Snap (SNAP) shares at last check are off 30% to 52-week lows, after the photo-centered social-media giant reported disappointing third-quarter earnings.

The stock move is also having a negative impact on Meta (META), Alphabet (GOOGL) (GOOG), Pinterest (PINS) and others.

The fact that U.S. stocks are pushing higher in the first half of Friday’s session is helping lift some of these names, but not Snap.

The company missed on revenue expectations and provided a grim outlook for next quarter.

Snap's announcement of a $500 million buyback plan was doing little to inspire investors to buy the stock.

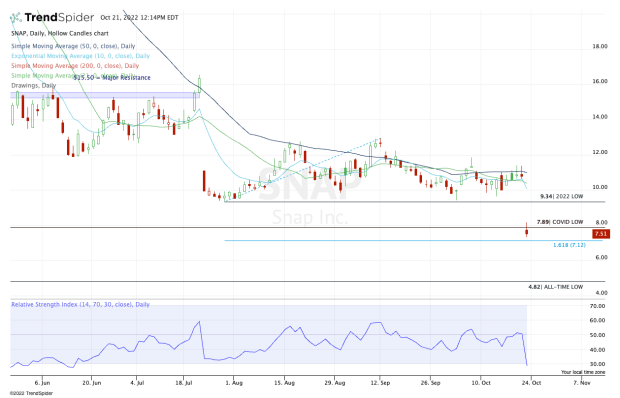

Now the stock is trading below its covid-19 low of $7.89, and the charts need to be revisited.

Trading Snap Stock at 52-Week Lows

Chart courtesy of TrendSpider.com

In late August, we called out the 50-day and 10-week moving averages, saying that the stock had to clear these two measures “for the bulls to have any sort of sustainable upside momentum.”

Well, the stock couldn’t clear these measures in the nearly two months that followed that analysis.

That kept our downside levels in play, which included a retest of the covid low at $7.89 and potentially the 161.8% downside extension down at $7.12.

We’ve hit the first level, but not the second level — yet.

I will be blunt: This stock was bound to post a big move after the earnings report. Because it was a disappointment, that big move was to the downside. On the chart, there is no meaningful support to be found; Snap is in no man’s land.

The one exception might come if it can regain the covid low. Then the bulls can technically look at it as a reversal setup, with a stop-loss just below the new lows.

In that scenario, perhaps Snap stock can trade back to the prior 2022 low at $9.34, then potentially fill the gap at $10.62.

On the downside, I truly have no idea how far this stock could dip. Below $7 and who's to say that the all-time low just under $5 isn’t in play?

Snap is a much better company than it was in 2018 when it last hit that level, but that doesn’t mean a move like this is off the table.

The bottom line: Keep an eye on the $7.89 mark. Below it is bad, but above it and the charts are just a little bit more constructive for the bulls.