Stocks ended mixed Wednesday, with the S&P 500 and the Nasdaq again closing at record highs, despite disappointing economic reports.

The Dow Jones Industrial Average lost 23.85 points, or 0.06%, to end at 39,308, while the S&P 500 gained 0.51% to finish at 5,537.02 and the tech-heavy Nasdaq rose 0.88% to close the session at 18,188.30.

Both the S&P 500 and the Nasdaq reached fresh all-time highs in the session and closed at records.

Quincy Krosby, chief global strategist for LPL Financial, said that the ADP private payroll report was disappointing “as it came in slightly below expectations with 150,000 new jobs added primarily within the leisure and hospitality categories.”

“Initial and continuing unemployment claims inched higher as the overall labor market, while still generally resilient, reflects signs of a gradual normalization to pre-pandemic levels,” he said.

Krosby said that should Friday's payroll report disappoint - particularly in terms of the unemployment rate climbing above 4% -“the dollar should ease accordingly as 2-year and 10-year Treasury yields edge lower.”

"With a broader series of weaker than expected data releases, markets will soon expect the Fed to take keen notice and begin to introduce language commensurate with its dual mandate, but with a renewed focus on its maximum employment directive," he said.

Updated at 10:31 AM EDT

Turbo Tesla

Tesla shares hit a six-month high of $244.69 each in early Wednesday trading, putting the stock within touching distance of positive territory for the year, following a stronger-than-expected second quarter delivery tally that has trigged a host of analyst upgrades.

Tesla shares were marked 5.77% higher in early Wednesday trading to change hands at $244.56, the highest in nearly six months and a move would trim the stock's 2024 decline to just 1.38%.

Related: Analysts reset Tesla stock price targets as robotaxi event looms

Updated at 10:12 AM EDT

Growth cracks

The Institute for Supply Management's benchmark survey of sentiment in the services sector, the biggest driver of US GDP, slumped below the 50 point mark that signals broader economic contraction last month, raising major questions over near-term growth prospects.

The ISM's non-manufacturing index was pegged at 48.8 points, down sharply from the May reading of 53.8 and the Wall Street consensus of 52.5, even as a subindex tracking prices paid at the wholesale levels rose to 56.3 from 58.1.

Benchmark 10-year Treasury notes yields fell 9 basis points to 4.363% following the data release, while 2-year notes were down 7 basis points to 4.685% and the dollar index hit a two-week low of 105.210.

Stocks nudged higher, with the S&P 500 up 8 points, or 0.15% and the Nasdaq up 20 points, or 0.11%.

ISM services in contraction, now below the economy breakeven line https://t.co/ypDuQrIwRe pic.twitter.com/DFEpTjES6F

— Sam Ro 📈 (@SamRo) July 3, 2024

Updated at 9:52 AM EDT

Firmer open

The S&P 500 was marked 6 points, or 0.1% higher in thin trading volumes in the opening minutes of trading, with the Nasdaq adding 20 points, or 0.11% in concert. The Dow, meanwhile, nudged 10 points higher paced by gains for JPMorgan (JPM) and Visa (V) .

S&P 500 Opening Bell Heatmap (Jul. 03, 2024)$SPY +0.05%🟩$QQQ +0.04%🟩$DJI +0.16%🟩$IWM +0.07%🟩 pic.twitter.com/2blX0hqEfH

— Wall St Engine (@wallstengine) July 3, 2024

Rising claims

The Labor Department said weekly jobless claims rose by 4,000 over the period ending on June 29 to 238,000, just ahead of Wall Street forecasts, with the closely-tracked four week average rising to 238,500.

The figures aren't likely to have a huge impact on Friday's June non-farm payroll report, which is forecast to show 189,000 new jobs, year-on-year wage growth of 4% and a headline unemployment rate of 4%.

Initial jobless claims up to 238k vs. 235k est. & 234k in prior week; continuing jobless claims up to 1.858M vs. 1.84M est. & 1.832M in prior week … greatest increases in NY (+4.5k), NJ (+2.2k), & CA (+2.1k); greatest decreases in CT (-1.7k), MD (-1k), WI (-882) pic.twitter.com/cL6waOHZOk

— Liz Ann Sonders (@LizAnnSonders) July 3, 2024

Updated at 8:23 AM EDT

Private payroll data

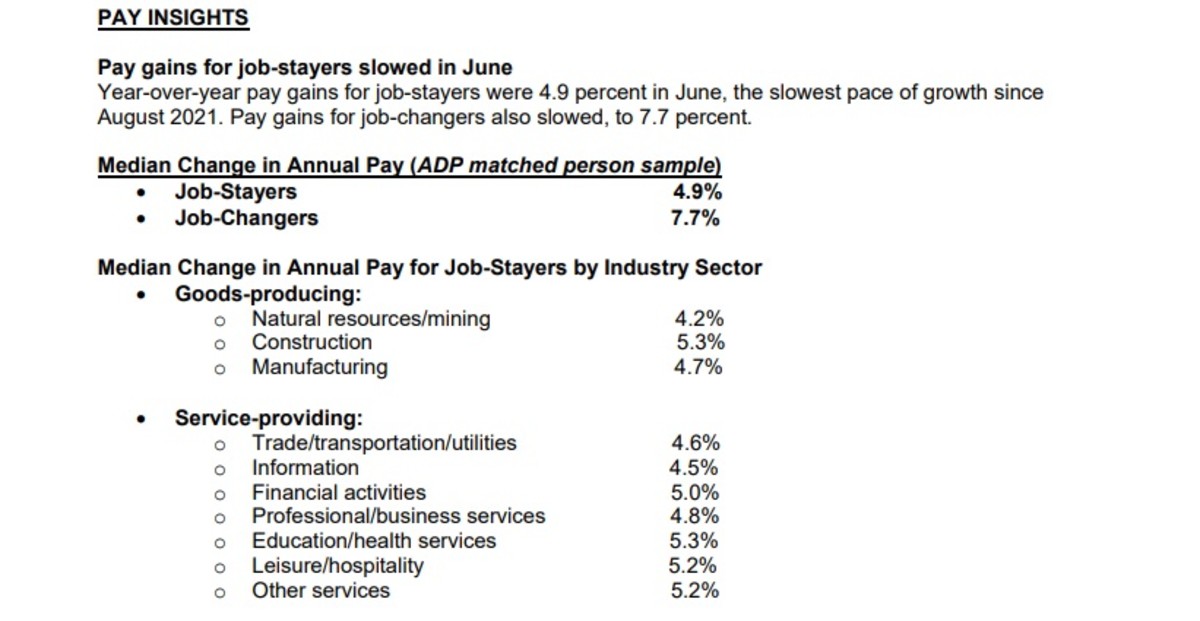

The U.S. economy added 150,000 new jobs last month, payroll processing group ADP reported Wednesday, a smaller-than-expected tally that was paced by hiring in the leisure and hospitality sector.

Wage gains were also easing, falling below the 5% mark for the first time in nearly three years, as the broader labor market continues to cool

“Job growth has been solid, but not broad-based,” said chief economist Nela Richardson. “Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.”

Stock Market Today

Stocks powered higher again Tuesday, taking the S&P 500 to its first-ever close above 5,500 and extending the benchmark's year-to-date advance to around 15.5%.

Tech stocks were once again pacing session gains, led by a 10.2% advance for Tesla (TSLA) , which followed stronger-than-expected second quarter delivery figures and helped the Nasdaq rise 0.84% to a fresh record high north of the 18,000-point mark.

Benchmark 10-year Treasury note yields were little changed in overnight dealing at 4.442%, with 2-year notes trading at 4.754% despite some dovish comments from Fed Chairman Jerome Powell at a central banking forum in Portugal that added to the case for autumn rate cuts.

Stocks are set for modest gains to finish out the first half of the holiday-shortened week, with markets set to close at 1 pm Eastern Time ahead of tomorrow's July 4 holiday celebrations.

Investors are focused on payroll-processing group ADP's June employment report and weekly jobless claims from the Labor Department.

The Federal Reserve will also publish minutes of its June policy meeting, but the release is expected at 2 pm Eastern, around an hour after markets are officially closed for the day.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 5000 suggest a 2-point opening bell dip, with the Dow Jones Industrial Average called 20 points to the upside.

The Nasdaq, which is up 20.1% for the year, is priced for a 15-point advance, thanks in part to premarket gains for Nvidia (NVDA) , Apple (AAPL) and Tesla.

Other stocks on the move include Eli Lilly (LLY) , which was marked 0.63% higher at $912.44. Late on Tuesday it won Food and Drug Administration approval for its early Alzheimer's treatment.

Paramount Global (PARA) shares were also on the move, rising 9.1% to $11.70 each, after reports suggested Shari Redstone and National Amusements have reached a deal to sell their controlling interest to Skydance Media for around $1.75 billion.

More Wall Street Analysts:

- Analyst updates Oracle stock price target after earnings

- Analyst reboots Trade Desk stock price target after Netflix deal

- Analysts adjust Micron stock price target ahead of earnings

In overseas markets, Britain's FTSE 100 was marked 0.54% higher ahead of tomorrow's national elections, which are expected to deliver a huge majority to the left-leaning Labour party and elevate its leader, Kier Starmer, to the position of prime minister.

Europe's Stoxx 600, meanwhile, jumped 0.85% in Frankfurt, with tech stocks leading the advance.

Overnight in Asia, the Nikkei 225 added another 1.26% to remain firmly over the 40,000 point mark in Tokyo, while the regionwide MSCI ex-Japan index rose 0.92% into the close of trading.

Related: Single Best Trade: Wall Street veteran picks Palantir stock