September S&P 500 E-Mini futures (ESU24) are up +0.04%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.11% this morning as trading resumed after the Independence Day holiday, with market participants bracing for the all-important U.S. payrolls reading due later in the day.

The minutes of the Federal Open Market Committee’s June 11-12 meeting, released Wednesday, showed that officials didn’t deem it appropriate to lower borrowing costs “until additional information had emerged to give them greater confidence that inflation” is on track to their 2% goal. Officials pointed to inflation progress evidenced by smaller monthly gains in the core personal consumption expenditures price index and May consumer price data released hours before the rate decision. While “some” participants emphasized the need for patience, “several” officials highlighted that further weakening in demand could lead to a larger increase in unemployment. At the same time, the minutes showed that several policymakers remained ready to raise interest rates if inflation remained elevated. “Participants noted the uncertainty associated with the economic outlook and with how long it would be appropriate to maintain a restrictive policy stance,” according to the FOMC minutes.

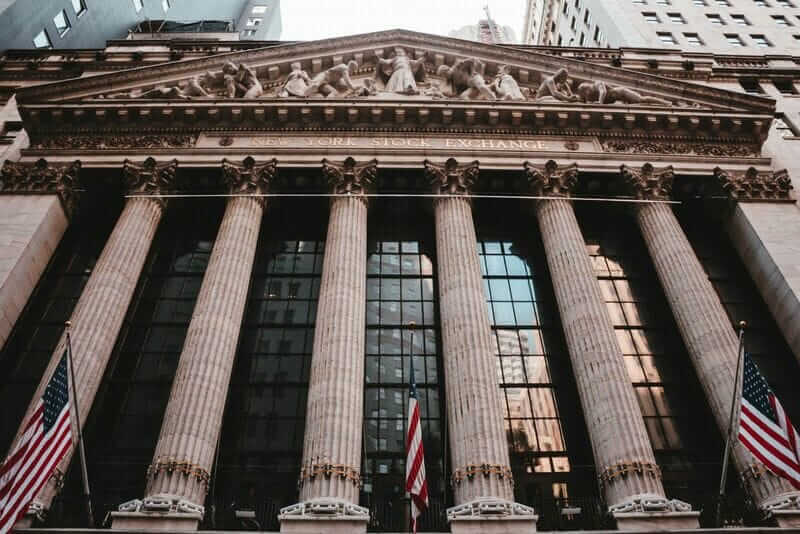

In Wednesday’s holiday-shortened trading session, Wall Street’s main stock indexes ended mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new record highs. Paramount Global (PARA) surged nearly +7% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that Skydance Media had reached a preliminary agreement to buy National Amusements and merge with Paramount. Also, Tesla (TSLA) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Bank of America Global Research raised its price target on the stock to $260 from $220. In addition, chip stocks advanced following a sharp decline in bond yields, with Nvidia (NVDA) and Broadcom (AVGO) rising over +4%. On the bearish side, Simulations Plus (SLP) tumbled more than -14% after the company suspended its quarterly cash dividend and cut its full-year EPS guidance.

The ADP National Employment report on Wednesday showed private payrolls rose by 150K jobs in June, weaker than expectations of 163K. Also, the U.S. June ISM services index fell to 48.8, weaker than expectations of 52.6 and the steepest pace of contraction in 4 years. In addition, U.S. factory orders unexpectedly fell -0.5% m/m in May, weaker than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose +4K to 238K, compared with 234K expected.

“With the ISM services falling to 48.8, the weakest since the pandemic and job claims deteriorating, ultimately the negative data is being seen as positive for markets,” said Justin Onuekwusi, chief investment officer at St James Place. “It feels like September is the date everyone is now looking at.”

Meanwhile, U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 68.1% chance of a 25 basis point rate cut at September’s policy meeting.

Today, all eyes are focused on U.S. Nonfarm Payrolls data, set to be released in a couple of hours. Economists, on average, forecast that June Nonfarm Payrolls will come in at 191K, compared to the previous value of 272K.

A survey conducted by 22V Research revealed varied expectations among investors regarding the market reaction to the jobs report, with 40% predicting a “negligible/mixed” response, 34% expecting “risk-on,” and 26% anticipating “risk-off.”

U.S. Average Hourly Earnings data will also be closely watched today. Economists expect June’s figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +4.1% y/y.

The U.S. Unemployment Rate will be reported today as well. Economists foresee this figure to remain steady at 4.0% in June.

In addition, market participants will be looking toward a speech from New York Fed President John Williams.

In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.342%, down -0.05%.

The Euro Stoxx 50 futures are up +0.38% this morning as investors digested the U.K. general election results and awaited key U.S. jobs data later in the day. Technology stocks outperformed on Friday. Data from the Federal Statistical Office showed Friday that German monthly industrial production unexpectedly fell in May. Separately, data from the Eurostat showed Friday that the euro area’s monthly retail sales rose less than expected in May. Meanwhile, U.K. stocks climbed and the pound strengthened on Friday following the Labour Party’s majority win in Parliament, solidifying its mandate to fulfill promises of enhanced economic stability. Rishi Sunak acknowledged his defeat, paving the way for Keir Starmer to assume the role of prime minister. Also, Marine Le Pen’s National Rally party is anticipated to miss securing an absolute majority in upcoming second-round elections, further lifting market sentiment. In corporate news, Aixtron Se (AIXA.D.DX) surged over +16% after reporting robust order intake in the second quarter.

U.K.’s Halifax House Price Index, Germany’s Industrial Production, France’s Industrial Production, and Eurozone’s Retail Sales data were released today.

U.K. June Halifax House Price Index has been reported at -0.2% m/m, weaker than expectations of +0.2% m/m.

The German May Industrial Production came in at -2.5% m/m, weaker than expectations of +0.2% m/m.

The French May Industrial Production stood at -2.1% m/m, weaker than expectations of -0.6% m/m.

Eurozone May Retail Sales arrived at +0.1% m/m and +0.3% y/y, compared to expectations of +0.2% m/m and +0.1% y/y.

Asian stock markets today closed mixed. China’s Shanghai Composite Index (SHCOMP) closed down -0.26% and Japan’s Nikkei 225 Stock Index (NIK) closed flat.

China’s Shanghai Composite Index closed lower today as investor sentiment continued to deteriorate ahead of a crucial policy meeting later this month. Insurance and bank stocks led the declines on Friday. Sentiment turned negative on Friday due to the implementation of increased European Union tariffs on Chinese electric cars. China’s state-backed Global Times has called on the EU to “show sincerity” in technical discussions before implementing tariffs on Chinese-made electric vehicles. Meanwhile, Bloomberg News reported on Friday that the People’s Bank of China has “hundreds of billions” of yuan worth of medium- and long-term bonds available for borrowing, which it will sell based on market conditions, citing a statement from the central bank. Analysts suggest this move is likely aimed at stabilizing sharply declining long-term bond yields. In corporate news, Guangdong Kinlong Hardware Products fell over -3% after it projected a drop of up to 61.2% in first-half attributable profit, expected to range between 5 million yuan to 7.5 million yuan. Investor attention in July centers on the Third Plenum of the Chinese Communist Party, where policies for deepening reforms and advancing China’s modernization efforts are expected to be outlined.

Japan’s Nikkei 225 Stock Index gave up early gains and ended flat today as investors booked profits and looked ahead to the U.S. nonfarm payrolls report later in the day. Losses in automobile and shipping stocks offset gains in retail and pharmaceutical stocks on Friday. Data released by the Ministry of Internal Affairs and Communications on Friday revealed an unexpected decline in Japanese household spending in May, driven by continued pressure from higher prices, complicating the central bank’s decision on the timing of interest rate increases. Separately, preliminary data from the Cabinet Office showed that Japan’s leading economic index for gauging the economic outlook rebounded slightly from a three-month low in May. Meanwhile, the yen strengthened for a second consecutive day on Friday against the dollar, rebounding further from the lowest level since 1986 reached on Wednesday. Japanese Finance Minister Shunichi Suzuki stated Friday that authorities will closely monitor both the stock and foreign exchange markets with a sense of urgency. In corporate news, Kewpie climbed over +7% after the company reported a 160.9% surge in profit to 12.5 billion yen in the second quarter, driven by higher sales and stable costs. The Nikkei Volatility, which takes into account the implied volatility of Nikkei 225 options, closed down -0.48% to 16.76.

The Japanese May Household Spending came in at -0.3% m/m and -1.8% y/y, weaker than expectations of +0.5% m/m and +0.2% y/y.

The Japanese May Leading Index was at 111.1, in line with expectations.

Pre-Market U.S. Stock Movers

Cryptocurrency-exposed stocks are moving lower in pre-market trading, with the price of Bitcoin slumping to its lowest level since February. Marathon Digital (MARA) is down about -8%. Also, Hut 8 Mining (HUT) is down more than -9%, and Riot Blockchain (RIOT) is down over -6%.

Macy’s (M) gained more than +4% in pre-market trading following a report from the Wall Street Journal that Arkhouse Management and Brigade Capital Management increased their buyout offer for the department store chain to $24.80 per share, or about $6.9 billion.

You can see more pre-market stock movers here

Today’s U.S. Earnings Spotlight: Friday - July 5th

Kalvista Pharma (KALV).

More Stock Market News from Barchart

- 2 High-Yield Stocks With New 'Buy' Ratings from Goldman

- What to Expect From Regions Financials’ Next Quarterly Earnings Report

- Travelers Companies Earnings Preview: What to Expect

- What You Need to Know Ahead of American Express' Earnings Release