Snap (SNAP) has been all over the map over the last day.

Considered by many to be a growth stock, this name has been lumped in with the other poor performers.

As such, shares are down 65% from the all-time high.

However, it was in the spotlight on Thursday night and honestly, I’m surprised it’s holding as well as it is today.

The company reported disappointing top- and bottom-line figures even though revenue rose more than 37% year over year. Worse, management expects sales growth of 20% to 25% next quarter vs. expectations for 28%, as some of its larger clients pull back on spending.

That’s not the type of quarter or guidance you want to see from a company, even if user growth is pretty solid. Not in a climate like this.

After dumping lower in after-hours trading Thursday, the stock rebounded back toward its closing price of $29.42.

Despite the turmoil and volatility in the stock market on Friday, Snap stock has traded in both positive and negative territory.

Trading Snap Stock

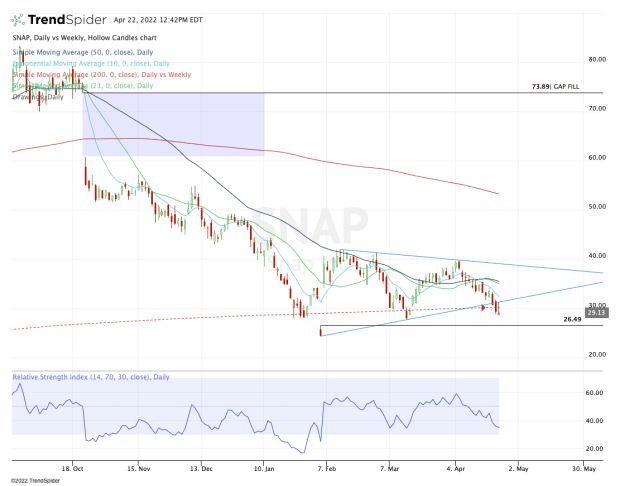

Chart courtesy of TrendSpider.com

As impressed as I am that Snap stock is holding up — and even went green today — it still has a concerning chart.

As one RealMoney contributor put it, Snap looks “more likely to crack than pop.”

The stock rallied up toward Thursday’s high, but before it could get there it ran into the underside of prior uptrend support (blue line).

As Snap stock was forming a wedge pattern — defined by higher lows and lower highs — it was trading below all of its daily major moving averages. Even though it was hot off a strong quarterly result in February, it hasn’t been able to fight off the wretched price action in growth stocks.

From here, bulls need to see it not only reclaim uptrend support, but also the 10-day moving average. If it can do that, it opens the door to the 21-day and 50-day moving average near $35.

Above that would put wedge resistance in play (blue line).

On the downside, the post-earnings low is the level to watch for now at $28.64. Below this area will mean that Snap is failing to hold its 200-week moving average as well, something it’s been able to do thus far on a weekly basis.

A break of that area puts the gap-fill level in play at $26.50. Below that and the 2022 low is on the table at $24.32.

Unless Snap stock can snap some of these downtrends, lower prices may be on tap. For now, watch $31.50 on the upside. Above it bodes well for Snap. Below it suggests caution.