Consumers in South Africa continue to grapple with a high cost of living, particularly with the latest rising fuel costs. In the last several months, the price for one litre of 95 octane petrol (inland) has risen by 36.4%, from R19.61 in January 2022 to R26.74 (about US$1.60) in July 2022.

A combination of factors underlies this massive increase. One of the biggest is the Russia-Ukraine conflict as the two countries are substantial players in the global commodities market. This is a concern for South Africa, which is highly dependent on imports of energy products.

The country’s dependence on crude oil imports is directly related to the spike in domestic petroleum prices. The country is a price-taker in the international oil market. This exposes it to the volatility that arises from the imbalance between international demand and supply of crude oil.

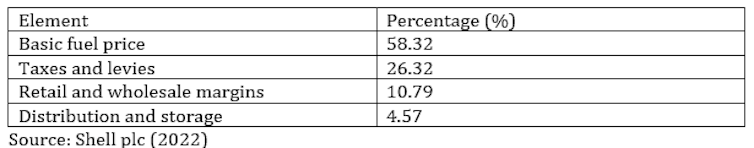

South Africa has a fuel levy which is a component of the retail price of fuel and a major source of tax revenue. Broadly, the price of fuel at the pump consists of four elements: basic fuel price (which is determined by the international price of crude oil and the cost of transportation and insurance); taxes and levies (chiefly, the general fuel levy and the road accident fund levy); retail and wholesale margins; and distribution and storage.

Read more: Explainer: How South Africa's petrol price is set

To take some sting out of the high fuel cost, government reduced the general fuel levy by R1.50 per litre for April, May and June and by R0.75 for July.

The announcement of the temporary relief measures prompted calls from political parties and the public for a review of the fuel price structure. This is on the back of continued increases in the retail price of fuel. More are forecast.

Political parties and some economists argue that government levies are artificially inflating fuel prices, while government’s recent responses are temporary and inadequate. Therefore, a long-term and workable solution would be to deregulate fuel prices.

But in our view, while deregulation would promote competitive pricing, it could also lead to cuts in government spending or increases in other taxes. Scrapping levies – or reducing them significantly – would leave a R90 billion (US$5.3 billion) hole in government revenue.

How then would different government policy responses to high fuel prices affect people’s livelihoods in South Africa? This article is based on the results of a 2012 paper. But we believe the findings are still relevant to the current debate.

In our paper we assessed the impact of three alternative policy responses to high oil prices in South Africa on poverty.

The three scenarios

We used an analytical framework that enabled counterfactual and alternative policy response experiments.

We used an energy-focused macro-micro model that provides a detailed analysis of the impacts of external shocks – such as high fuel prices and alternative policy responses – on poverty.

We assessed the poverty implications of three alternative government policy responses to high oil prices in South Africa.

In the first policy experiment, consumers were assumed to take the full brunt of oil price increases. We referred to this as the floating-price scenario, akin to complete price deregulation.

In the other two experiments the government was assumed to intervene and compensate for oil price increases through a price-subsidy mechanism based on different financing regimes. We referred to these as price-setting scenarios.

In price-setting scenario 1, the subsidy was financed by the government with the imposition of additional taxes on households and corporates. In price-setting scenario 2, the subsidy was partially financed with revenues from a 50% tax on the profits of the synthetic petroleum industry. In other words, a form of windfall tax.

The results should be taken as giving a short-term perspective of the impact of recent oil price shocks. They reveal that the different scenarios or government policy responses to high fuel prices would increase the measures of poverty. These are:

the poverty headcount – the percentage of South Africans living below the food poverty line

the poverty gap – the amount of money needed to bring poor people to the food poverty line or to help them secure the necessities for survival

poverty severity – the differences that exist among poor people regarding their level of poverty.

Under the floating-price scenario, the poverty headcount, gap and severity increased by 1.2%, 1.5%, and 1.6% respectively.

Of particular interest is the marginal increase in poverty measures under the price-setting scenarios compared with the floating-price scenario. This is because for the government to subsidise fuel prices, it would have to raise taxes on households or companies.

The net effect of these financing methods would be a reduction in households’ and corporates’ income and savings. This would lead to a slight worsening of the poverty situation. The decline in saving and investment under the price-setting scenarios would restrict the country’s growth, employment and income distribution perspectives.

Outlook

Our analysis showed that the high oil price increases poverty, and subsidising the oil price worsens the effect.

In addition, we found that the poorest households suffer the worst effects, thus worsening income inequality.

An important message from this study is that oil price shocks increase poverty and inequality, irrespective of whether prices are deregulated or subjected to control through a general subsidy. Therefore, subsidies to shield the general population from oil price increases do not automatically reduce poverty and inequality.

It is, therefore, worthwhile for the government to find more effective policy responses – such as targeting poor and vulnerable households and people – instead of a universal subsidy response if its aim is to reduce poverty and its severity.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.