Investors with a lot of money to spend have taken a bullish stance on ServiceNow (NYSE:NOW).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NOW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 20 uncommon options trades for ServiceNow.

This isn't normal.

The overall sentiment of these big-money traders is split between 40% bullish and 20%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $87,734, and 17 are calls, for a total amount of $854,851.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $530.0 to $1300.0 for ServiceNow over the recent three months.

Insights into Volume & Open Interest

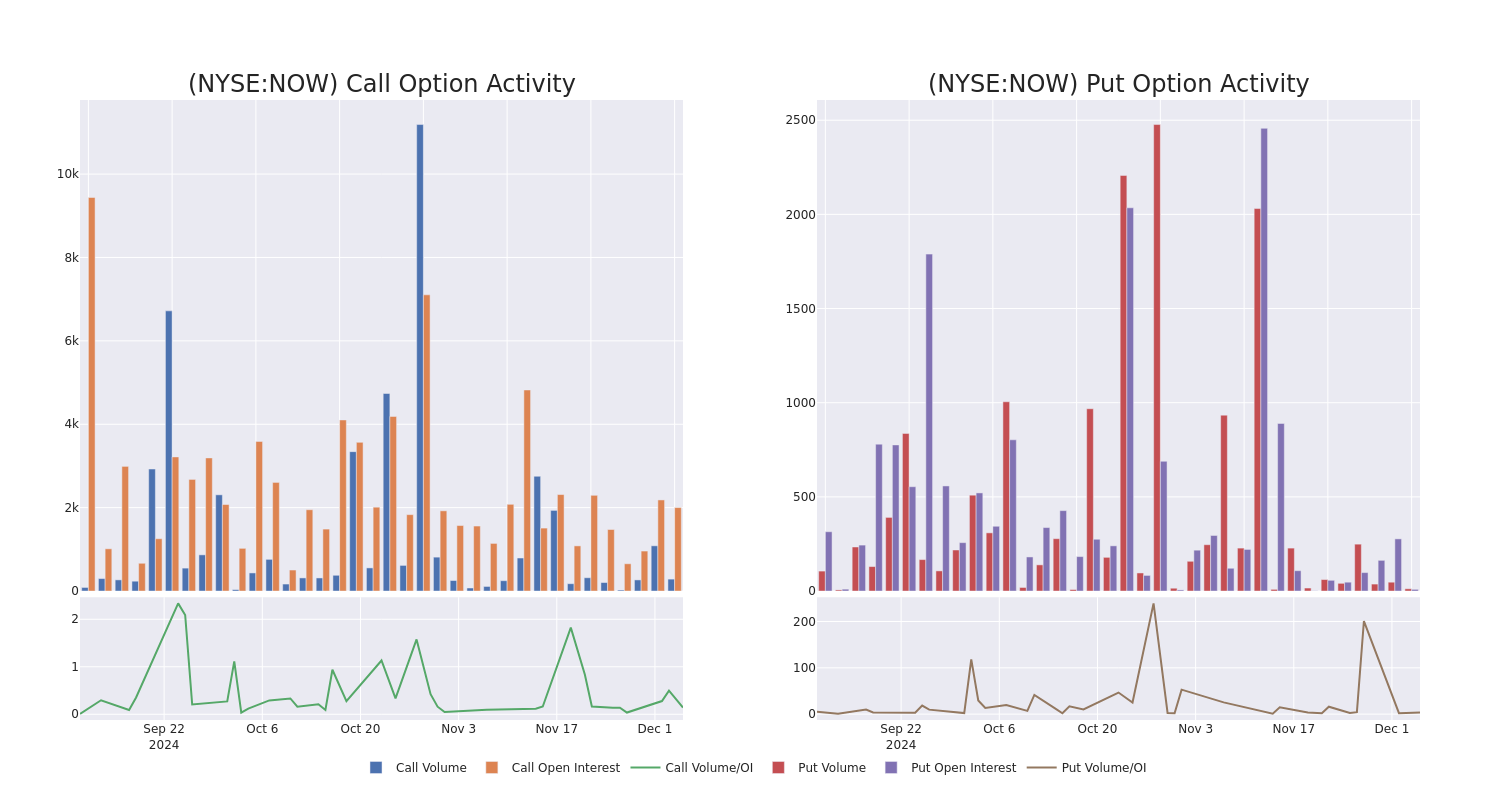

In today's trading context, the average open interest for options of ServiceNow stands at 148.89, with a total volume reaching 359.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ServiceNow, situated within the strike price corridor from $530.0 to $1300.0, throughout the last 30 days.

ServiceNow Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | TRADE | BULLISH | 02/21/25 | $69.9 | $68.1 | $69.9 | $1140.00 | $174.7K | 36 | 26 |

| NOW | CALL | TRADE | BEARISH | 12/20/24 | $34.5 | $30.6 | $31.46 | $1120.00 | $78.6K | 748 | 33 |

| NOW | CALL | SWEEP | NEUTRAL | 12/06/24 | $14.9 | $11.2 | $13.8 | $1120.00 | $68.8K | 276 | 62 |

| NOW | CALL | TRADE | BULLISH | 01/15/27 | $663.8 | $644.0 | $658.0 | $540.00 | $65.8K | 3 | 1 |

| NOW | CALL | TRADE | NEUTRAL | 01/17/25 | $614.1 | $599.5 | $606.4 | $530.00 | $60.6K | 97 | 1 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

After a thorough review of the options trading surrounding ServiceNow, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of ServiceNow

- With a trading volume of 481,580, the price of NOW is up by 1.09%, reaching $1136.0.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 47 days from now.

What The Experts Say On ServiceNow

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1154.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Wells Fargo persists with their Overweight rating on ServiceNow, maintaining a target price of $1250. * An analyst from Wells Fargo persists with their Overweight rating on ServiceNow, maintaining a target price of $1150. * An analyst from Needham has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $1150. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on ServiceNow with a target price of $1070. * Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on ServiceNow with a target price of $1150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ServiceNow, Benzinga Pro gives you real-time options trades alerts.