Stocks ended higher, with the Dow and the S&P 500 hitting records, as investors looked beyond threats of significant tariffs on imported goods from President-elect Donald Trump.

The Dow Jones Industrial Average gained 123.74 points, or 0.28%, to end the session at a record high 44,860.31. The S&P 500 climbed 0.57% to close at a record 6,021.63, while the tech-heavy Nasdaq rose 0.63% to finish the day at 19,174.30.

The Federal Reserve released minutes from its November policy meeting, which suggested renewed caution on further rate cuts from policymakers,

"The minutes did nothing to alter my view that the policy rate is going to be adjusted lower next week and will continue to do so through the next calendar year," said Jamie Cox, Managing Partner for Harris Financial Group.

Updated at 3:31 PM EST

Wait-and-see

Updated at 3:31 PM EST

Wait-and-see

Minutes from the Federal Reserve's November policy meeting suggested renewed caution on further rate cuts from policymakers, with many noting that "monetary policy decisions were not on a pre-set course and were conditional on the evolution of the economy and the implications for the economic outlook".

The view hasn't altered bets on a December reduction, however, with the odds of a 25 basis point cut holding at around 63%, but it could tame bets on further moves into 2025 as the new administration takes office and the Fed has more understanding of its tax, spending and trade policies.

"The near-term outlook for the labor market presents a strong case for further easing next year," said Sam Tombs, chief U.S. economist at Pantheon Macroeconomics. "Nonetheless, tariffs and deportations have the potential to boost core PCE inflation considerably before it has returned fully to the 2% target."

⚠️BREAKING:

— Investing.com (@Investingcom) November 26, 2024

*FED MINUTES SHOW BROAD SUPPORT FOR `GRADUALLY' LOWERING RATES

*FED: SOME SAW PAUSE OR FASTER CUTS AS OPTIONS DEPENDING ON DATA pic.twitter.com/Ae3j2LrYm8

Updated at 12:32 PM EST

Holding gains

Stocks are holding gains into the mid-day session, with the S&P 500 just a few points shy of its all-time high and last marked 0.3% higher at 6,004.50 points.

Amgen's 8.9% slide is responsible for 170 points of downside weight to the Dow's 129 point decline while the Nasdaq was last marked 85 points, or 0.45% higher from last night's close.

S&P 500 $SPX will hit 6,200 before the end of the year, says Goldman Sachs pic.twitter.com/gFTvfCoR3I

— Barchart (@Barchart) November 26, 2024

Updated at 11:32 AM EST

Bump in the road

General Motors (GM) shares slumped lower in early trading, with Ford Motor (F) and Stellantis (STLA) also moving into the red, as investors reacted to the threat of significant tariffs on imports from Mexico and Canada from President-elect Donald Trump.

Both automakers have significant operations in the USMCA territories, and the 25% levy proposed by the President-elect could cripple profits at each of the Detroit 3 giants.

GM shares were last marked 7.3% lower at $55.82 each while Stellantis fell 4.5% to $12.76 each. Ford was marked 2% lower at $11.17 each.

With $GM pulling back to its short-term rising trend-line, this is a tempting play as a bounce, but it has also now become a heavy headline risk play after the tariff tweets from last night. pic.twitter.com/77UBXdyKFQ

— Ryan Mallory (@SharePlanner) November 26, 2024

Updated at 10:13 AM EST

Rising confidence

The Conference Board's index of consumer confidence jumped higher this month, with a reading of expectations rising to the highest in three years.

“November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years," said chief economist Dana Peterson.

"Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income,” she said

Consumer Confidence Expectations Index - highest since Dec 2021 pic.twitter.com/OTeMw7OYBN

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 26, 2024

Updated at 9:38 AM EST

Mixed open

The S&P 500 was marked 17 points, or 0.29% higher in the opening minutes of trading with the Nasdaq gaining 91 points, or 0.44%.

The Dow was marked 155 points lower while the mid-cap Russell 2000 slipped 10 points, or 0.44%.

S&P 500 Opening Bell Heatmap (Nov. 26, 2024)$SPY +0.26%🟩$QQQ +0.48%🟩$DJI -0.44%🟥$IWM -0.76%🟥 pic.twitter.com/pzuAjZbk1u

— Wall St Engine (@wallstengine) November 26, 2024

Updated at 9:07 AM EST

Amgen's loss

Amgen (AMGN) shares are dragging the Dow lower in premarket trading after the drugmaker published data from its anti-obesity treatment that disappointed investor expectations.

Amgen said its MariTide treatment helped overweight or obese patients lower 20% of their body weight following a year-long trial, a level that was seen to have met the baseline threshold of investor forecasts.

Amgen shares were marked 11.9% lower in premarket trading to indicate an opening bell price of $259.02 each.

The move is likely to clip between 210 to 220 points from the Dow, which is called 140 points lower at the start of trading.

$AMGN: their GLP1 / WT loss drug. Is unlikely commercially viable IMHO. $PINK.

— Michael Taylor (@Mike_Taylor1972) November 26, 2024

- 11% drop out rate us VERY high for a tightly controlled study…real world Rx drops likely closer to 30%

- docs unlikely to Rx a drug w poor profile vs well tolerated GLP1’s $LLY $NVO. pic.twitter.com/tdqIvniH1J

Updated at 7:28 AM EST

Retail warnings

Two key U.S. retailers lowered their full-year profit forecasts Tuesday, suggesting the holiday shopping season could be muted by elevated inflation and broader consumer uncertainty.

Electronics retailer Best Buy (BBY) , which relies heavily on Apple purchases, estimates that same-store sales for the holiday period will fall between 2.5% and 3.5% from 2023 levels.

Kohl's (KSS) , meanwhile, posted a weaker-than-expected third-quarter update, slashed its full-year sales forecast, and ousted Chief Executive Tom Kingsbury after less than two years at the helm of the upscale clothing and home-goods retailer

Kohl's shares were marked 15.9% lower in premarket trading at $15.50, a move that would extend their 2024 slide to around 50%. Best Buy shares, meanwhile, were marked 7% lower at $86.50.

Kohl's is simply horrific. My God. Guides FY to mid-point of $1.35 vs $2 prior.$KSS pic.twitter.com/GTHaLuLGVv

— Jeff Macke (@JeffMacke) November 26, 2024

Stock Market Today

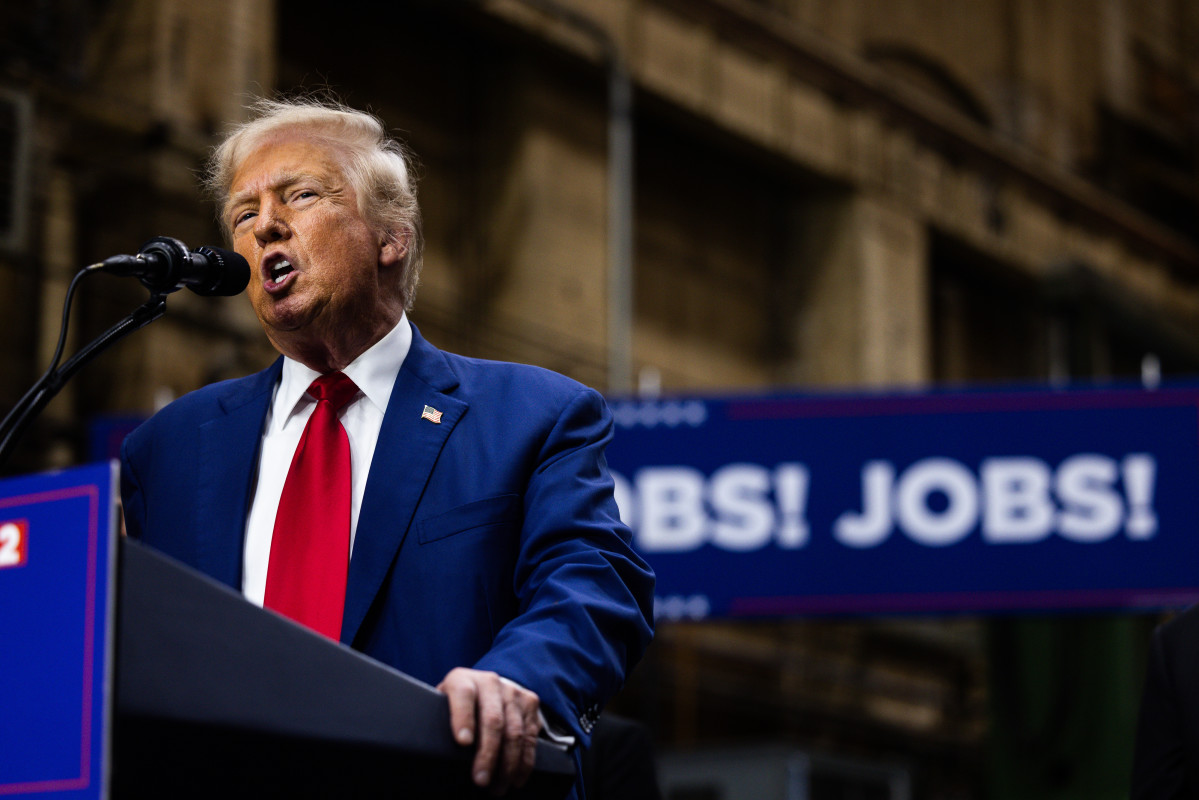

Trump's late Monday message on his Truth Social social-media network suggested he would impose additional tariffs of around 10% on China-made imports, while slapping a 25% levy on imports from both Canada and Mexico, both of which are signatories to the U.S.-Mexico-Canada Agreement trade agreement.

The tariff threats, which Trump linked to broader issues of drug importation and illegal immigration, look set to undo some of the market's early-week optimism tied to the nomination of Wall Street veteran Scott Bessent as treasury secretary.

“As everyone is aware, thousands of people are pouring through Mexico and Canada, bringing Crime and Drugs at levels never seen before,” Trump said. “This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!”

The U.S. dollar index, which tracks the greenback against a basket of six major global currency peers, rose to 106.821 in overnight dealing, while both the Canadian dollar and the Mexican peso slumped.

The euro was also on the back foot, falling to 1.0516 against the dollar as investors worried the the eurozone bloc would be the next target of Trump's tariff ploy.

Benchmark 10-year Treasury note yields rose 2 basis points overnight to 4.301%. Two-year notes reversed some of yesterday's advance, which followed a strong auction of $69 billion in new notes, to trade at 4.275%.

Related: Goldman Sachs analyst sees starting point for year-end S&P 500 rally

On Wall Street, stocks are set for a muted open, with futures contracts tied to the S&P 500 priced for a 6-point opening-bell gain and those linked to the Dow Jones Industrial Average called 20 points higher.

The tech-focused Nasdaq, meanwhile, is priced for a 22-point opening bell gain.

Stocks on the move include Rivian Automotive (RIVN) , which jumped 7.2% in the premarket following conditional approval for a $6.6 billion loan from the Department of Energy to build an EV production facility in Georgia.

Intel (INTC) shares were 2% higher at $25.34 after the chipmaker secured $7.9 billion in grants and subsidies under the Chips Act to build new semiconductor facilities in Oregon, New Mexico and Arizona.

Eli Lilly (LLY) , meanwhile, jumped 2% to $770 after President Joe Biden proposed rule changes to Medicare and Medicaid that would force the U.S. government to cover anti-obesity treatments such as the drugmaker's Mounjaro.

The U.S.-listed shares of Novo Nordisk (NVO) , the Denmark-based maker of weight-loss-drug-market leader Ozempic, was marked 1.7% higher in the premarket.

In overseas markets, the Stoxx 600 index was marked 0.56% lower in mid-day Frankfurt trading, with auto stocks leading the decline amid concerns about new tariffs on U.S. imports, while Britain's FTSE 100 fell 0.34% in London.

More Wall Street Analysts:

- Walmart analysts reset stock price targets ahead of Black Friday

- Analysts revamp Cisco stock price targets after earnings

- Analysts revisit Applied Materials stock price targets after Q4 earnings

Overnight in Asia, stocks in China were lower across the board, with the CSI 300 benchmark falling 0.21% and the Shanghai Composite down 0.12%. The market moves pulled the regionwide MSCI ex-Japan benchmark 0.55% lower into the close of trading.

Japan's Nikkei 225, meanwhile, was marked 0.87% lower by the close of trading in Tokyo.

Related: Veteran fund manager sees world of pain coming for stocks