Stocks tumbled Friday as investors retreated from stocks amid a shift in risk sentiment from inflation concerns to worries about a near-term recession.

The Dow Jones Industrial Average tumbled 610 points, or 1.51%, to end the session at 39,737.26, while the S&P 500 lost 1.84% to 5,346.56, while the tech-heavy Nasdaq finished the day down 2.43% to 16,776.16.

The Nasdaq went into correction territory, more than 10% below its recent high in early July.

Stocks began falling after the Bureau of Labor Statistics said Friday that a net 114,000 new jobs were created in July, below the downwardly revised total of 179,000 recorded in June and well south of this year's monthly average of around 222,000.

Economists were looking for a headline total of around 175,000 new hires in the July report with a headline unemployment rate of 4.1%.

Data on Thursday showed weekly jobless claims jumped to the highest levels in nearly a year over the period ended July 27, the Labor Department said, with around 250,000 Americans filing their first paperwork for unemployment benefits.

Softer wage gains underscored concerns that the Federal Reserve's reluctance to lower interest rates is choking off growth prospects.

“The latest snapshot of the labor market is consistent with a slowdown, not necessarily a recession,” said Jeffrey Roach, Chief Economist for LPL Financial. “However, early warning signs suggest further weakness. The number of those working part time for economic reasons rose the highest since June 2021."

"If the labor market weakens further, markets will likely price in three cuts this year," he added.

Updated at 2:18 PM EDT

While you were seeping

Global oil prices are getting hammered in the wake of the market's 'risk off' trade heading into the close of the week, with traders factoring in a big pullback in demand alongside the expected weakness in GDP growth.

Brent crude futures contracts for October delivery, the global pricing benchmark, were last down $3 on the session at $76.45 each, the lowest since January.

WTI futures for September delivery, which are tightly linked to U.S. gas prices, fell $3.11 to $73.20 per barrel.

Money managers reduced their net-length in Brent crude oil futures and options by 68,359contracts to 77,990 in the week ending July 30

— Giovanni Staunovo🛢 (@staunovo) August 2, 2024

Long-only positions fell by 55,708

Short-only positions rose by 12,651

other reportables net-length rose by 35,701

ICE #oott

Updated at 12:18 PM EDT

Volatility vortex

The market's benchmark volatility gauge, the CBOE Group's VIX index, surged more than 40% in midday trading to the highest levels since October of last year as the selloff on Wall Street accelerates into the afternoon session.

The VIX was last marked 39.7% higher at $25.88, a level that suggests traders are expecting daily swings of around 1.62%, or 86.5 points, for the S&P 500 each day over the coming month.

That compares to VIX readings suggesting daily swings of around 40 points at the start of last month.

Stocks are still trading deeply in the red, with the S&P 500 down 112 points, or 2.07%, and the Nasdaq falling 435 points, or 2.53%

The Dow was last marked 785 points lower on the session with the small-cap focused Russell 2000 falling 80 points, or 3.68%, to erase most of its outsized July gains.

The $VIX just crossed above 28, highest since March 2023 during the regional bank crisis. There was an excessive amount of bullish sentiment a few weeks ago. Now moving quickly to fear. Many become more bearish as the market moves lower - you want to have the opposite mentality. pic.twitter.com/ztF7GL2pQO

— Charlie Bilello (@charliebilello) August 2, 2024

Updated at 11:07 AM EDT

Intel implosion

Intel shares have lost nearly $30 billion in market value this morning, and were last marked 28% lower at $20.92 each, after the chipmaker's disappointing second quarter earnings lead to deeper cost cuts, job losses and a suspension of its quarterly dividend.

Some analysts, however, are looking at some hidden value in today's historic collapse, which has taken the stock back to levels last seen in the early 2000s.

"While Intel missed out on the early cycle demand, they could become materially relevant as AI chip demand graduates to end devices, laptops, and AI inferencing workloads," said Tejas Dessai, research analyst at Global X. "We’ve only scratched the surface when it comes to the total addressable market for AI chips thus far."

Until the market matures in those directions however, we expect a bumpy ride,” he cautioned.

Related: Analysts revamp Intel stock price targets on post-earnings collapse

Updated at 9:37 AM EDT

Summer slump

Wall Street is opening firmly in the red, with a 90 point decline for the S&P 500 and a 515 point pullback for the Dow Jones Industrial Average.

The Nasdaq, meanwhile, was marked 442 points, or 2.58% lower at the start of trading, a move that drags the tech-focused benchmark into correction territory.

S&P 500 Opening Bell Heatmap (Aug. 02, 2024)$SPY -1.55%🟥$QQQ -2.29% 🟥$DJI -1.24%🟥$IWM -3.62%🟥 pic.twitter.com/ZPaTyYcJSq

— Wall St Engine (@wallstengine) August 2, 2024

Updated at 9:04 AM EDT

Fifty sense?

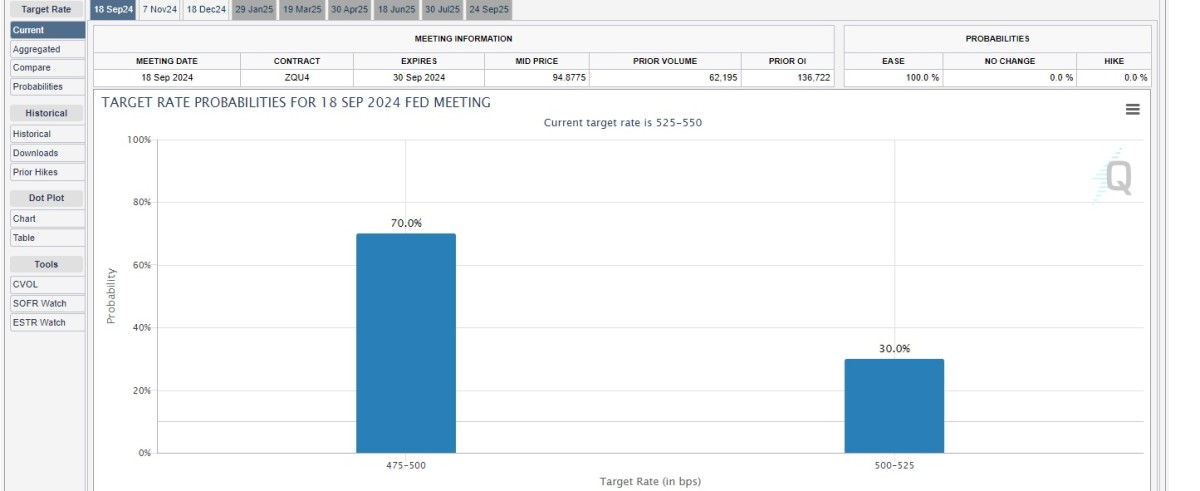

The weaker-than-expected jobs report, paired with a host of weakening activity data, has boosted bets on a 50 basis point rate cut from the Fed when it meets next month in Washington.

The CME Group's FedWatch now pegs the odds of a half-point cut at 70%, up from just 11.5% last week and 5.5% a month ago. Traders are also expecting more, and possibly deeper, cuts over the final two meetings of the year.

“These numbers reflect a sharp deceleration in hiring, confirming the weakness we saw in yesterday’s claims data," said David Russell, global head of market strategy at TradeStation. "The same Fed that was behind the curve on inflation could now find itself behind the curve fighting a slowdown."

"September 18 can’t come soon enough," he added.

Updated at 8:49 AM EDT

No longer working

The Labor Department's July jobs report is underscoring concern that the Fed has made a big policy error in not reducing rate earlier this summer, as hiring slowed and wages gains slumped.

Related: Jobs report cements the case for big September Fed rate cut

A net 114,000 new jobs were created last month, well shy of the Street's 175,000 forecast and the second-lowest tally of the year. Average hourly earnings, meanwhile, were up 3.6%, the smallest gain since May of 2021, while the headline unemployment rate rose to 4.3%, the highest since October of 2021.

Stocks extended their sharp declines, with futures tied to the S&P 500 indicating a 93 points opening bell decline and the Dow called 515 points lower.

Rate-sensitive 2-year note yields, meanwhile, fell to a 15-month low of 3.952%, while 10-year note yields tumbled to 4.802%.

The totality of today’s jobs report is leading markets to signal not one but two concerns: a growth scare, and worries about a Federal Reserve policy mistake.#economy #jobs #econtwitter pic.twitter.com/hv5NmWXUnA

— Mohamed A. El-Erian (@elerianm) August 2, 2024

Stock Market Today

Stocks ended sharply lower last night following both a muted reading for manufacturing activity in the world's biggest economy, which fell to an 8-month low in July, and concern that the Federal Reserve's reluctance to lower interest rates may have harmed growth prospects and raised recession risks.

"Investors had difficulty digesting the manufacturing data — is this a one-off or is this the slow roll toward the recession that never happened?" asked Jamie Cox, managing partner for Harris Group Financial in Richmond, Va.

"Markets are now thinking maybe the Federal Reserve should have cut this week," he added.

Related: The Fed's biggest problem isn't inflation anymore

Deteriorating employment data was also added to the mix, with softer-than-expected tallies for weekly jobless claims and and a closely tracked report on corporate layoffs showing the weakest hiring intentions since 2012.

Treasury bond yields, which have normally been supportive for stocks, plunged sharply as a result, but with the moves based on flight-to-safely rather than rate-cut projections, markets reacted negatively.

Benchmark 10-year note yields, which fell below the 4% level for the first time since February last night, were last marked at January levels of 3.942% in early New York trading.

At the same time, 2-year note yields, which are the most sensitive to projections in interest rate changes, fell to 4.115%, the lowest since May of last year. Bets on a 50 basis-point Fed rate cut in September jumped to 29.5%, according to the CME Group's FedWatch.

Markets will be keenly focused on today's July employment report, which is expected to show another slowdown in hiring and muted wage growth.

Original estimates were for a headline increase of 177,000 new jobs, but weaker data earlier this week has widened the forecast to between 140,000 and 180,000 heading into the release at 8:30 am Eastern Time.

On Wall Street, stocks are looking at a sharply lower Friday open following last night's selloff, with futures contracts tied to the S&P 500 indicating a 69-point decline at the start of trading.

The Dow Jones Industrial Average, meanwhile, is called 425 points lower with the tech-focused Nasdaq priced for a 350-point pullback.

Apple (AAPL) shares were a notable premarket mover, rising 0.4% after the iPhone maker posted better-than-expected fiscal-third-quarter earnings and said sales and margins would likely improve over the coming months.

Related: Apple earnings top forecasts, iPhone sales slip ahead of AI launch

Amazon (AMZN) was marked 8.5% lower after it posted a mixed set of second-quarter earnings. The report included a modest miss on the revenue side that was accentuated by the group's plans to ramp up capital spending on AI projects over the second half of the year.

Intel (INTC) shares, meanwhile, collapsed more than 20% in the premarket, taking the stock back to levels since the mid-1990s, after the chipmaker issued a muted near-term sales forecast, unveiled plans for a 15% reduction in head count and suspended its quarterly dividend.

Related: Analysts revamp Intel stock price targets on post-earnings collapse

More Wall Street Analysts:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Analysts prescribe new Walgreens stock price targets after earnings

- Analyst revises Facebook parent stock price target in AI arms race

In overseas markets, Europe's regional Stoxx 600 benchmark fell 1.67% in Frankfurt, with Britain's FTSE 100 down 0.52% in London.

Overnight in Asia, Japan's Nikkei 225 fell 5.08% for its biggest single-day decline since the pandemic, with the broader Topix index, which includes domestic-focused stocks, suffering the worst day since 2016.

The regionwide MSCI ex-Japan benchmark fell 2.44% into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks