/Southwest%20Airlines%20Co%20plane-by%20Eliyahu%20Parypa%20via%20iStock.jpg)

Dallas, Texas-based Southwest Airlines Co. (LUV) is a passenger airline company, providing scheduled air transportation services in the U.S. and near-international markets. With a market cap of $20.3 billion, Southwest employs over 73,000 people and its operations span various U.S. states and 10 other nations.

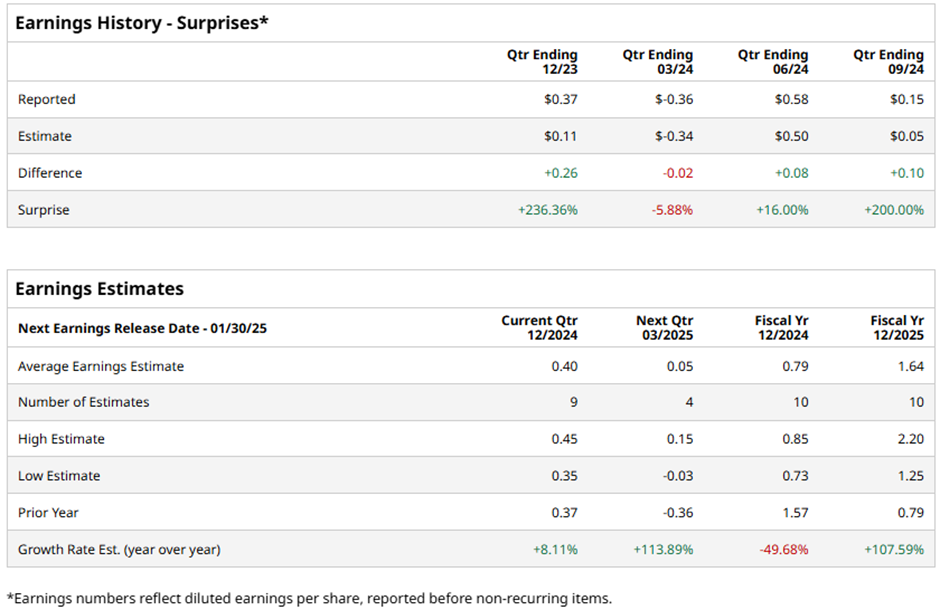

The airline giant is expected to release its fourth-quarter earnings before the market opens on Thursday, Jan. 30. Ahead of the event, analysts expect Southwest to report a non-GAAP profit of $0.40 per share, up 8.1% from $0.37 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates thrice over the past four quarters while missing on one other occasion. Its adjusted EPS for the last reported quarter plunged 60.5% year-over-year to $0.15 but notably surpassed analysts’ estimates of $0.05.

For fiscal 2024, Southwest is projected to deliver an adjusted EPS of $0.79, down a massive 49.7% from $1.57 in fiscal 2023. Meanwhile, in fiscal 2025, its earnings are expected to rebound 107.6% year-over-year to $1.64.

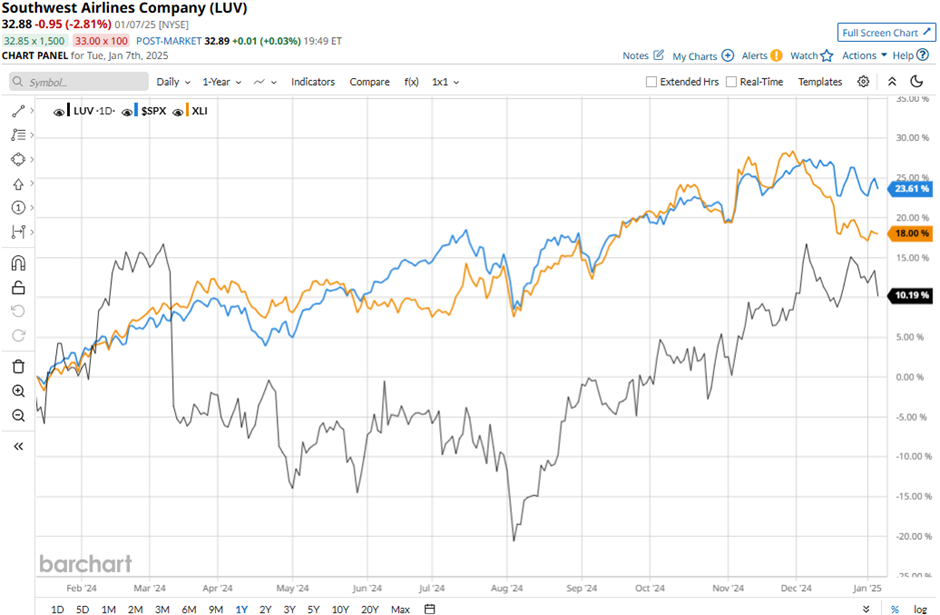

LUV stock has gained 12.8% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 25.8% surge and the Industrial Select Sector SPDR Fund’s (XLI) 18.7% gains during the same time frame.

Southwest Airlines’ stock plunged 5.6% after the release of its Q3 results on Oct. 24. Although the company reported a 5.3% year-over-year growth in operating revenues which surpassed Wall Street’s expectations, its profitability has gone for a toss. High labor costs have led to a 12.5% rise in expenses for salaries, wages, and benefits, totaling $3.1 billion. This, coupled with diminishing pricing power, resulted in a steep decline in operating income to $38 million, down from $117 million in the year-ago quarter. Additionally, the airline’s cash flow from operations has tanked 81.7% year-over-year, amounting to $113 million.

On a brighter note, Southwest Airlines has maintained significant cash reserves and short-term investments on its balance sheet, providing a financial runway to tackle upcoming challenges in the next quarters.

Analysts remain cautious about LUV’s prospects. The stock has a consensus “Hold” rating overall. Out of the 21 analysts covering the stock, four recommend “Strong Buy,” one advises “Moderate Buy,” 11 suggest “Hold,” and five advocate “Strong Sell” rating.