When we talk about airlines, Spirit Airlines (SAVE) does not usually dominate the headlines. Lately though, that’s been the case given the ongoing bidding war for the company.

Frontier Group (ULCC) is vying to acquire Spirit Airlines, but so is JetBlue (JBLU).

Shares were slumping more than 8% on Friday as it appears the company is favoring Frontier’s offer, which on paper, is inferior to JetBlue’s offer. Of course, it could be posturing to milk an even higher bid from the latter.

As reported earlier by TheStreet:

“Frontier's $21.99 per share bid for Spirit, while notably shy of the sweetened $33.50 level proposed by JetBlue, carries fewer antitrust risks and is considered a ‘superior proposal' by the Spirit board of directors.”

At current prices — with Spirit changing hands around $22.50 — Frontier’s offer represents a roughly 2% decline in the stock price.

For some investors, they will likely consider this the “floor,” while the “ceiling” would be considered to be up at $33.50, which is JetBlue’s offer.

Is it really that simple: ~2% downside and ~50% upside? Not quite. A worst-case scenario would be failure for the airline to secure a deal from either company (or blocked by a regulator).

That could take the floor offer off the table, opening Spirit Airlines stock up to significant downside.

Trading Spirit Airlines Stock

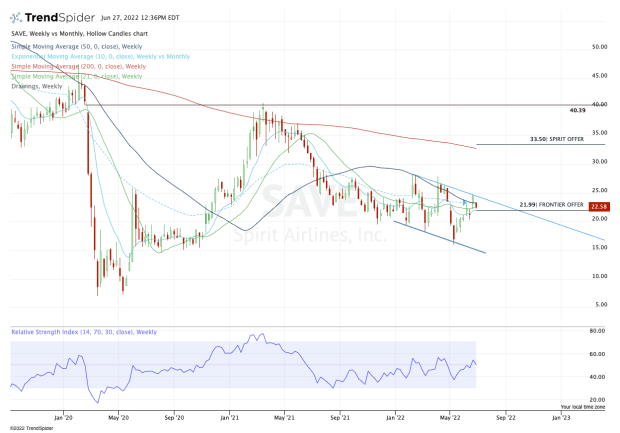

Chart courtesy of TrendSpider.com

When it comes to trading or investing, there is no one strategy that wins all of the time. It’s just not possible, particularly in a market like this.

In that sense, technical analysis does not work all of the time either. When we’re in a broken market — like March 2020 for instance — technicals just don’t matter.

Similarly, in M&A situations where it’s a very binary outcome, technicals can be tough to rely on as well. If the company accepts the deal, the stock price has the potential to soar. If the board declines the deal, the stock price usually falls regardless of where support “should” come into play.

As it relates to Spirit Airlines, the stock is clearly trapped in a downward channel with resistance coming from the declining 50-week moving average and from the $28 area.

If Spirit fails to hold above Frontier’s buyout offer near $22 and the stock loses the 10-week and 21-week moving averages, then we could be looking at a test of $20 or even lower. A close below $20 could put channel support in play.

On the upside, Spirit needs to clear $25 and to do so, investors will need to feel that JetBlue’s offer is a likely candidate. Above $25 puts $28 resistance in play, followed by the potential move up to the 200-week moving average and the $33.50 JetBlue offer.

Of course, an investor could also consider a long position alongside a protective put option, although that alters the risk/reward ratio of the trade.