Financial giants have made a conspicuous bearish move on Alibaba Gr Hldgs. Our analysis of options history for Alibaba Gr Hldgs (NYSE:BABA) revealed 22 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $126,900, and 20 were calls, valued at $1,652,468.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $75.0 and $125.0 for Alibaba Gr Hldgs, spanning the last three months.

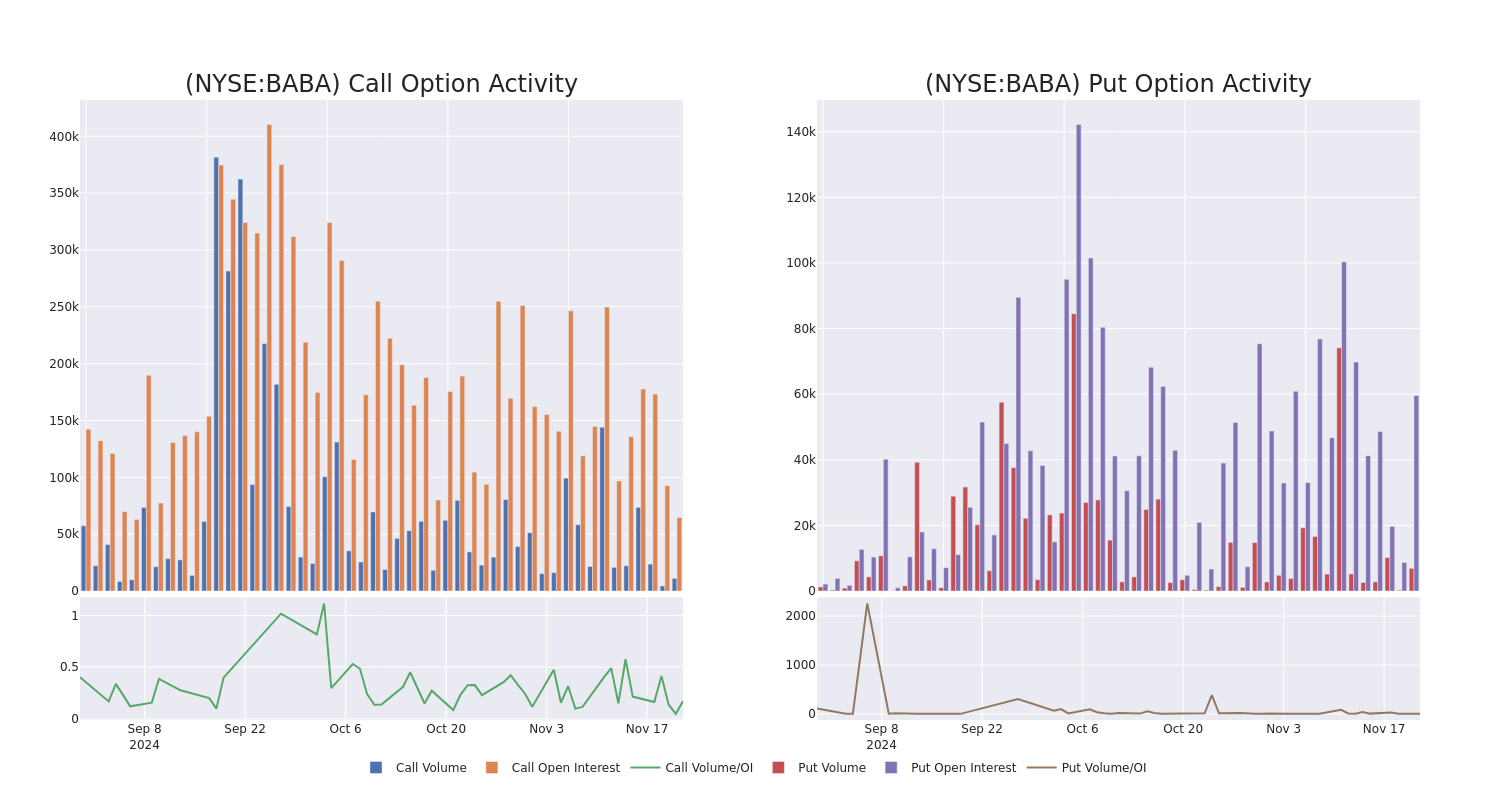

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Alibaba Gr Hldgs options trades today is 4470.82 with a total volume of 9,270.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Alibaba Gr Hldgs's big money trades within a strike price range of $75.0 to $125.0 over the last 30 days.

Alibaba Gr Hldgs Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BABA | CALL | SWEEP | BEARISH | 01/17/25 | $9.35 | $9.25 | $9.25 | $80.00 | $461.6K | 17.0K | 518 |

| BABA | CALL | SWEEP | BEARISH | 01/17/25 | $9.3 | $9.1 | $9.1 | $80.00 | $212.0K | 17.0K | 1.0K |

| BABA | CALL | SWEEP | BEARISH | 01/17/25 | $9.3 | $9.1 | $9.18 | $80.00 | $199.1K | 17.0K | 735 |

| BABA | CALL | SWEEP | BEARISH | 02/21/25 | $2.98 | $2.94 | $2.94 | $97.50 | $88.5K | 3.5K | 352 |

| BABA | PUT | SWEEP | BEARISH | 03/21/25 | $38.0 | $37.65 | $37.75 | $125.00 | $83.0K | 0 | 22 |

About Alibaba Gr Hldgs

Alibaba is the world's largest online and mobile commerce company as measured by gross merchandise volume. It operates China's online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer). The China commerce retail division is the most valuable cash flow-generating business at Alibaba. Additional revenue sources include China commerce wholesale, international commerce retail/wholesale, local consumer services, cloud computing, digital media and entertainment platforms, Cainiao logistics services, and innovation initiatives/other.

After a thorough review of the options trading surrounding Alibaba Gr Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Alibaba Gr Hldgs's Current Market Status

- Trading volume stands at 7,723,345, with BABA's price up by 1.77%, positioned at $86.69.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 70 days.

Professional Analyst Ratings for Alibaba Gr Hldgs

In the last month, 4 experts released ratings on this stock with an average target price of $119.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $118. * Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $118. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Alibaba Gr Hldgs with a target price of $113. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Alibaba Gr Hldgs with a target price of $130.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Alibaba Gr Hldgs with Benzinga Pro for real-time alerts.