Stocks ended higher Wednesday as investors picked through a key July inflation report that could test the case for a big Federal Reserve interest rate cut next month.

The Dow Jones Industrial Average gained 242 points, or 0.61%, to finish the session at 40,008.39, while the S&P 500 inched up 0.38% to 5,455.21 and the tech-heavy Nasdaq close higher by 0.03% to end the day at 17,192.60.

Consumer prices increased 2.9% year-over-year, down from 3% in June and the lowest reading since March 2021, according to the Bureau of Labor Statistics.

On Tuesday, the bureau said that the Producer Price Index was 2.2% for the 12 months ended in July, a pullback from the 2.7% increase in June.

“CPI & PPI both came in at or slightly below expectations which should continue to fuel the fire for the first rate cut in September with the largest remaining question being will it be 25bps or 50bps,” said Alex McGrath, chief investment officer for NorthEnd Private Wealth. “Obviously, we are not back to the Fed’s targeted inflation rate but as the consumer really begins to show signs of weakness here, the fire under their feet continues to get hotter."

"The unemployment rate moving back above 4%, which should move down in the next reading given the impact of the hurricane in Texas, will also serve as another data point to support a cut," he added.

Updated at 12:18 PM EDT

Moving higher

Stocks are having a second look at today's inflation data, which has at the very least cemented the case for a quarter point rate cut from the Fed next month, even as it was unable to carve out the case for a larger half-point reduction.

"Today’s report was a further reinforcement of the Fed’s confidence in deflating inflation, back down to pre-Covid comparable inflationary readings," said Rick Rieder, BlackRock’s chief investment officer of global fixed income.

"We think the Fed can now start cutting rates in September and probably will deliver at least 75 basis points of total policy rate cuts by year-end, to get the Funds rate to a still elevated level of low-to-mid-4%," he added. "Markets are clearly anticipating this type of move with over 100 basis priced in the swaps market for this year."

The S&P 500 was last seen 24 points, or 0.45% higher on the session while the Nasdaq gained 35 points, or 0.2%. The Dow was last marked 274 points higher, reclaiming the 40,000 point level for the first time since August 1.

$SPX Bears are firing a lot of bullets and not making much progress. I'm surprised the decline isn't gaining a head of steam. Watching. pic.twitter.com/lGnf51WWMg

— Jon Markman 🛸 (@jdmarkman) August 14, 2024

Updated at 10:37 AM EDT

Google slump

Alphabet (GOOGL) shares are a big drag on the Nasdaq in early trading following a report from Bloomberg that the Department of Justice could advocate for the breakup of the Google parent.

The DoJ, which won an antitrust case against Alphabet last week, during which a Federal Judge deemed it to have illegally monopolized the online search market, is weighing options for remedies that could include seeking the divestment of its Android operating system or its Chrome web browser.

Alphabet shares were last marked 3.5% lower on the session at $160.14 each, a move that would extend the stock's one-month decline to around 15%.

This also marks the beginning of the end for Google’s search dominance.

— Stephen McBride (@DisruptionHedge) August 14, 2024

This ruling doesn’t mean $GOOG will disappear from your iPhone. What’ll likely happen is you’ll have a menu of options to choose from instead of one.

This is how it works in Europe.

Updated at 9:48 AM EDT

Mixed open

The S&P 500 was marked 4 points lower, or 0.06% in the opening minutes of trading, while the Nasdaq drifted 44 points, or 0.25%.

The Dow was marked 75 points higher, with the Russell 2000 rose 2 points or 0.08%.

S&P 500 Opening Bell Heatmap (Aug. 14, 2024)$SPY +0.21%🟩$QQQ +0.34% 🟩$DJI +0.03% 🟩$IWM +0.31% 🟩 pic.twitter.com/NFPfqlAZvc

— Wall St Engine (@wallstengine) August 14, 2024

Updated at 9:20 AM EDT

No jacket required

Stocks are moving around a bit aimlessly following the July CPI report, but rate traders are starting to solidify their bets on the size of the September rate cut based on some of the underlying pressures that remain stubbornly elevated in the world's biggest economy.

"Today’s CPI print removes any lingering inflation obstacles that may have been preventing the Fed from starting the rate cutting cycle in September," said Seem Shah, chief global strategist at Principal Asset Management. "Yet, the number also suggests limited urgency for a 50 basis point cut."

"With supercore inflation up from last month and a sustained deceleration in shelter inflation still elusive, a gradual reduction in policy rates may be all the Fed can provide at this time - and all that it needs to deliver," she added. "With the broad economic picture looking more mid-cycle adjustment than recession, aggressive Fed easing may not be required."

Updated at 8:45 AM EDT

Not Big enough

Inflation pressures eased again last month, with the Commerce Department reporting a headline CPI rate of 2.9%, the slowest in more than three years.

However, modest ticks higher in monthly price pressures, as well as an an in-line reading for the core inflation measure, is testing bets on a 50 basis point Fed rate cut and pushing stocks lower in premarket trading

U.S. stock futures nudged modestly lower in the wake of the inflation data, with the S&P 500 called 2 point lower while the Nasdaq was called 30 points to the downside. The Dow Jones Industrial Average, meanwhile, is priced for a 25 point decline.

Benchmark 10-year Treasury note yields rose 2 basis points following the data release to change hands at 3.864% while 2-year notes were pegged 5 basis points higher at 3.981%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.84% lower at 104.171.

Ten days ago, markets were pricing in 60% chance of an inter-meeting Fed cut, and a near-certain 50bp cut by September. Back to reality.

— Frederik Ducrozet (@fwred) August 14, 2024

Updated at 7:25 AM EDT

Mars deal

Kellanova (K) , the snacks-focused division spun out from WK Kellogg (KLG) last year, powered higher in premarket trading after agreeing to a $36 billion takeover from privately owned candy maker Mars.

Mars will pay $83.50 a share for Kellanova in an all-cash deal, the companies said, a 12% premium to yesterday's closing price but around 33% north of where the stock was trading when news of the takeover was first reported by Reuters.

Kellanova shares were marked 8.1% higher in premarket trading to indicate an opening bell price of $80.51 each.

Check back for updates throughout the trading day

Stocks ended firmly higher yesterday, with the S&P 500 closing at levels seen prior to last week's global market turmoil, thanks in part to a softer-than-expected reading for factory-gate inflation and the ongoing recovery in megacap tech stocks.

An elevated reading of small business optimism from the NFIB's monthly survey added to the bullish tone, with investors looking to consolidate the S&P 500's five-day advance through today's inflation reading.

Economists expect headline price pressures to hold steady at 3%, still well north of the Fed's 2% target, with core inflation easing to 3.2% on an annual basis.

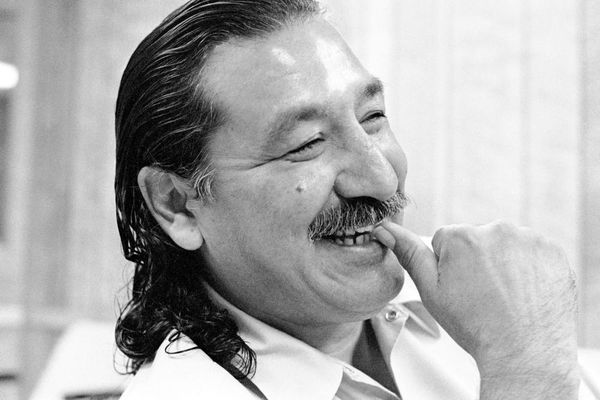

Olivier Douliery/Bloomberg via Getty Images

The CME Group's FedWatch tool suggests a 52.5% chance of a 50 basis point rate cut from the Fed when it meets next month in Washington. The odds of a 25 basis point reduction are pegged at 47.5%.

Rate traders are also anticipating further cuts over the Fed next three meetings after September, including in January 2025.

"The CPI data will not stand in the way of rapid Fed easing in order to bolster the slowing economy," said Ian Shepherdson of Pantheon Macroeconomics.

Benchmark 10-year Treasury note yields were holding at 3.833% heading into the July CPI report, with 2-year notes pegged at 3.929%.

The U.S. dollar index, meanwhile, was marked 0.08% lower at 102.474 against a basket of its global peers.

On Wall Street, stock futures were essentially flat, with the S&P 500 indicated 4 points higher and the Nasdaq set for a 15 point gain. The Dow Jones Industrial Average was also priced for a modest 17 point gain.

Alphabet (GOOGL) shares were a notable early mover, falling 1.1% in premarket trading following a Bloomberg report that the Department of Justice is looking to break up the Google parent following its victory in an antitrust suit last week.

More Wall Street Analysts:

- Analysts reboot Amazon stock price targets after earnings

- Analyst reboots Rivian stock price target on updated plans

- Analysts reboot Arm Holdings stock price target following earnings

In Europe, Britain's FTSE 100 gained 0.38% in London as rate cut bets solidified following a softer-than-expected July inflation report, while the regional Stoxx 600 benchmark edged 0.16% higher in Frankfurt.

Overnight in Asia, the Nikkei 225 finished 0.58% higher in Tokyo while the region-wide MSCI ex-Japan benchmark was marked 0.56% higher into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks