The week began with the Dow and S&P 500 at record levels yet again. This comes despite more worries that the Delta variant could put a severe damper on our end-of-summer BBQs and the start of the school year. To say the least, it could also cause some significant hiccups in the economic recovery. The U.N.’s latest report on climate change, calling it ‘code red for humanity,’ could cause concern for the markets, too. If anything, it should alarm you that one day the planet could boil alive or get conquered by floods. Despite this, a historically strong earnings season is set to continue for another week and hopefully build off of last Friday’s blowout jobs report. With an endless tug of war occurring between good and bad news, the best thing to do in situations like this is to add broad exposure through ETFs. To help, we’ve built out a list of ETFs rated as Top Buys for this week. Hopefully, some of these picks can help you diversify your portfolio and mitigate some concerns and risks. Q.ai’s deep learning algorithms have identified several ETFs to look out for based on their fund flows over the last 90-days, 30-days, and 7-days.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

SPDR S&P 500 ETF Trust (SPY)

The first Top Buy ETF for this week is the SPDR S&P 500 ETF Trust. This ETF is widely considered the benchmark ETF for tracking the S&P 500 as closely as possible. It is also the largest ETF in the world in terms of AUM with $357,840,044,986.53 AUM. Its fund flows have been consistently negative, with a 90-day fund flow of -$8,325,357,495.00, 30-day fund flow of -$6,112,775,059.80, and 1-week fund flow of -$2,742,224,900.95. With a net expense ratio of 0.094%, it is also very cheap to own.

iShares S&P 500 ETF (IVV)

The next Top Buy ETF is another S&P 500-tracking ETF- the iShares S&P 500 ETF. The goal of this ETF is relatively similar to the SPY ETF- to mirror the performance of the S&P 500 as closely as possible. With $273,877,156,749.00, it is another large-sized ETF in terms of AUM. Its fund flows have been mixed but primarily positive with a 90-day fund flow of $1,676,123,195.00, 30-day fund flow of $1,200,389,965.00, and 1-week fund flow of -$1,003,590.00. With a net expense ratio of 0.03%, it is also very cheap.

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF is our next Top Buy ETF this week. This ETF aims to track the broader stock market, across all indices. The ETF also includes stocks of all cap sizes, and both growth stocks and value stocks. The fund is another large ETF in terms of AUM with $234,272,783,020.77 AUM. It has seen consistently positive fund flows, with a 90-day fund flow of $9,975,965,841.55, 30-day fund flow of $3,336,167,759.55, and 1-week fund flow of $722,179,259.02. Its net expense ratio of 0.03% is also very cheap and reasonable.

Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF is our fourth Top Buy this week, and our third ETF which aims to track the performance of the S&P 500 as closely as possible. With $215,377,023,543.30 it is also one of the largest ETFs on our list in terms of AUM. Its fund flows have been consistently positive with a 90-day fund flow of $12,125,724,482.34, 30-day fund flow of $5,221,769,007.86, and 1-week fund flow of $1,088,962,622.01. With a net expense ratio of 0.03%, it is also very cheap.

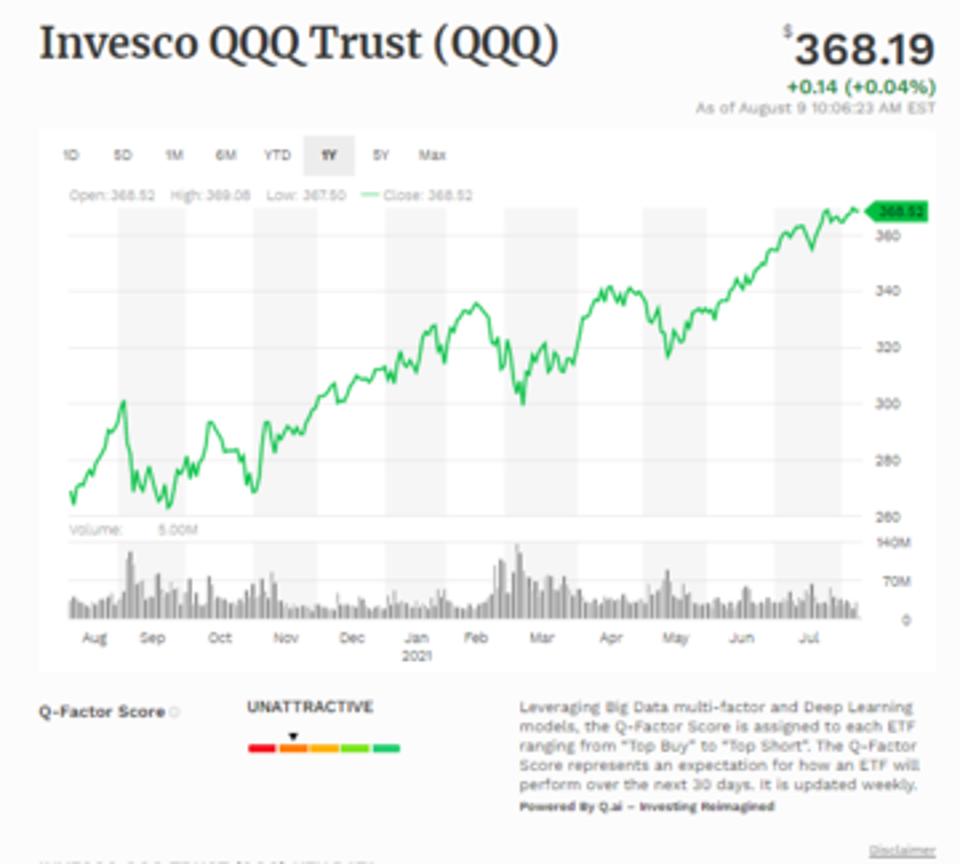

Invesco QQQ Trust (QQQ)

The Invesco QQQ Trust comes in as our next Top Buy ETF for the week. This ETF is considered to be the benchmark ETF that tracks the tech-heavy NASDAQ

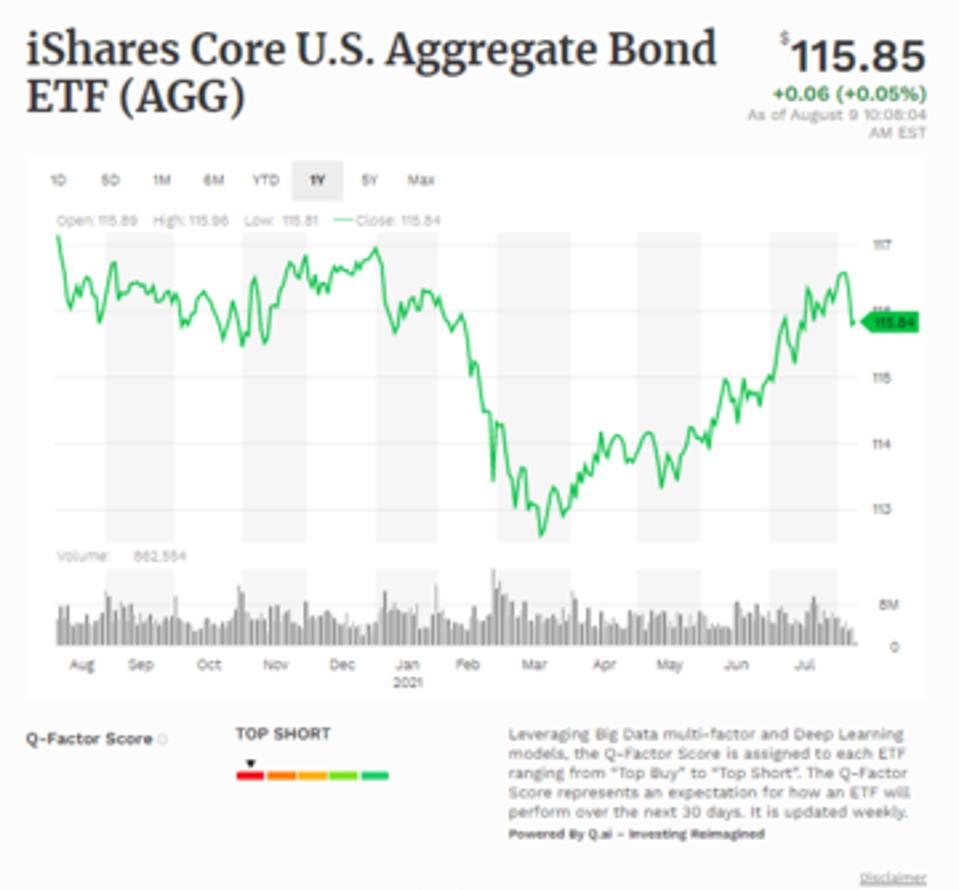

iShares Core U.S. Aggregate Bond ETF (AGG)

The iShares Core U.S. Aggregate Bond ETF is our next Top Buy this week. This ETF aims to track an index composed of the total U.S. investment-grade bond market, and is surely one to keep an eye on with unpredictable yields. This ETF is midsized in terms of AUM with $85,805,140,912.00 AUM. The ETF has also witnessed mixed fund flows with a 90-day fund flow of $312,828,370.00, 30-day fund flow of -$489,913,110.00, and 1-week fund flow of $0.00. Its net expense ratio of .05% is also reasonable.

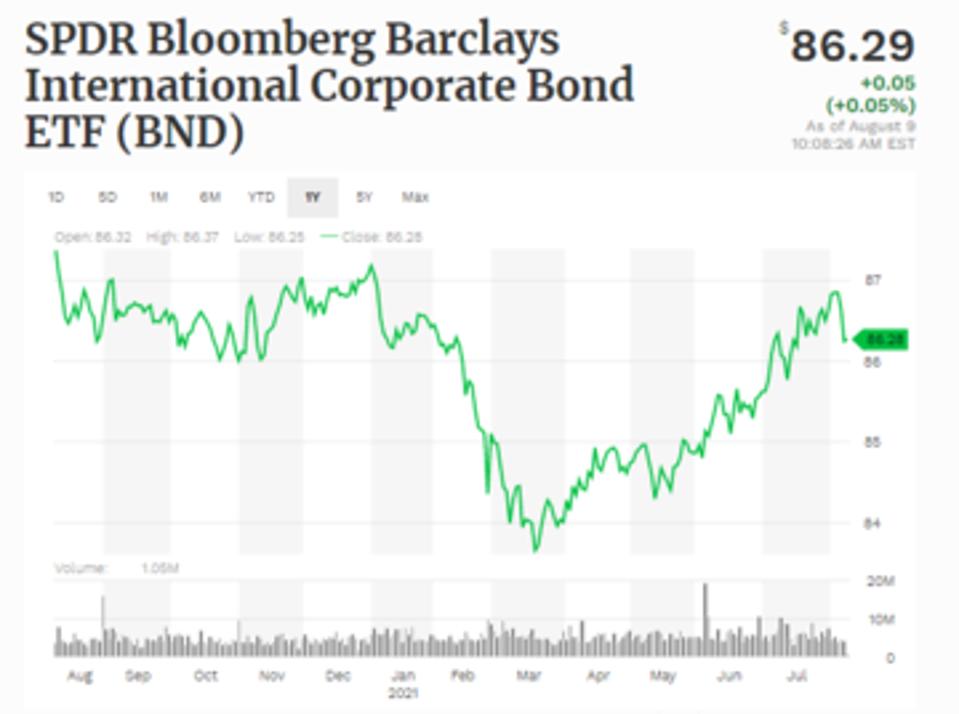

Vanguard Total Bond Market ETF (BND)

The Vanguard Total Bond Market ETF is our next Top Buy. This ETF seeks to give investors exposure to a broad index of taxable US dollar denominated bonds. With $72,294,153,077.30 AUM, this ETF is medium-sized. It has seen consistently positive fund flows, with a 90-day fund flow of $4,980,804,000.00, 30-day fund flow of $727,331,000.00, and 1-week fund flow of $130,094,000.00. With a net expense ratio of 0.05%, this ETF is also extremely cheap.

iShares S&P SmallCap 600 ETF (IJR)

The next Top Buy ETF is the iShares S&P SmallCap 600 ETF. This ETF aims to give investors exposure to a broad range of U.S.-based small-cap stocks. The ETF is the smallest sized on our list this week based on $68,860,805,533.80 AUM. The ETF has also seen consistently negative fund flows with a 90-day fund flow of -$655,996,145.00, 30-day fund flow of -$1,439,868,160.00, and 1-week fund flow of -$304,107,805.00. The ETF also has a decent 0.06% net expense ratio.

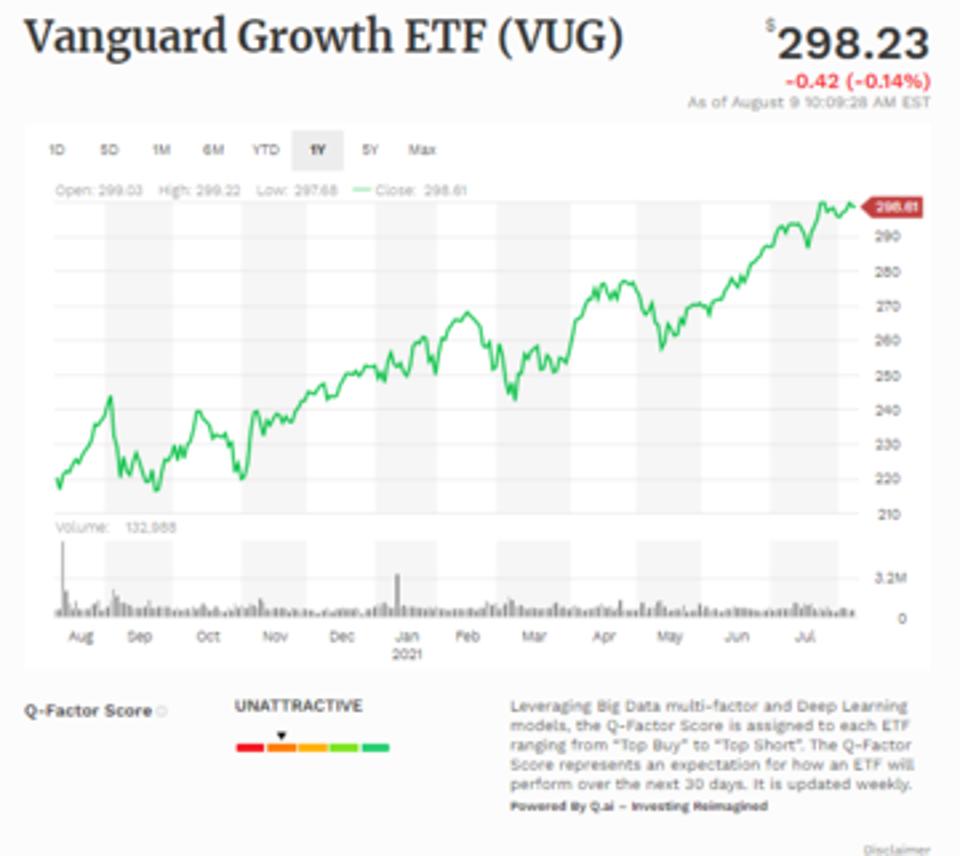

Vanguard Growth ETF (VUG)

The next to last Top Buy on this week’s list is the Vanguard Growth ETF. This ETF aims to give investors exposure to a basket of large-cap growth stocks. The ETF has $73,465,594,499.10 AUM and is medium-sized. It has seen positive fund flows, with a 90-day fund flow of $2,160,101,315.83, 30-day fund flow of $956,127,439.46, and 1-week fund flow of $145,137,069.37. With a net expense ratio of 0.04%, this ETF is also extremely cheap and attractive to own.

Vanguard Value ETF (VTV)

The final Top Buy on this week’s list is the Vanguard Value ETF. This passively managed ETF aims to give investors easy exposure to large-cap value stocks. The ETF has $74,533,882,248.64 AUM and is medium-sized. It has seen positive fund flows, with a 90-day fund flow of $3,848,575,556.33, 30-day fund flow of $548,561,601.53, and 1-week fund flow of $103,234,194.79. With a net expense ratio of 0.04%, this ETF is also fairly reasonable to own.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.