High-rolling investors have positioned themselves bearish on Asana (NYSE:ASAN), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ASAN often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 30 options trades for Asana. This is not a typical pattern.

The sentiment among these major traders is split, with 33% bullish and 46% bearish. Among all the options we identified, there was one put, amounting to $38,905, and 29 calls, totaling $1,616,393.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $12.5 and $30.0 for Asana, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Asana's options for a given strike price.

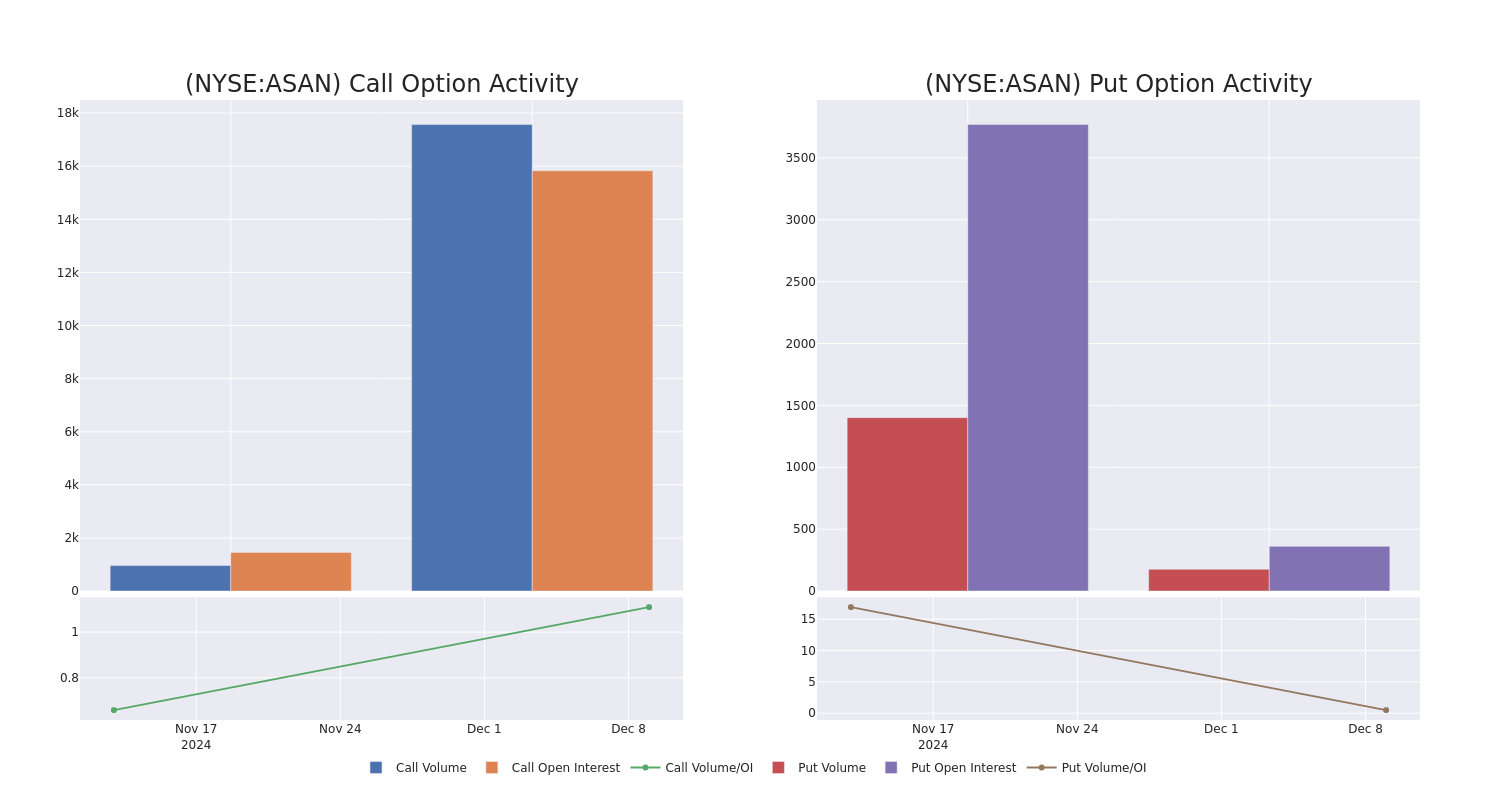

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Asana's whale activity within a strike price range from $12.5 to $30.0 in the last 30 days.

Asana Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASAN | CALL | SWEEP | BEARISH | 01/17/25 | $12.0 | $11.8 | $11.8 | $12.50 | $224.2K | 2.2K | 201 |

| ASAN | CALL | SWEEP | BEARISH | 01/17/25 | $8.2 | $6.8 | $6.8 | $17.50 | $136.0K | 3.1K | 300 |

| ASAN | CALL | SWEEP | BEARISH | 01/17/25 | $12.9 | $12.5 | $12.5 | $12.50 | $100.0K | 2.2K | 501 |

| ASAN | CALL | SWEEP | BEARISH | 01/17/25 | $7.6 | $7.4 | $7.4 | $17.50 | $93.2K | 3.1K | 1.4K |

| ASAN | CALL | SWEEP | BEARISH | 01/17/25 | $7.5 | $7.3 | $7.3 | $17.50 | $69.3K | 3.1K | 1.0K |

About Asana

Asana is a provider of collaborative work management software delivered via a cloud-based SaaS model. The firm's solution offers scalable, dynamic tools to improve the efficiency of project and process management across countless use cases, including marketing programs, managing IT approvals, and performance management. Asana's offering supports workflow management across teams, provides real time visibility into projects, and reporting and automation capabilities. The firm generates revenue via software subscriptions on a per seat basis.

Following our analysis of the options activities associated with Asana, we pivot to a closer look at the company's own performance.

Where Is Asana Standing Right Now?

- Currently trading with a volume of 8,089,965, the ASAN's price is up by 11.81%, now at $24.81.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 91 days.

Professional Analyst Ratings for Asana

5 market experts have recently issued ratings for this stock, with a consensus target price of $18.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Scotiabank has revised its rating downward to Sector Perform, adjusting the price target to $15. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Asana, targeting a price of $18. * An analyst from Jefferies has decided to maintain their Hold rating on Asana, which currently sits at a price target of $16. * An analyst from JMP Securities has decided to maintain their Market Outperform rating on Asana, which currently sits at a price target of $25. * Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Asana, targeting a price of $19.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Asana with Benzinga Pro for real-time alerts.