Stocks ended mixed Monday, with the S&P 500 and Nasdaq reaching fresh closing highs, amid scheduled testimony from Federal Reserve Chairman Jerome Powell and the start of the second quarter earnings season.

The Dow Jones Industrial Average finished down 31 points, or 0.08%, to end the session at 39,344.79, while the S&P 500 edged up 0.10% to 5,572.85 and the tech heavy Nasdaq gained 0.28% to finish the day at 18,403.74.

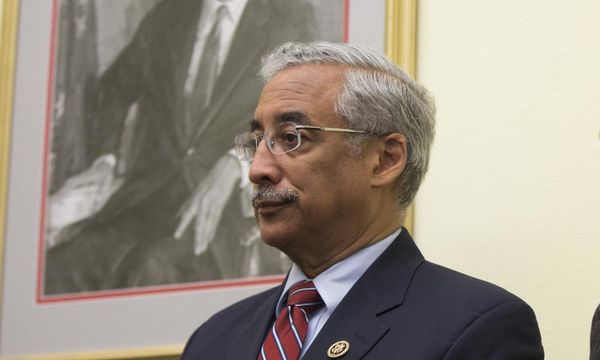

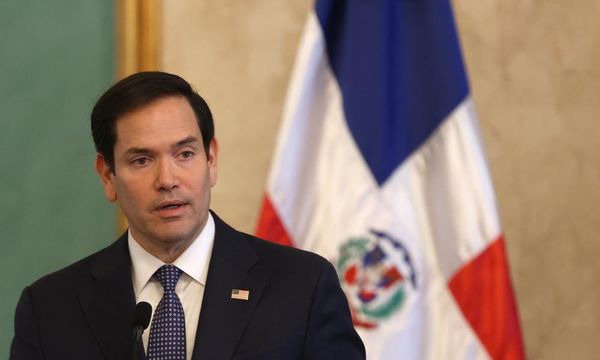

Federal Reserve Chairman Jerome Powell is scheduled to speak to the Senate Banking Committee and the House Financial Services Committee as part of his semiannual testimony to Congress, which begins Tuesday.

In addition, the June consumer price index will be released Thursday, while the producer price index data will be released Friday.

“The CPI and PPI reports will likely show inflation moved sideways in June despite the month's lower prices of gasoline, diesel, and used cars,” said Bill Adams, chief economist for Comerica Bank. “Inflation slowed sharply in the second half of 2023, so unless inflation slows even more dramatically in the next few months, the headline year-over-over measure of prices is likely to hold little changed."

Shelter costs are an exception, and likely rose at a slower year-over-year pace in June than in May, Adams added.

"The fiscal deficit likely narrowed in June, in part reflecting typical seasonality of revenues and outlays," he said. "Wholesale sales likely dipped in May as lower petroleum prices weighed on revenues. Consumer sentiment likely improved in the July preliminary survey as consumers became a little less downbeat about the effect of inflation on their household finances."

Updated at 1:12 PM EDT

Flat Monday

Stocks are hovering around the flatline heading into the final hours of trading, with the S&P 500 marked 1 point lower and the Nasdaq rising 27 points, or 0.15%

Benchmark 10-year Treasury note yields, meanwhile, are down 5 basis points on the session at 4.274% while 2-year notes were last pegged at 4.624%.

Related: Analyst revamps S&P 500 target ahead of CPI inflation report

Updated at 10:52 AM EDT

Nvidia higher

Nvidia (NVDA) shares are extending gains in early trading, rising nearly 2% to $128.20 each, following a price target upgrade from UBS tied to channel checks on demand for its AI-powering Blackwell processors.

"This comes as sentiment on the stock - though still strong - has faded somewhat in recent weeks, creating more of a 'wall of worry' that should be ultimately healthy if our outlook materializes," said UBS analyst Timothy Arcuri.

Related: Analyst revisits Nvidia stock price target after Blackwell checks

Updated at 9:37 AM EDT

Solid start

The S&P 500 was marked 13 points, or 0.22% higher in the opening minutes of trading while Boeing's early gain helped the Dow to a 224 point advance. The Nasdaq was last seen 22 points, or 0.17% higher.

Both benchmarks, in fact, hit new intra-day highs, with the S&P 500 extending its 2024 gain to around 17%.

S&P 500 Opening Bell Heatmap (Jul. 08, 2024)$SPY +0.24%🟩$QQQ +0.12%🟩$DJI +0.57%🟩$IWM +1.09%🟩 pic.twitter.com/Ei3gTjlJ9M

— Wall St Engine (@wallstengine) July 8, 2024

Updated at 8:21 AM EDT

Drug deal

Morphic Holding (MORF) shares soared more than 75% in premarket trading after the bowel disease specialists agreed to a $3.2 billion takeover by Eli Lilly (LLY) .

Eli Lilly will pay $57 per share for Morphic, a nearly 80% premium to its Friday closing price, and gain access to its late-stage drugs aimed at treating ulcerative colitis and Crohn's disease.

Eli Lilly $LLY will pay $3.2 billion in cash for Morphic Therapeutic $MORF, a biotech working on oral integrin drugs for chronic autoimmune diseases - a roughly 100% premium (of course!) on Friday's closing price. $XBI $IBB https://t.co/BEwdlzQxom

— Richard J Law 🚜--🇺🇦 🍉 (@drrichjlaw) July 8, 2024

Stock Market Today

Stocks ended higher last week, with record closing levels again for the S&P 500 and the Nasdaq Composite as big tech stocks got a boost from softer Treasury yields tied to a mixed June jobs report.

The Labor Department said 206,000 new hires were added last month, but the agency also clipped around 111,000 from prior-month forecasts, suggesting a slower pace of demand heading into the summer.

Wage growth was pegged at 3.9%, the slowest in three years, while the unemployment rate ticked modestly higher to 4.1%.

Related: June jobs report bolsters bets on an autumn Fed interest rate cut

The data set up an interesting week for markets as traders look for clarity on their bets that the Federal Reserve will see easing inflation pressures and a slowing economy, and implement the first of its long-awaited rate cuts in mid-September.

Federal Reserve Chairman Jerome Powell could offer some clues in that respect when he speaks to the Senate Banking Committee and the House Financial Services Committee as part of his semiannual testimony to Congress, which begins Tuesday.

The Commerce Department will also publish its estimate of June inflation Thursday, with analysts expecting the headline rate eased to an annual rate of 3.1%.

And the Treasury will conduct benchmark auctions of 10-year notes and 30-year bonds this week, starting on Wednesday, with investors focused on the level of foreign demand for the record-sized sales.

Benchmark 10-year Treasury note yields were pegged at 4.308% heading into the start of the New York trading session, with 2-year notes trading at 4.637%.

Related: Biden debate flop boosts Trump, but economy may be tougher opponent

On Wall Street, investors will look to the start of the second-quarter-earnings season this week, with updates from PepsiCo (PEP) on July 11 and JP Morgan (JPM) , Wells Fargo (WFC) and Citigroup (C) the following day.

LSEG data estimate collective second-quarter profits for the S&P 500 rose 10.6% from a year earlier to $495.2 billion, with information-technology and communication-services stocks contributing around 30.6% of the overall tally.

Heading into the start of the trading day, the S&P 500 is called around 1 point lower, with the Dow Jones Industrial Average priced for a 12 point gain. The tech-focused Nasdaq is called 1 point higher

Boeing (BA) shares were a notable early mover, rising 0.5% to $185.80 after the planemaker agreed to a deal with the U.S. Department of Justice to plead guilty to a fraud and conspiracy charge, while paying a $243.6 million fine. The plea is tied to fatal 737 Max crashes in 2018 and 2019.

More Wall Street Analysts:

- Analyst updates Oracle stock price target after earnings

- Analyst reboots Trade Desk stock price target after Netflix deal

- Analysts adjust Micron stock price target ahead of e

In overseas markets, France's CAC-40 was marked 0.4% higher, with a similar gain for the regional Stoxx 600 benchmark. The market moves followed Sunday's French parliamentary elections, which saw a center-left coalition, which includes socialist lawmakers, win the largest number of seats.

The win not only prevents the far right National Rally Party from assuming power, but also leaves President Emmanuel Macron in the role of power broker as he looks to build a coalition government from the widely disparate results.

Overnight in Asia, Japan's Nikkei 225 slipped 0.32% into the close of trading as the yen edged higher, to 161.02 against the U.S. dollar. The regionwide MSCI ex-Japan benchmark fell 0.08%.

Related: Veteran fund manager sees world of pain coming for stocks