Stocks finished higher, with the S&P 500 and the Nasdaq both posting fresh record closes as AI chipmaker Nvidia took the crown as the world's most valuable public company.

The Dow Jones Industrial Average gained 56.76 points, or 0.15%, to finish at 38,834.86, while the S&P 500 rose 0.25% to close at 5,487.03 and the tech-heavy Nasdaq added 0.03% to end at 17,862.23.

Nvidia shares hit a fresh all-time high in late morning trading and finished the session up 3.51% as AI heavyweight beat out Microsoft as the world's most valuable company.

Meanwhile, May retail sales were disappointing as they came in softer than expected/

"Retail sales came in really light this morning and while that may be good news for inflation hawks, it could be the beginning of a slowdown in growth, which would hurt a lot more than a couple of interest rate cuts would help," said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

Zaccarelli said that the big story of this bull market has been "the resilient consumer and without them, the economy would have slowed – or fallen into recession – a long time ago."

"Stock prices are going up without the help of rate cuts because corporate profits and the economy continue to expand," he added. "Without the consumer, this bull market is going to stall out, so investors need to see more consumer spending and not a material slowdown, which this report could be indicating."

Updated at 12:18 PM EDT

Nvidia, Nvidia, have you seen Nvidia?

Nvidia shares hit a fresh all-time high in late morning trading, extending the AI chipmaker's remarkable 2024 gain to around 180% and valuing the market's second biggest stock at just over $3.3 trillion.

In fact, the combined value of Nvidia, Apple and Microsoft, the market's three biggest stocks, is somewhere in the region of $10 trillion, which is around double the value of Japan's benchmark Nikkei 225.

The combined market cap of all 2000 companies in the Small Cap Russell 2000 Index: $3.02 trillion.

— Charlie Bilello (@charliebilello) June 17, 2024

The market cap of 3 largest US companies:

-Microsoft $MSFT: $3.33 trillion

-Apple $AAPL: $3.32 trillion

-Nvidia $NVDA: $3.23 trillionhttps://t.co/rQuXrxVXM0 pic.twitter.com/OlsRwFBfnN

Updated at 10:45 AM EDT

Fed ammo?

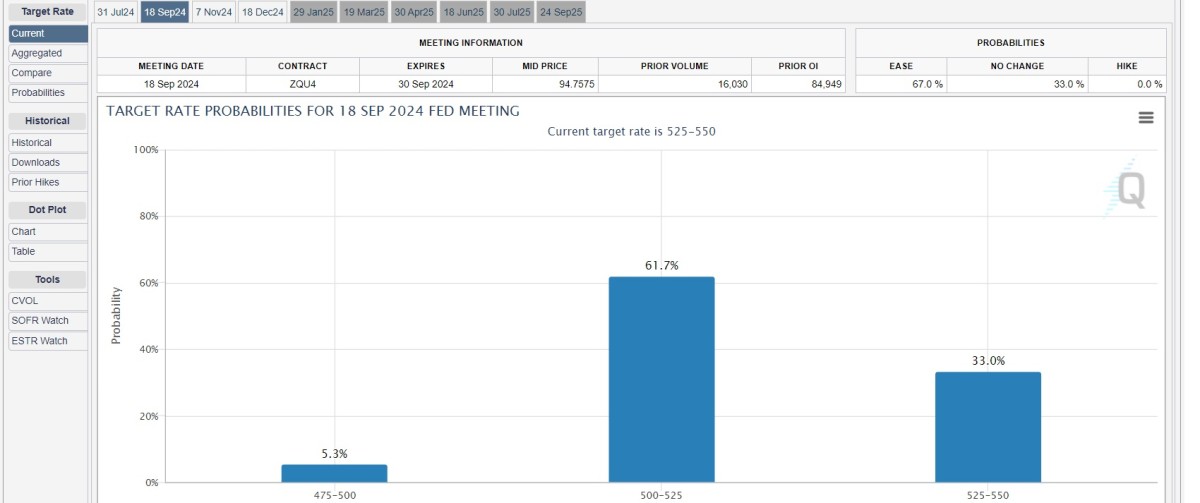

The softer-than-expected reading for May retail sales, as well as downward revisions to the March and April tallies, added a bit of heft to bets on a September Fed rate cut, with the CME Group's FedWatch now pegging the odds at around 67%.

"Should employment data, particularly initial unemployment claims, continue to indicate a more defined softening in the labor market, the Fed may -- as suggested by Fed Chair Powell--need to recalibrate its timetable in terms of when to commence policy easing," said LPL Financial's chief global strategist Quincy Krosby.

Updated at 9:35 AM EDT

Firmer open

The S&P 500 was marked 5 points, or 0.08%, higher in the opening minutes of trading, with the Dow gaining 34 points and the Nasdaq essentially unchanged from its record high close on Monday.

S&P 500 Opening Bell Heatmap (Jun. 18, 2024)$SPY +0.06%🟩$QQQ +0.07%🟩$DJI +0.04%🟩$IWM -0.15%🟥 pic.twitter.com/8nSo8CJLcb

— Wall St Engine (@wallstengine) June 18, 2024

Updated at 8:51 AM EDT

Shop till you ... drop?

Retail sales rose only modestly last month, the Commerce Department report, with a 0.1% advance that was offset by a big reduction in the overall tally for April, which is now officially negative.

The closely-tracked control group reading, which feeds into GDP calculations, was also disappointing, showing a modest 0.4% gain for May and a revised -0.5% reading for April.

Stocks aren't reacting much to the muted spending picture, but markets are seeing another leg lower in benchmark Treasury yields and a likely nudge higher in bets on a September Fed rate cut.

Some retail sales category highlights (prior month):

— Liz Ann Sonders (@LizAnnSonders) June 18, 2024

Sporting goods +2.8% (-2.4%)

Clothing +0.9% (+1.7%)

E-commerce +0.8% (-1.8%)

Motor vehicles, parts +0.8% (-0.4%)

Eating, drinking -0.4% (-1.8%)

Building materials -0.8% (+0.3%)

Furniture -1.1% (+0.9%)

Gas stations -2.2%… pic.twitter.com/7awIjLKyPh

Stock Market Today

The S&P 500 notched its 30th record close of the year last night, rising 41.6 points on the session to take the benchmark's year-to-date gain to around 14.75%, powered once again by outsized gains in the tech sector.

The Nasdaq also closed at a record and has gained nearly 19% this year, as investors continue to drive tech stocks higher on hopes that an artificial-intelligence wave will translate into robust profit growth both in the tech sector itself and beyond.

Related: Analysts revisit S&P 500 price targets after record run

Focus in today's session, however, is likely to fall on the health of the broader economy and the chances that slowing inflation will prompt the Federal Reserve into an autumn interest-rate cut.

The Commerce Department will publish its official estimate of May retail sales at 8:30 am Eastern time, with economists looking for a monthly gain of around 0.3%. Industrial production data for the same month will follow at 9:15 am Eastern time.

A cohort of six Fed officials will also be making public statements today as investors attempt to find clues as to when, or indeed whether, the Fed will begin reducing its benchmark lending rate, which sits at a 22-year high of between 5.25% and 5.5%.

The CME Group's FedWatch tool pegs the odds of a September rate cut at around 61%, with similar odds for a follow-on reduction in December.

In the bond market, benchmark 10-year note yields were trading at 4.292% heading into the start of the New York session and ahead of a $16 billion auction of 20-year bonds later in the session, with 2-year notes were pegged at 4.774%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.16% higher at 105.493.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 suggest an 8 point opening-bell gain, while those linked to the Dow Jones Industrial Average are indicating a 33 point advance.

The tech-focused Nasdaq, meanwhile, is called 67 points higher, thanks in part to premarket gains for index heavyweights Nvidia (NVDA) , Tesla (TSLA) and Apple (AAPL) .

More Wall Street Analysts:

- Analyst revamps Microsoft stock price target despite controversy

- Analysts reset Nio stock price targets after earnings

- Dollar Tree’s new price strategy prompts analysts to revise targets

In overseas markets, European stocks rebounded from a six-week low to rise 0.51% in early Frankfurt trading, helped by solid gains for the banking sector, while Britain's FTSE 100 rose 0.41% in London.

Overnight in Asia, the Reserve Bank of Australia left its benchmark lending rate unchanged at 4.35%, the highest in 12 years, while the Bank of Japan signaled the chances of a July rate hike, only the second move higher in 17 years.

The Nikkei 225 was marked 1% higher by the close of trading in Tokyo, while the regionwide MSCI ex-Japan index added 0.63%.

Related: Veteran fund manager picks favorite stocks for 2024