My Q4 2024 Barchart report on the soft sector of the commodities asset class concluded with:

Soft commodities led the raw materials asset class in 2023 and 2024. While the odds favor a correction in 2025 because of commodity cyclicality, the sector remains a bullish freight train.

The soft sector declined by 13.79% in Q1 2025, the only sector posting a loss over the first three months of 2025. While one of the soft commodities posted a double-digit percentage gain, moving to a new all-time high, four soft commodities declined, with two high-flyers posting over 30% declines.

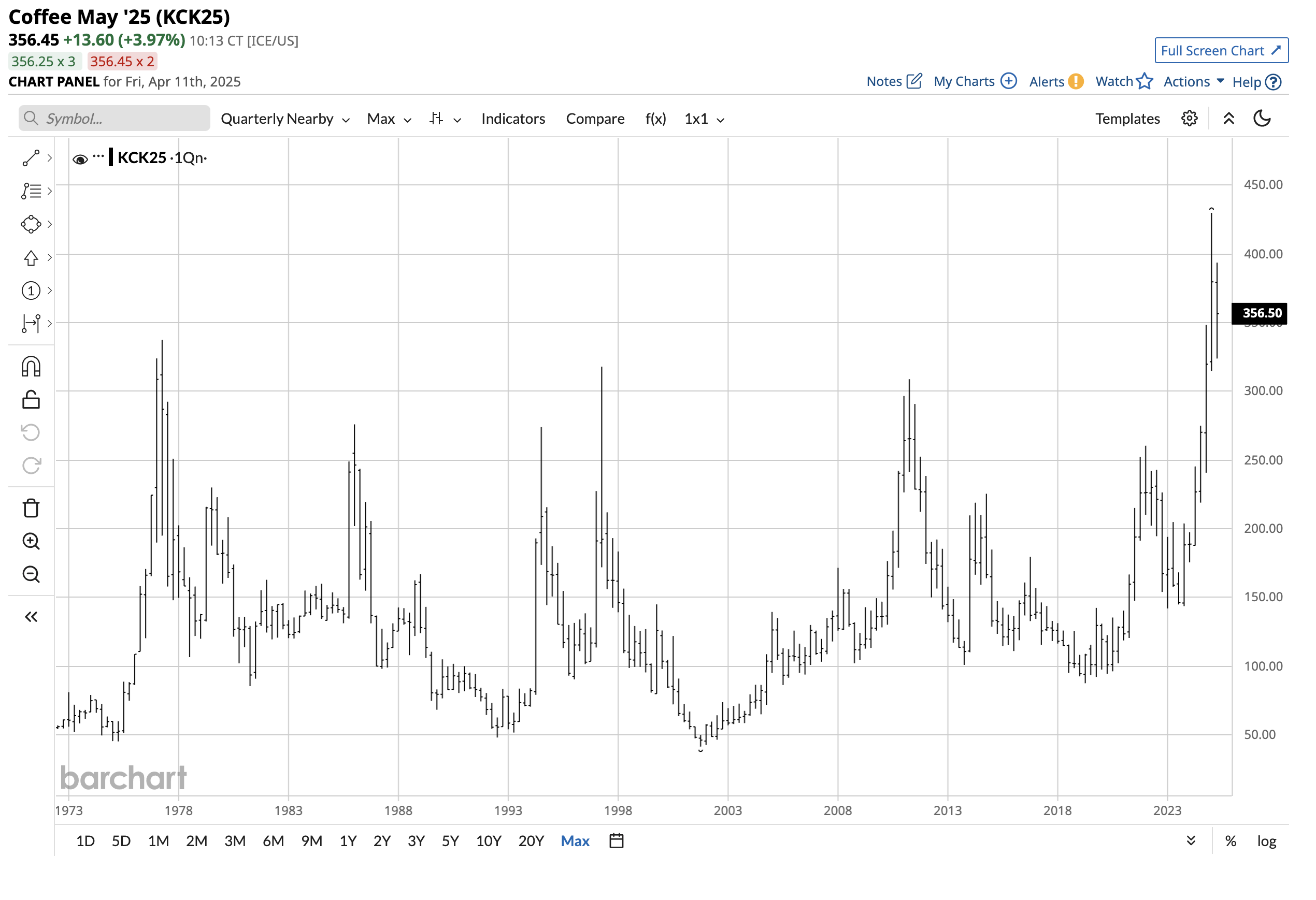

Arabica coffee futures lead on the upside

Arabica coffee futures on the Intercontinental Exchange (ICE) moved 18.76% higher in Q1 after moving 69.81% higher in 2024.

The quarterly coffee futures chart shows the rise to a record $4.2995 per pound high in Q1 2025. The nearby contract settled at $3.7975 per pound on March 31, 2025, and continued to pull back in early April as risk-off conditions continue to impact markets across all asset classes. Coffee rose over supply concerns because of adverse weather and growing conditions in Brazil, the world’s leading coffee bean producer. However, record-high prices and worries over U.S. tariffs have caused the most recent decline. At over the $3.55 per pound level on April 11, the coffee futures remain above the previous $3.3750 per pound peak reached in 1977 as supply concerns continue to keep coffee prices elevated.

Sugar and cotton post declines

The ICE world sugar futures reached a 28.14 cents per pound high in Q4 2023, the highest price since Q4 2011. In 2024, the sugar futures declined by 6.41%, adding to the loss with a 2.08% Q1 2025 decline. The nearby world sugar futures contract settled at 18.86 cents per pound at the end of Q1 and was lower, around the 18 cents level in early Q2.

The ICE cotton futures reached a $1.5595 per pound high in Q2 2022, the highest price since Q2 2011. In 2024, the cotton futures declined by 15.56%, adding to the loss with a 2.30% Q1 2025 decline. The nearby cotton futures contract settled at 66.83 cents per pound at the end of Q1 and was lower, around the 66.25 cents level in early Q2.

Cocoa and FCOJ futures plunge after reaching record highs in 2024 and early 2025

Frozen concentrated orange juice futures had been a bullish beast, posting a 64.63% 2024 gain after moving 46.41% higher in 2023.

The quarterly FCOJ chart shows the rise to a record $5.4315 per pound high in Q4 2024. Orange prices exploded higher on falling Brazilian and Floridian supplies and crop diseases. In Q1 2025, FCOJ led the soft commodities sector on the downside as the price dropped by 51.05%, posting the most significant loss in the commodities asset class. The nearby FCOJ futures contract settled at $2.4355 per pound on March 31, 2025, and was higher near the $2.80 level on the May contract on April 11.

Cocoa futures were a bullish beast in 2024, gaining an incredible 178.24% after rising 22.76% in 2023.

The quarterly cocoa futures chart reached an all-time peak of $12,931 per ton in Q4 2024. Falling West African supplies due to adverse weather conditions and crop diseases caused the explosive rally that took cocoa prices to stratospheric levels. Cocoa futures fell 32.32% in Q1 2025, with the price settling at $7,902 per ton, significantly higher than the previous 1977 $5,104 peak. At over $8,400 per ton on April 11, cocoa prices have rallied in early Q2 2025 and are substantially higher than the 1977 high.

The prospects for Q2 2025 and beyond

While cocoa, coffee, and FCOJ prices have retreated from their highs in late 2024 and early 2025, they remain elevated. Sugar prices are in neutral territory, while cotton remains under pressure.

The factors impacting the path of least resistance for all five soft commodities over the coming weeks and months are:

- The weather and crop diseases in the leading growing areas are the most influential factors for prices in Q2 and beyond.

- The current tariff environment could distort prices, causing elevated volatility as trade barriers can create oversupply in some regions and shortages in others.

- The cure for high prices is always those high prices because they encourage increased production, and consumers tend to seek substitutes.

The bottom line is that the high-flying softs at elevated prices, including cocoa, coffee, and FCOJ, could experience additional downside pressure over the coming months and years. Sugar is in neutral territory with technical support around the 17 cents level. Cotton has been under pressure and could find a floor around the 60 cents per pound level, making it attractive on a risk-reward basis.

DBA is an ETF with soft commodity exposure

The Invesco DB Agriculture Fund (DBA) owns agricultural futures contracts, which include soft commodities, grains, oilseeds, and meats.

The quarterly chart highlights DBA’s slight 0.94% decline in Q1, moving from $26.59 at the end of 2024 to $26.34 per share on March 31, 2025. DBA outperformed the soft commodity sector in Q1 2025 because of the 0.05% gain in the grain and oilseed sector and an 8.42% gain in the animal protein sector.

The only soft commodity with an ETF is world sugar. The Teucrium Sugar ETF (CANE) tracks the price action in three actively traded ICE world sugar futures contracts, excluding the nearby contract, to minimize roll risks. Since most volatility tends to occur in the nearby contract, CANE tends to underperform the nearby sugar futures contract, where the most speculative activity occurs on the upside and tends to outperform when the sugar price declines.

Expect volatility to continue in the soft commodities sector over the coming weeks and months. As high prices cure high prices, low prices tend to cure low prices in commodities. Keep an eye on cotton, which is at a level that could eventually make the fluffy fiber an attractive candidate to take the bullish baton.