The Chancellor has unveiled his highly anticipated spring statement, vowing to “stand by” British families in the face of the mounting cost of living.

The PA news agency takes a look at the contents of Wednesday’s update in the Commons.

– Fuel duty

In a move expected by many, the Chancellor announced his intention to cut fuel duty to ease the pressure on cash-strapped households.

The Government has frozen the duty for 11 years, but has faced calls to reduce it as oil costs – and consequently pump prices – hit record highs on the back of the Ukraine conflict.

Mr Sunak said the duty will be cut by 5p per litre for a year, from Wednesday evening.

Figures from data firm Experian Catalist show the average cost of a litre of petrol at UK forecourts on Tuesday was 167.3p, while diesel was 179.7p.

This represents an increase of 18.0p per litre for petrol and 27.0p for diesel over the past month.

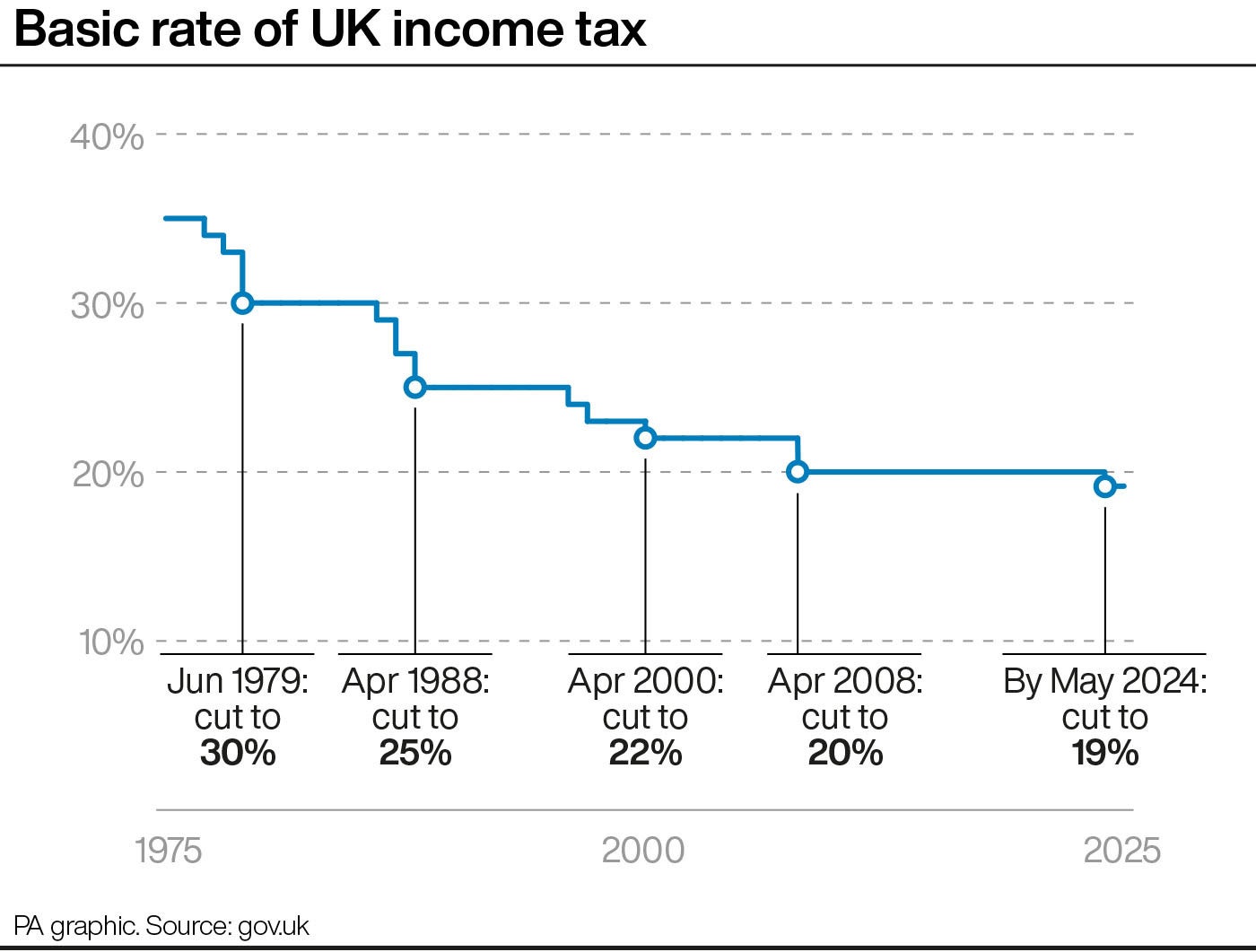

– Income tax

Eyebrows were raised by an unexpected promise from the Chancellor to cut the basic rate of income tax before the end of the current parliament in 2024.

He told MPs: “A clear goal for Conservative chancellors, and even some Labour ones, has been to cut income tax. The fact this has only happened twice in 20 years tells you how hard it is to do.

“Covid and the war in Ukraine have only added to the difficulty of achieving this by the end of this parliament.”

He said it would “clearly be irresponsible to meet this ambition this year”.

But he added: “By 2024, the OBR (Office for Budget Responsibility) currently expects inflation to be back under control, debt falling sustainably, and the economy growing. Our fiscal rules are met with a clear safety margin.

“So my final announcement today is this: I can confirm, before the end of this parliament in 2024, for the first time in 16 years, the basic rate of income tax will be cut from 20 to 19p in the pound.

“A tax cut for workers, for pensioners, for savers. A £5 billion tax cut for 30 million people. It is fully costed and fully paid for in the plan announced today.”

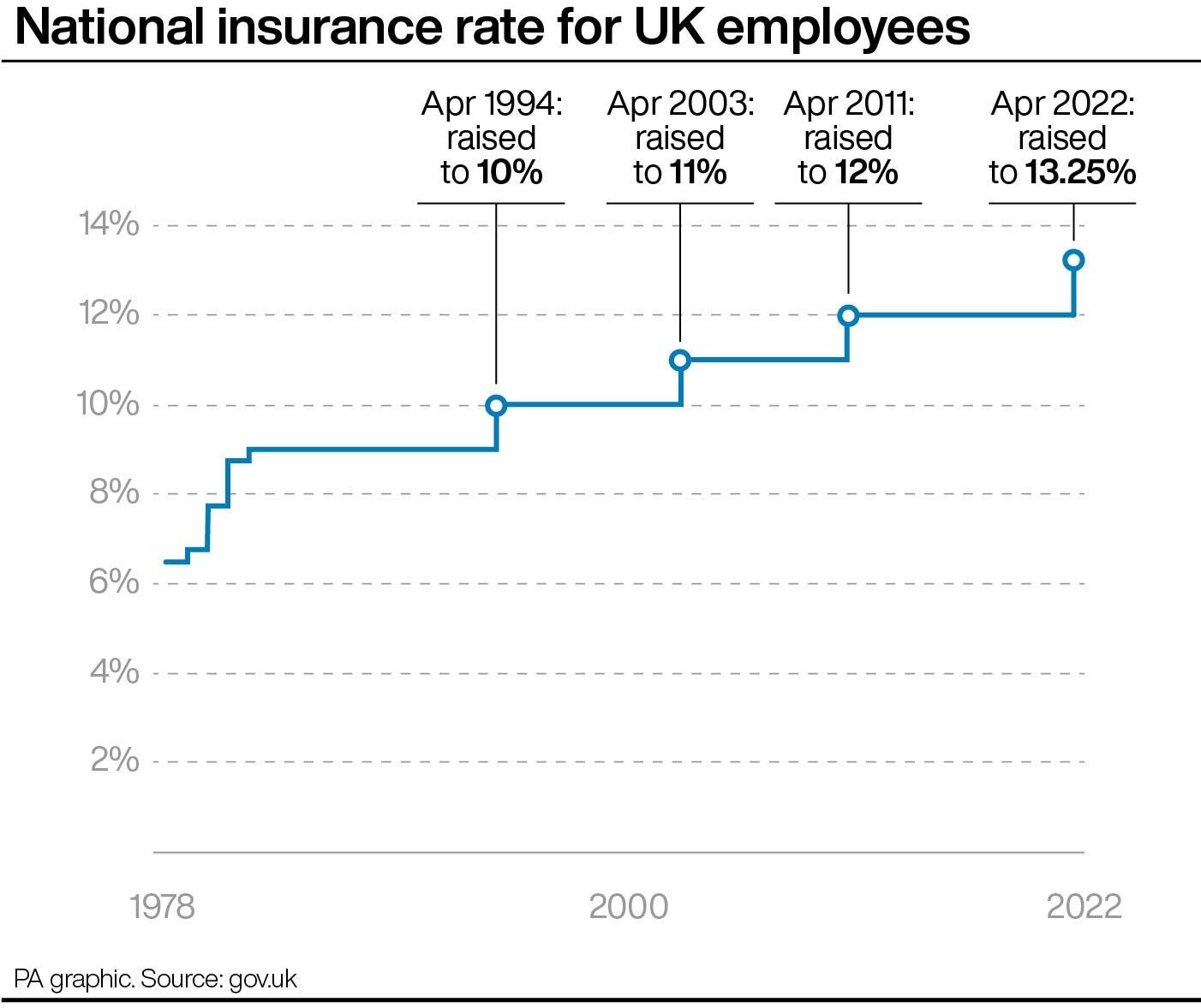

– National insurance

The cost-of-living crisis driven by rising fuel and energy prices was set to be exacerbated in April by a 1.25 percentage point rise in national insurance to fund the NHS and social care.

It came as no surprise that the Chancellor decided against postponing the planned hike, despite calls from across the political spectrum – as both he and the Prime Minister had been adamant that the increase would go ahead.

But Mr Sunak did elect to raise the threshold for when the payments are made – a compromise some had anticipated.

He said the change amounted to “a £6 billion personal tax cut for 30 million people across the United Kingdom, a tax cut for employees worth over £330 a year”.

The Chancellor’s plan will increase the threshold at which people start paying national insurance contributions by £3,000 to £12,570 from July.

Mr Sunak said around 70% of workers would have their tax cut by more than the increase due in April.

– VAT

Mr Sunak announced VAT will be scrapped for energy efficiency measures such as solar panels, heat pumps and insulation for five years to tackle high energy bills.

He said: “We’ll also reverse the EU’s decision to take wind and water turbines out of scope – and zero rate them as well. And we’ll abolish all the red tape imposed by the EU. A family having a solar panel installed will see tax savings worth over £1,000. And savings on their energy bill of over £300 per year.”

The Chancellor said the policy will not apply immediately to Northern Ireland due to “deficiencies” in the Northern Ireland Protocol but said support would be offered.

The move was welcomed by the Conservative Environment Network group of Tory MPs who had urged him to slash VAT on energy-saving products and installation.

Stephen Crabb, MP for Preseli Pembrokeshire, said: “This tax cut will mean more families can afford to insulate their home, cut their energy bills and stay warm.

“Insulating homes is the quickest way to help shield people from high gas prices and reduce our dependency on imported energy.”

– Benefits

It had been suggested the Chancellor could also uprate benefits to put more money in the pockets of low and middle-income households.

The Resolution Foundation had called for a five percentage point increase to keep pace with inflation, calling it the most effective way to support hardest-hit families.

The think tank said it would deliver four times more support to the bottom half of the income distribution per pound spent than scrapping the rise in national insurance contributions.

However Paul Johnson, director of the Institute for Fiscal Studies (IFS), said there was “no new help for those dependent on benefits in today’s statement”.

He tweeted: “The big omission from this statement was anything for those subsisting on means-tested benefits.

“They will be facing cost-of-living increases of probably 10% but their benefits will rise by just 3.1%.

“And (it is a) cut compared to last year if you account for withdrawal of £20 (Universal Credit) uplift.”

– Energy bills

Mr Sunak had already unveiled plans to help with rising energy bills, with a £200 loan to every family to cut their gas and electricity payments from October – although not until the price cap jumps 54%.

In addition to removing VAT on materials such as solar panels, heat pumps and insulation, the Chancellor announced he would double the Household Support Fund to £1 billion “to do more to help our most vulnerable households with rising costs”.

Local authorities will receive the funding from April, he said.

– Help for businesses

The Chancellor said employment allowance will rise to £5,000 from next month, which he described as a “new tax cut” worth up to £1,000 for half a million small businesses.

Green technology will also be exempt from business rates from April, saving firms £35 million in 2022-23.