Whales with a lot of money to spend have taken a noticeably bearish stance on Snap.

Looking at options history for Snap (NYSE:SNAP) we detected 27 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $137,561 and 24, calls, for a total amount of $2,414,438.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $18.0 for Snap, spanning the last three months.

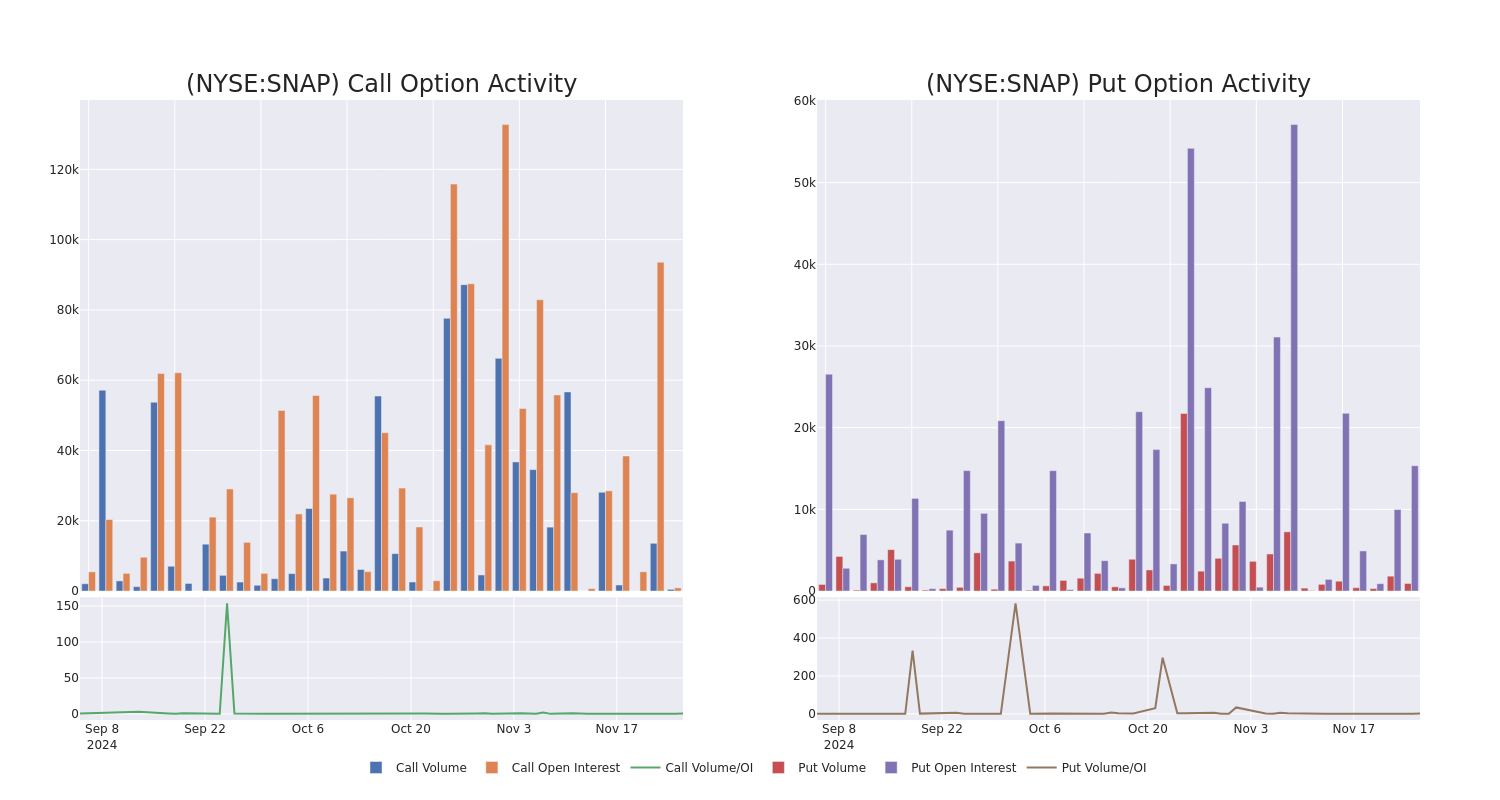

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $10.0 to $18.0, over the past month.

Snap Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BEARISH | 12/06/24 | $1.51 | $1.5 | $1.5 | $11.50 | $608.8K | 16.1K | 10.7K |

| SNAP | CALL | TRADE | BULLISH | 01/17/25 | $0.75 | $0.71 | $0.75 | $13.00 | $525.0K | 39.0K | 7.3K |

| SNAP | CALL | SWEEP | BULLISH | 12/06/24 | $0.72 | $0.7 | $0.72 | $12.50 | $292.4K | 14.6K | 15.9K |

| SNAP | CALL | SWEEP | BULLISH | 12/06/24 | $1.52 | $1.47 | $1.5 | $11.50 | $109.0K | 16.1K | 3.3K |

| SNAP | CALL | SWEEP | BEARISH | 12/06/24 | $1.53 | $1.48 | $1.5 | $11.50 | $106.2K | 16.1K | 4.3K |

About Snap

Snap is a technology company best known for its marquis social media application Snapchat, a visual messaging application that has amassed hundreds of millions of users. The app was initially only used to communicate with family and friends through photographs and short videos (known as "Snaps"). Users can now enjoy augmented reality, or AR, lenses, content from famous creators and celebrities, updates about local events, and more. Although the app offers a paid subscription option with premium features, advertising sales produce most of the app's revenue. The firm also sells wearable devices called AR Spectacles, which can capture photos and videos overlayed with AR lenses, but these make up a small portion of Snap's overall sales.

Snap's Current Market Status

- With a volume of 17,827,051, the price of SNAP is up 5.99% at $12.84.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 63 days.

Expert Opinions on Snap

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $13.703333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Loop Capital persists with their Buy rating on Snap, maintaining a target price of $16. * An analyst from Guggenheim has revised its rating downward to Buy, adjusting the price target to $12. * Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Snap with a target price of $13.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snap with Benzinga Pro for real-time alerts.