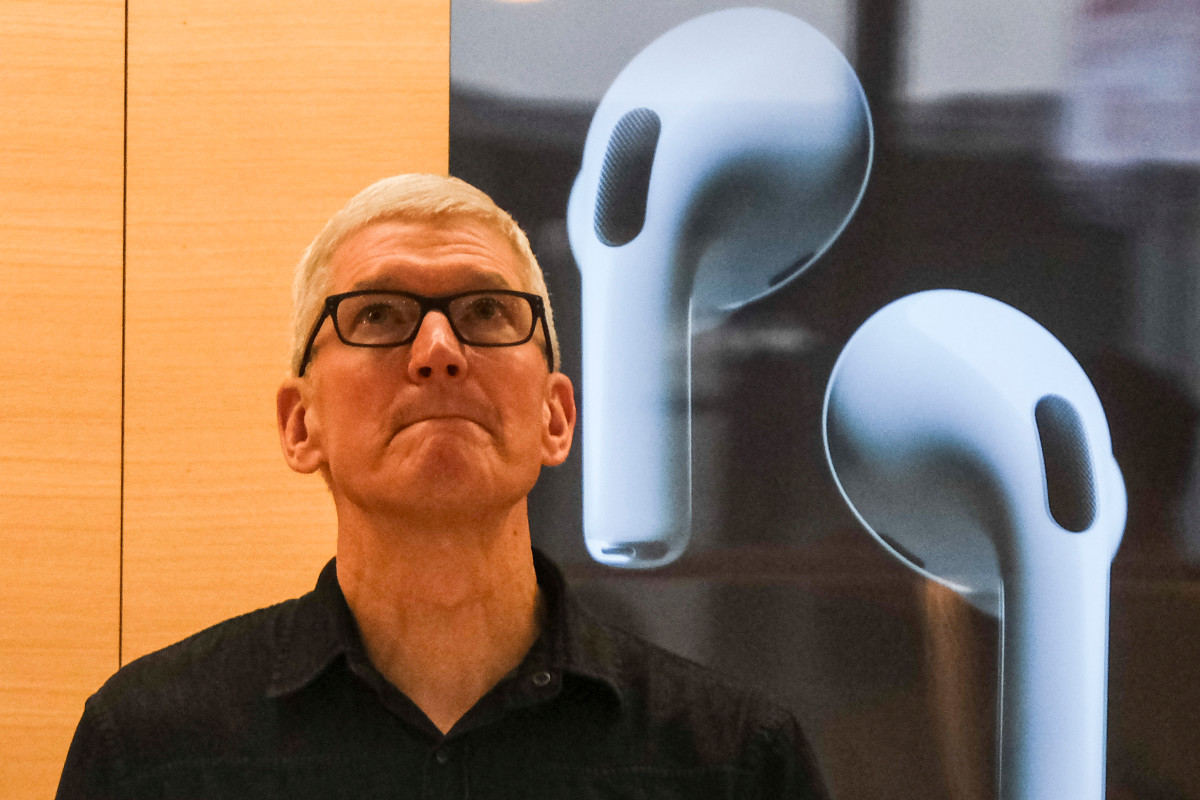

Apple still red

Apple shares are looking to nudge into positive territory for the year following last night's record quarterly earnings, which was paired with a bullish revenue outlook and iPhone upgrade projection.

"Overall, Apple exceeded estimates both on the top and bottom line, and the services revenue was the major bright spot of the report as it helped offset the shortfall in iPhone sales revenue," said Ed Egilinsky, managing director at Direxion.

"Despite some challenges with the earnings report, Apple did produce a record quarter giving some renewed optimism for bulls who believe another uptrend with the stock is about to resume," he added.

Apple shares were last marked 1.28% higher on the session at $240.64 each, but remain down around 1.32% for the year.

Related: Analysts overhaul Apple stock price targets after record Q1 earnings

Updated at 10:22 AM EST

Nvidia summoned

Nvidia (NVDA) shares edged higher in early trading, but are still on pace for a 10% decline over the first month of the year, following reports that President Donald Trump has invited CEO Jensen Huang for a one-to-one meeting at the White House.

Trump, who has shown unusual interest in developing AI technologies on U.S soil, is expected to raise the issue of reports suggesting that DeepSeek, the China-based AI startup, is using Nvidia-made chips that are restricted by export rules.

Nvidia, the world's biggest AI chipmaker, has seen its share price fall sharply in the wake of DeepSeek's emergence and its claim to have built a large-language model and chatbot for less than $6 million.

Nvidia shares were last marked 1.05% higher in early trading and changing hands at $125.96 each.

BREAKING: Nvidia, $NVDA, CEO Jensen Huang will meet with President Trump at the White House amid the DeepSeek situation, per FT. pic.twitter.com/Dwfy24Axtm

— The Kobeissi Letter (@KobeissiLetter) January 31, 2025

Updated at 9:38 AM EST

Solid Open

The S&P 500 was marked 23 points, or 0.38% higher in the opening minutes of trading while the Nasdaq rose 140 points, or 0.71%.

The Dow gained 107 points while the mid-cap Russell 2000 gained 24 points, or 1.07% following the December inflation data release.

"Inflation is running above the Fed target, but the trend is stable," said Scott Helfstein, head of investment strategy at Global X. "This is okay for the economy, companies and consumers."

"The Fed is justified in waiting to lower rates, but we think that relative price stability should help fuel a reacceleration on corporate investment next year in areas like AI and automation," he added.

S&P 500 Opening Bell Heatmap (Jan 31, 2025)$SPY +0.45% 🟩$QQQ +0.79% 🟩$DJI +0.34% 🟩$IWM +0.14% 🟩 pic.twitter.com/nfZTi6T6AI

— Wall St Engine (@wallstengine) January 31, 2025

Updated at 8:42 AM EST

Last mile challenge

The Federal Reserve's preferred inflation gauge held steady again last month but a big jump in personal spending into the end of the year continues to suggest elevated pressures and a lack of 'last mile' progress.

The Bureau of Economic Analysis' PCE Price Index report for the month of December showed core prices rising at an annual rate of 2.8%, matching the November reading and Wall Street's consensus forecast.

Core pressures, which strip away volatile food and energy prices, were up 0.2% on the month, compared with November's 0.1% gain and Wall Street's consensus estimate of 0.2%.

Stocks were little-changed following the data release, with futures indicating a 21-point opening bell gain for the S&P 500 and a 105-point advance for the Dow Jones Industrial Average. The tech-focused Nasdaq is called 140 points higher.

Benchmark 10-year note yields were 2 basis points higher at 4.539% following the data release, while 2-year notes rose 1 basis points to 4.218%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.39% higher at 108.217.

Dec PCE Price Index 2.6% - highest since April.

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 31, 2025

Well above the FOMC's 2% target. pic.twitter.com/1jQhtiCagE

Updated at 8:06 AM EST

Oil's well?

Exxon Mobil (XOM) shares edged higher in premarket trading following a better-than-expected fourth quarter earnings report that included solid production figures from its low-cost operations in Guyana.

Exxon earned $1.67 per share, or $7.39 billion, over the three months ending in December, taking its full-year profit total to $33.46 billion.

Smaller rival Chevron (CVX) , meanwhile, missed Street forecasts thanks in part to the quarterly loss for its refining business in five years. The group earned $3.24 billion over the December quarter, or $2.06 per share, even with a downstream loss of $248 million tied to weaker margins.

Exxon shares were marked 0.31% higher at $109.91 each while Chevron fell 1.74% to $153.60 each.

$CVX Chevron Q4 earnings report.

— Nick | Dividend Investor & Educator (@Smartnetworth1) January 31, 2025

Adj. EPS $2.06 ❌ $2.11 Estimate

Sales $52.226B ✅ $46.750B Estimate

Chevron raises dividend by 4.9% to $1.71.

Stock Market Today

Stocks finished firmly higher on Thursday, with Tesla (TSLA) and Meta Platforms (META) helping offset a slump in Microsoft MSFT and driving the S&P 500 into a 0.53% gain by the close of trading.

Apple (AAPL) looks set to take the baton this morning following last night's better-than-expected first quarter earnings and a current quarter revenue outlook that topped Street forecasts.

"We came away [from last night's conference call]optimistic about secular stories tied to services, expanding AI capabilities/geographic expansion and profit margin expansion potential,' said CFRA analyst Angelo Zino.

Shares in the world's biggest tech company, and the heaviest weight on both the S&P 500 and the Nasdaq, were marked 3.37% higher in premarket trading.

Shutterstock-Ringo Chiu

The tech gains were somewhat tempered, however, by a muted profit outlook from Samsung Electronics, which noted weakness in the sale of AI components thanks in part to U.S. export restrictions.

Away from equities, the U.S. dollar index jumped 0.4% to trade at 108.235 against a basket of its global peers after President Trump reiterated his threat to apply a 25% tariff on imported goods from Canada and Mexico, which operate in a trade agreement that he renegotiated in 2019, starting Feb. 1.

The President also warned the so-called BRIC nations, which include Brazil, Russia, India and China, that forming a common currency that competes with the dollar would lead to "100% tariffs".

Related: Analysts revisit Meta stock price targets after earnings surprise

Trump noted that oil imports could be excluded from the levies, a remark that added downward pressure to global crude prices.

"Investors are confused by the unclear tariff rollouts from the Trump administration [and] the lack of details is complicating market pricing," said Boris Kovacevic, global macro strategist at Convera.

In the bond market, Treasury yields nudged modestly higher amid the tariff news and heading into today's reading of the Federal Reserve's preferred inflation gauge, the PCE Price Index, at 8:30 am Eastern time.

Benchmark 10-year note yields were last marked 2 basis points higher at 4.535% while 2-year notes were pegged at 4.209%.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 suggest an opening bell gain of around 25 points, with the Dow Jones Industrial Average called 165 points higher. The Nasdaq, meanwhile, is also priced for a 165 point gain.

More Wall Street Analysts:

- Every major Wall Street analyst's S&P 500 forecast for 2025

- Iconic fund manager has blunt words on markets after Trump return

- Fidelity analyst unveils market forecast for 2025

In overseas markets, yesterday's ECB rate cut is helping the Stoxx 600 towards its seventh consecutive weekly gain, with the regional benchmark last seen 0.4% higher in mid-day Frankfurt trading.

Overnight in Asia, Samsung's fourth quarter earnings report and outlook kept South Korea's KOSPI in the red following its return from the Lunar New Year Holiday week, dragging the MSCI ex-Japan benchmark 0.11% lower into the close of trading.

Japan's Nikkei 225, meanwhile, rose 0.15% into the close of trading to trim its January loss to 0.81%.

Related: Veteran fund manager issues dire S&P 500 warning for 2025