Investors with a lot of money to spend have taken a bullish stance on Deckers Outdoor (NYSE:DECK).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DECK, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Deckers Outdoor.

This isn't normal.

The overall sentiment of these big-money traders is split between 44% bullish and 33%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $35,000, and 8, calls, for a total amount of $1,102,578.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $220.0 for Deckers Outdoor over the last 3 months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Deckers Outdoor options trades today is 141.44 with a total volume of 253.00.

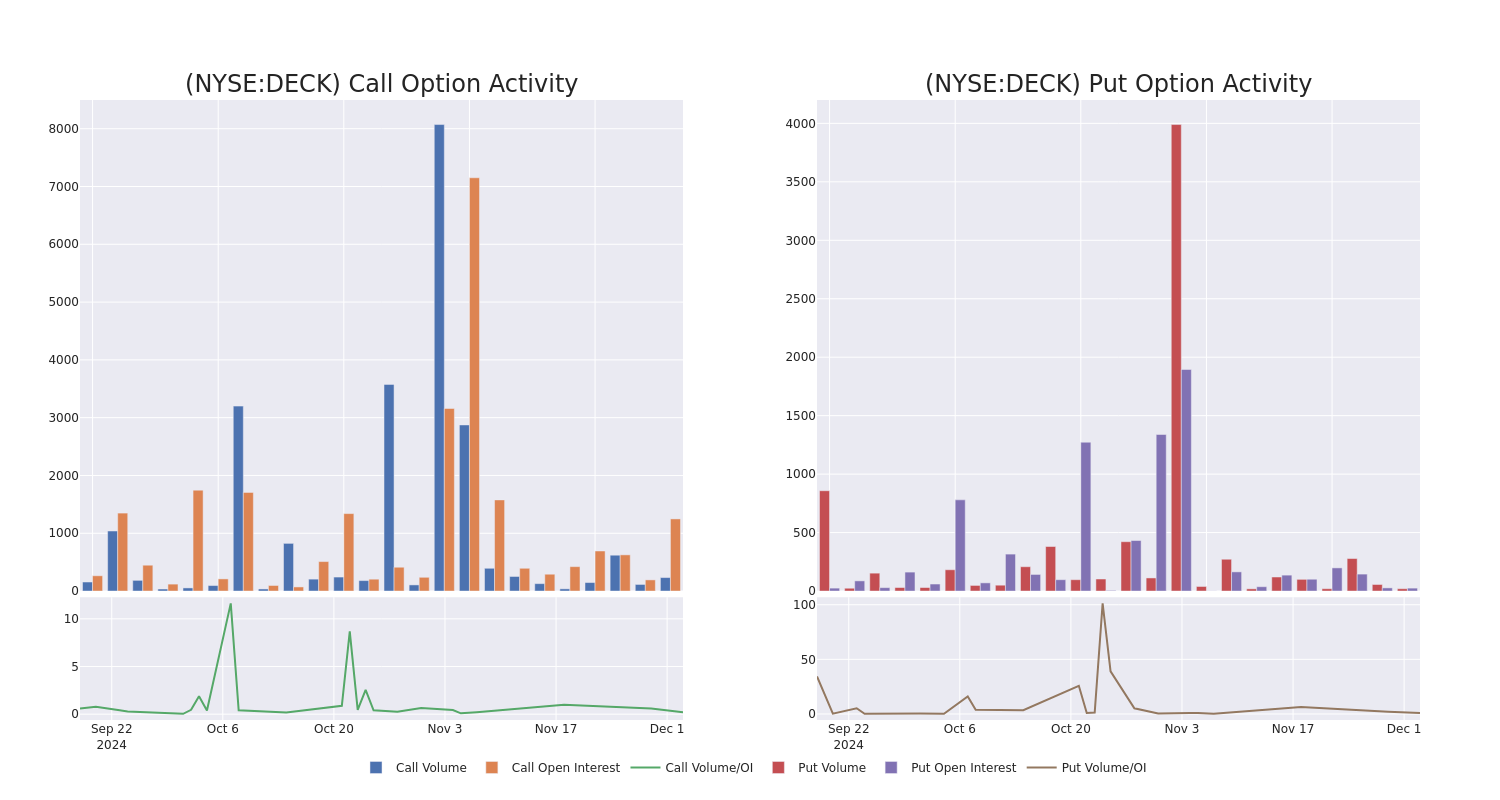

In the following chart, we are able to follow the development of volume and open interest of call and put options for Deckers Outdoor's big money trades within a strike price range of $100.0 to $220.0 over the last 30 days.

Deckers Outdoor Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | CALL | TRADE | BEARISH | 12/20/24 | $108.7 | $105.5 | $105.5 | $100.00 | $633.0K | 96 | 60 |

| DECK | CALL | SWEEP | NEUTRAL | 12/20/24 | $54.9 | $45.0 | $49.3 | $153.33 | $118.6K | 79 | 24 |

| DECK | CALL | SWEEP | BULLISH | 12/20/24 | $8.4 | $7.8 | $8.4 | $200.00 | $84.0K | 690 | 100 |

| DECK | CALL | TRADE | NEUTRAL | 01/15/27 | $54.8 | $53.0 | $53.89 | $200.00 | $80.8K | 11 | 15 |

| DECK | CALL | SWEEP | BEARISH | 02/21/25 | $80.0 | $71.3 | $71.2 | $130.00 | $72.6K | 68 | 10 |

About Deckers Outdoor

Founded in 1973, California-based Deckers designs and sells casual and performance footwear, apparel, and accessories. In fiscal 2024, Ugg and Hoka accounted for 52% and 42% of total sales, respectively. The firm also markets niche brands Teva, Ahnu, and Koolaburra. Deckers generates most of its sales through wholesale partnerships, but also operates e-commerce in more than 50 countries and about 178 company-operated stores. The company generated 67% of its fiscal 2024 sales in the United States.

In light of the recent options history for Deckers Outdoor, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Deckers Outdoor's Current Market Status

- Trading volume stands at 891,484, with DECK's price up by 0.8%, positioned at $203.51.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 58 days.

Professional Analyst Ratings for Deckers Outdoor

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $224.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $218. * An analyst from Truist Securities persists with their Buy rating on Deckers Outdoor, maintaining a target price of $230.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Deckers Outdoor, Benzinga Pro gives you real-time options trades alerts.