Markets move faster, technology reshapes industries overnight, and global events ripple through your portfolio in real-time. But smart investing in 2025 is about more than chasing the latest trend. It's about calculated moves that will stand the test of time.

As we forge ahead into 2025, new opportunities and challenges reshape how we think about growing our wealth. Here's your roadmap to smarter investing this year.

Stock Market – Focus on Growth and Stability

In 2025, the stock market may pay for careful stock picking. The blue-chip companies that boast solid cash flows with minimum debt now shine brighter than ever. Think of healthcare giants that develop breakthrough treatments - Vertex Pharmaceuticals (VRTX), Eli Lilly (LLY), Regeneron Pharmaceuticals (REGN), or Amgen (AMGN). Or established tech companies with practical AI applications, such as Microsoft (MSFT), Alphabet/Google (GOOGL), NVIDIA (NVDA), or Amazon (AMZN). Do not consider those promising the moon.

Keep an eye on companies offering renewable energy solutions. They're no longer just a feel-good investment. They're also profit powerhouses. Don't forget the basics: price-to-earnings ratios still matter, and firms with strong dividend histories often come through market storms better than their flashier peers.

Exchange-Traded Funds (ETFs) – Balance and Diversity in One

ETFs remain the Swiss Army knife of investing. They are ideal for investors seeking to get exposure to entire sectors without trying to pick winners. A new breed of ETFs now targets highly specific themes, from cybersecurity to water scarcity solutions.

The smart money in 2025 flows into low-cost ETFs that track broad market indices. They are boring, yes, but they work. Mix in some sector-specific ETFs that match your outlook on where the world is heading. Just keep those expense ratios under 0.5% - every penny saved is a penny earned.

Real Estate – Physical and Digital

Real estate is not just about physical buildings anymore. REITs let you own a slice of premium property without having to deal with tenants. Digital real estate, from virtual land in metaverse platforms to domain names, adds another twist to property investing.

However, don't discount traditional real estate. Housing shortages in key markets result in rental properties bringing in good, steady income. How? The key is, more than ever, in location. Properties near public transport links or up-and-coming tech hubs often perform well above the market average.

Bonds – Safer Investment with Predictable Returns

Government bonds offer safety, while corporate bonds provide better yields if you can stomach some risk. The sweet spot? High-grade corporate bonds from companies with rock-solid balance sheets.

Municipal bonds are worth a look, particularly if you're in a higher tax bracket. Their tax-free status can make their real returns more attractive than they first appear. Just remember: longer-term bonds carry more risk if interest rates rise.

Cryptocurrency Staking

The crypto market has evolved significantly. Bitcoin and Ethereum have matured, and their behavior is more predictable due to clearer regulations and increased institutional adoption, though volatility is an inherent characteristic. This means that sizing your crypto investments correctly is key. Even crypto bulls rarely put more than 5-10% of their portfolio here.

Traditional crypto deposits work like savings accounts – you store your digital assets on exchanges or in wallets, but these often come with risks and limited returns. Some exchanges offer interest on crypto holdings, but rates can be unpredictable, and security concerns remain.

Staking has emerged as a popular way to earn passive income in crypto. By locking up your tokens to support network operations, you can earn rewards. However, staking often requires technical knowledge and comes with lock-up periods that can limit your flexibility.

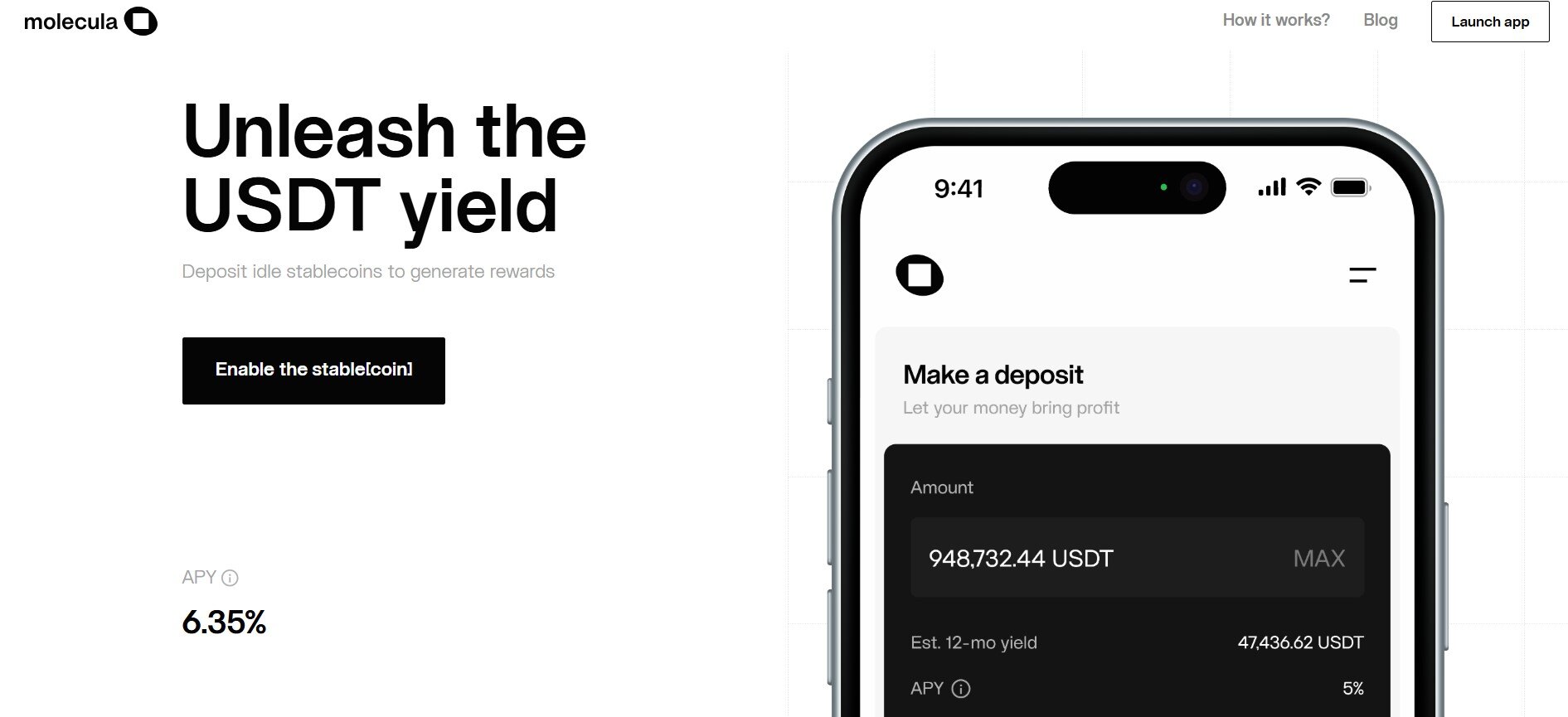

Molecula offers a different approach to crypto yield generation. It's a yield-generation platform built specifically for USDT (TRC20, ERC20) that transforms idle stablecoins into steady returns. The platform stands out by allocating funds only to reliable and proven DeFi tools and Real World Assets. Users maintain 24/7 access to their initial deposits and gain yields. No traditional lock-up concerns. Molecula also rewards users with internal assets for participating in its protocol and community, creating additional value streams.

When choosing crypto investments, focus on platforms and projects that prioritize:

- Clear security measures and regular audits

- Transparent operations you can actually understand

- Easy access to your funds

- Integration with real-world assets and uses

The days of meme coins making millionaires are mostly behind us. Look for cryptocurrencies and platforms that solve actual problems or make existing financial systems more efficient and accessible.

Alternative Investments – Art, Wine, and Collectibles

Fractional ownership platforms enable you to invest in fine art, rare wines, or vintage cars with relatively modest sums. These investments often march to the beat of a different drummer and can provide true diversification.

Digital collectibles have found their place - you can select a few NFTs among them. But be selective. Buy what you understand and, if possible, what you'd enjoy owning even if it never went up in value.

Conclusion

Smart investing in 2025 means being flexible yet focused. Diversify your risks, but don't over-diversify yourself. Keep the majority of your money in tried-and-true investments, and keep a small portion for calculated risks in newer areas. Remember, the best investment strategy is one you can stick with through market ups and downs.