Sportsman's Warehouse (NASDAQ:SPWH) is gearing up to announce its quarterly earnings on Tuesday, 2024-12-10. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Sportsman's Warehouse will report an earnings per share (EPS) of $-0.02.

Anticipation surrounds Sportsman's Warehouse's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

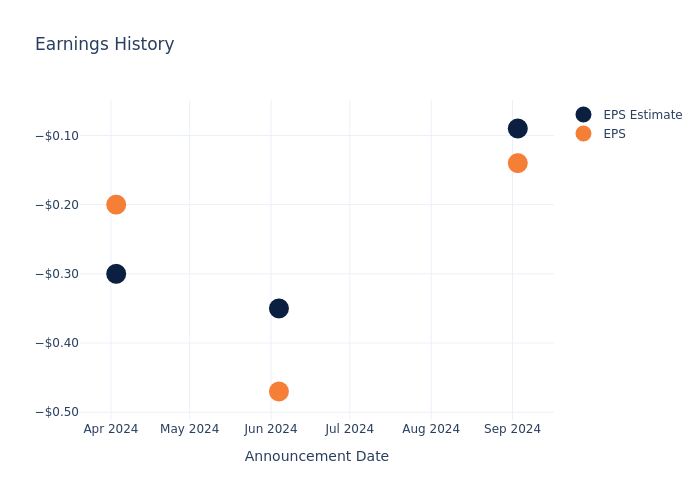

Earnings History Snapshot

Last quarter the company missed EPS by $0.05, which was followed by a 6.7% increase in the share price the next day.

Here's a look at Sportsman's Warehouse's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.09 | -0.35 | -0.3 | -0.12 |

| EPS Actual | -0.14 | -0.47 | -0.2 | -0.01 |

| Price Change % | 7.000000000000001% | -13.0% | 21.0% | -22.0% |

Tracking Sportsman's Warehouse's Stock Performance

Shares of Sportsman's Warehouse were trading at $2.12 as of December 06. Over the last 52-week period, shares are down 46.43%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Sportsman's Warehouse

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Sportsman's Warehouse.

Analysts have given Sportsman's Warehouse a total of 1 ratings, with the consensus rating being Buy. The average one-year price target is $3.5, indicating a potential 65.09% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Grove Collaborative Hldgs and Brilliant Earth Group, three key industry players, offering insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Outperform trajectory for Grove Collaborative Hldgs, with an average 1-year price target of $2.0, implying a potential 5.66% downside.

- The consensus outlook from analysts is an Outperform trajectory for Brilliant Earth Group, with an average 1-year price target of $3.0, indicating a potential 41.51% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Grove Collaborative Hldgs and Brilliant Earth Group, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sportsman's Warehouse | Buy | -6.71% | $90.02M | -2.41% |

| Grove Collaborative Hldgs | Outperform | -21.81% | $25.60M | -136.90% |

| Brilliant Earth Group | Outperform | -12.51% | $60.77M | -0.99% |

Key Takeaway:

Sportsman's Warehouse ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it ranks in the middle for Return on Equity.

All You Need to Know About Sportsman's Warehouse

Sportsman's Warehouse Holdings Inc together with its subsidiaries operates as an outdoor sporting goods retailer. It provides a one-stop shopping experience that equips customers with the right quality, brand name hunting, shooting, fishing, and camping gear to maximize enjoyment of the outdoors. The company offers products in the categories of Camping, Apparel, Fishing, Footwear, Hunting and shooting, and Optics, Electronics, Accessories, and Other products. It provides products such as Backpacks, Jackets, Camp essentials, Hiking boots, GPS devices, ATV accessories and Fishing rods, among others.

Understanding the Numbers: Sportsman's Warehouse's Finances

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Sportsman's Warehouse's revenue growth over 3 months faced difficulties. As of 31 July, 2024, the company experienced a decline of approximately -6.71%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Sportsman's Warehouse's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -2.05%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sportsman's Warehouse's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -2.41%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Sportsman's Warehouse's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -0.64%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 2.15, Sportsman's Warehouse adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Sportsman's Warehouse visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.