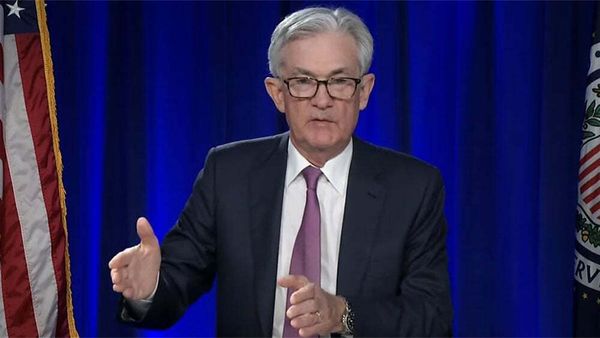

The stock market rally powered higher for much of the week with the S&P 500 moving above its 200-day moving average. Fed chief Jerome Powell reinforced expectations for slower rate hikes, while a key inflation report showed prices pressures moderating. But the jobs report was stronger than expected, especially wage growth. The S&P 500 tested its 200-day line following the employment data. Treasury yields fell for the week, but cut losses on Friday.

China stocks spiked higher as Covid curbs eased amid big protests with Pinduoduo and China EV makers such as Nio reporting strong results.

Software earnings were mixed, with Salesforce.com and CrowdStrike tumbling on weak guidance while Snowflake, Workday, Box and several others rallied.

Market Rally

The S&P 500 retook the 200-day moving average on Wednesday following comments from Fed chief Jerome Powell, but then fell back to test that key level on Friday's hot jobs report. China stocks soared on hopes for easier Covid restrictions. Treasury yields plunged. Crude oil and copper rebounded on China and a weaker dollar.

Jobs Report Won't Please Fed

November's jobs report delivered a triple-whammy: stronger-than-expected hiring, faster wage growth and weaker participation. Employers added 263,000 jobs, while the average hourly wage jumped 0.6% on the month. The 5.1% annual wage growth was a half-percent ahead of forecasts, as pay gains start to accelerate again. Friday's jobs data looked even worse in light of Fed chief Jerome Powell's latest speech Wednesday, which essentially declared that Fed policy will be driven by wage growth. Powell also said the inflation focus should be on core services inflation excluding housing. Meanwhile, the Fed's favored inflation gauge, the PCE price index showed price pressures easing a bit more than expected in October.

Business Software Mixed

Salesforce said Q3 EPS rose 10%, beating views, while revenue climbed 14% to $7.84 billion, just above views. The cloud software pioneer guided lower for the January quarter. Co-CEO Bret Taylor will depart in January, leaving Marc Benioff as sole CEO of the company. Snowflake reported a net loss in line, though the adjusted EPS topped. Revenue climbed 67% to $557 million, beating estimates of $539.4 million. The analytics firm forecast Q4 product revenue of $537.5 million, below estimates of $549.2 million and guided low for the next fiscal year. Workday reported EPS sank 10% but comfortably beat, while revenue grew 20.5% to $1.6 billion, narrowly beating. It also announced a $500 million buyback. CRM stock tumbled. SNOW initially dived but roared back on an improved outlook for free cash flow. WDAY jumped.

Cybersecurity

CrowdStrike reported Q3 adjusted EPS jumped 135% with revenue up 53% to $581 million, both beating. But annual recurring revenue just missed views, while CrowdStrike guided low on Q4 revenue. Shares plunged. Zscaler reported a 107% EPS gain and a 54% revenue gain and raised guidance for the current quarter, but shares tumbled as billings didn't beat views sufficiently. Okta reported a 1-cent loss, well above views, while revenue rose 37% to $481 million, topping estimates. For the January quarter, Okta forecast a profit vs. consensus for a loss.

Pure Storage Rises, NetApp Dives

Two leaders in the enterprise storage market reported lackluster guidance. NetApp earnings rose 16%, beating Q3 views, while a 6% revenue gain was in line. But NetApp guided low on Q4 revenue. Pure Storage beat estimates with a 41% EPS gain and 20% sales rise, but guided slightly lower on Q4 revenue. NTAP stock tumbled. PSTG initially dived on NTAP, but slashed weekly losses following earnings.

China EV Sales

Li Autooutsold Nio in November, though both Chinese EV startups scored record monthly deliveries. XPeng continued to lag. Li Auto sold 15,034 electric vehicles, a 12% increase vs. a year ago. Nio sold 14,178 EVs, up 30%. Xpeng sold 5,811 EVs, down 63%. Both Nio and XPeng predicted a stronger December. As expected, all three startups reported improving sales vs. October, with Covid-related supply headwinds easing and new models ramping up. Chinese EV giant BYD is due in coming days. China EV stocks skyrocketed, along with many other China names, on signs of easier Covid policies.

Drug News

Biogen, Eisai and Axsome Therapeutics surged on test results for their Alzheimer's treatments. Eisai said its Biogen-partnered drug, lecanemab, led to a 24%-37% improvement in symptoms over 18 months. Overall, lecanemab recipients showed a 27% slower decline in cognition than placebo recipients. However, roughly one in five patients who received lecanemab developed brain bleeding or swelling and two died. The deaths were in patients with comorbidities and taking anticoagulants, putting them at risk of brain hemorrhages, Eisai said. Meanwhile, Axsome's drug outperformed a placebo, delaying or preventing agitation in Alzheimer's patients. In other areas, Sarepta Therapeutics said the FDA will perform a speedy review of its gene therapy for Duchenne muscular dystrophy and Gilead Sciences said its lung cancer regimen with Arcus Biosciences outperformed a standard drug.

Dollar General Earnings Weak

The specialty discounter reported an 11% sales gain, the third straight quarter of slowly accelerating growth. EPS growth picked up to 12%, but fell short of views. Dollar General also guided low on earnings. Costco Wholesale, which reports Q3 earnings on Dec. 8, said November same-store sales rose 4.3%, below views, with many nonfood categories down. E-commerce sales slid 10.1%. DG and COST stock fell sharply.

Pinduoduo Soars On Earnings, Covid Hopes

The No. 3 Chinese e-commerce firm reported a 256% EPS jump on a 50% revenue gain, both easily beating views. Pinduoduo surged to a 52-week high, as Chinese stocks rebounded powerfully as Covid curbs eased. Bilibili posted better-than-expected quarterly results as daily and monthly active users both popped 25%.

News In Brief

Hewlett Packard Enterprise reported fiscal Q4 EPS of 57 cents a share, up 10% and meeting views. Revenue rose 7% to $7.9 billion, topping. For the January quarter, HPE forecast earnings and sales above views.

Credo Technology Group reported EPS of 2 cents vs. a 2-cent loss a year earlier. Revenue rose 94% to $51.4 million, topping estimates. For the January quarter, supplier of high-speed connectivity products for internet data centers forecast revenue of $55 million, just above estimates of $54.1 million.

Titan Machinery topped Q3 views, with EPS up 90% and sales jumping to $669 million in the third quarter. TITN stock blasted out of a base.

Horizon Therapeutics soared after saying it has received takeover interest from Amgen, Johnson & Johnson and Sanofi. The companies have until the end of the day on Jan. 10 to decide whether or not to make an offer.

Box jumped toward a buy point after reporting a 41% EPS gain and a 12% revenue rise, both slightly topping. Q4 revenue guidance was just below views. Box is pressured by economic headwinds and tighter spending on information technology.

Tesla delivered Semi big rigs to PepsiCo on Dec. 1, six years after unveiling the trailer-tractor EV. Tesla is offering a $3,750 discount for Model 3 and Y buys in December, as many would-be buyers delay purchases or taking delivery until 2023, when Tesla EVs will be eligible for up to $7,500 in credits.

Veeva Systems beat fiscal Q3 views, but Q4 guidance was slightly below the midpoint of consensus.

Ulta Beauty reported a 35% EPS gain with revenue up 17%, both beating. The beauty products retailer also raised guidance. Shares rose for a sixth straight week.