Major indexes finished mixed Wednesday as investors awaited a critical fourth-quarter report from artificial intelligence chip leader Nvidia, a Dow Jones Industrial Average component that moved higher in the regular session. Meanwhile, the S&P and Nasdaq finished with slight gains after four days of losses on the stock market today.

Dow Jones pulled back 0.4% and breached its 50-day moving average. After a strong start, the S&P 500 fell back below the 6,000 mark but still held a slim gain at the closing bell. It also dipped back below its 50-day line.

Meanwhile, the tech-heavy Nasdaq also saw some early gains vanish but managed to finish 0.3% higher. The index remained well below its 50-day moving average.

Small caps on the Russell 2000 started out strong with a 1.2% surge in the early going but gave those gains up and finished with a marginal gain. Growth stocks in the Innovator IBD 50 exchange traded fund recovered from a six-day skid, however, and gained 2.5% Wednesday.

Volume on both the New York Stock Exchange and Nasdaq turned lower compared with the same time on Tuesday. Breadth was mixed with advancers outnumbering decliners 5-to-4 on the Nasdaq, while losers had a slim advantage on the NYSE.

The yield on the benchmark 10-year Treasury note ticked lower to 4.25% — a new low for the year after a dip in consumer confidence for February alarmed investors on Tuesday.

Dow Jones: Nvidia Earnings Ahead

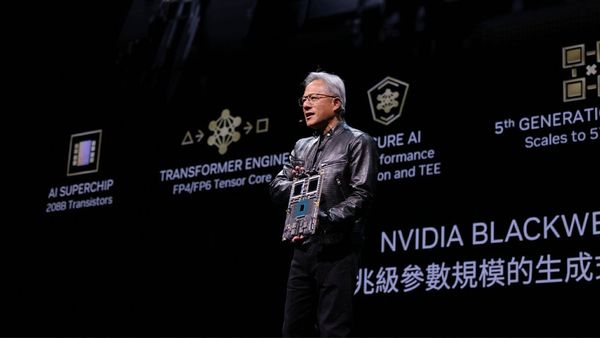

Nvidia's fourth-quarter results were due after the market close, as shares of the Dow Jones component try to rebound from their 200-day moving average. Analysts polled by FactSet see Nvidia sales at $38.1 billion with earnings at 85 cents a share.

Investors also wait for Nvidia's outlook after China's DeepSeek disrupted the artificial intelligence scene in January. Other headwinds include tariffs and competition from other tech titans that are making custom chips.

Nvidia is the last of the Magnificent Seven to report earnings this season. Shares were up nearly 4% in regular trading Wednesday but face resistance at their 50-day moving average. Meanwhile, mutual funds have started adding positions, putting Nvidia on Investors Business Daily's screen for stocks funds are buying.

Earlier, analysts at Mizuho had observed that Nvidia has to work through some "growing pains" before sales surge in the second half of the year.

Among other Dow Jones components, Amazon and Salesforce rose. Apple lagged. Health care leaders also were down.

3:21 p.m. ET

Intuit Jumps On Earnings

Intuit surged more than 12% and cleared its 50-day moving average after reporting earnings on Wednesday. Second-quarter sales rose 17% to $4 billion while earnings per share of $3.32 were 26% higher than the prior year.

1:53 p.m. ET

Stock Market Today: IBD 50 Chip Play Soars On Earnings

ACM Research gapped up past a buy zone from an entry at 26.32. Sales and earnings in the fourth quarter accelerated from the prior year. Sales grew 31% to $223.5 million while earnings per share of 56 cents were 30% higher than the prior year.

ACM ranks first in the IBD 50. It provides wafer cleaning and plating tools, as well as processes for the chip industry.

Masimo soared into a buy zone from an entry at 180.97 after fourth-quarter results late Tuesday. Sales grew 9% to $601 million but earnings growth accelerated for the second straight quarter, up 44% to $1.80 per share. The relative strength line is rising sharply.

Maplebear, the parent of delivery service Instacart, triggered a sell signal and fell below the 50-day moving average in heavy volume. Fourth-quarter sales and earnings decelerated to $883 million in sales and 53 cents in earnings per share.

12:16 p.m. ET

GE Vernova Partners With NRG

AI play GE Vernova jumped more than 5% amid news that the power company will partner with NRG on four projects to provide energy for data centers. Shares approached their 50-day line Wednesday.

11:01 a.m. ET

Stock Market Today: Coupang Up, Super Micro Soars

Coupang stepped up Wednesday after it reported earnings late Tuesday. Sales of $7.97 billion missed views of $8.14 billion, but earnings of 8 cents a share came well above estimates of 1 cent a share. Coupang stock broke out of a cup-with-handle base with a buy point of 25.67.

Korean online retail platform Coupang has a Relative Strength Rating of 80. Though its Earnings Per Share Rating lags at 39, it is expected to improve after its December-quarter results. Coupang was Tuesday's IBD Stock of the Day.

Are These Magnificent Seven Stocks A Buy Now?

Alphabet | Amazon | Apple | Meta | Microsoft | Nvidia | Tesla

Super Micro Computer surged after the company met a deadline to remain listed on the Nasdaq. The AI server titan filed its annual report for the year ended June 30 as well as quarterly reports, bringing it up to date with Nasdaq's reporting requirements.

Super Micro's chart has to work through significant damage, even with the stock's surge Wednesday. The Relative Strength Rating lags at 26 while the 200-day moving average is above the 50-day line. Shares were clearing the 200-day line on Wednesday.

Workday, Axon Jump On Results

Workday was also an earnings winner. Shares surged 6% and approached a buy point of 294 in an early-stage cup with handle. The stock also has cleared its 50-day moving average.

Sales grew to $2.2 billion while earnings per share also rose to $1.92 per share. Both beat analyst estimates of $1.78 earnings per share on sales of $2.18 billion.

These Are The Five Best Stocks To Buy Or Add To A Watchlist Now

Workday is on the IBD Tech Leaders list along with Nvidia.

Elsewhere, Taser maker Axon Enterprise vaulted more than 15% higher, breaking a five-day losing streak that led to a 30% loss. Fourth-quarter earnings came in at $1.67 per share with sales of $575.15 million. Analysts called for earnings of $1.40 a share on sales of $566 million. But the stock has to make more progress before it retakes the 50-day line.

Option Care Health broke out of a double-bottom base at a buy point of 33.05 on the stock market today.

AppLovin triggered a sell signal and plunged below the 50-day moving average in heavy volume.

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.