Deep-pocketed investors have adopted a bullish approach towards Dell Technologies (NYSE:DELL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DELL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Dell Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 33% bearish. Among these notable options, 2 are puts, totaling $101,853, and 10 are calls, amounting to $829,454.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $135.0 for Dell Technologies over the last 3 months.

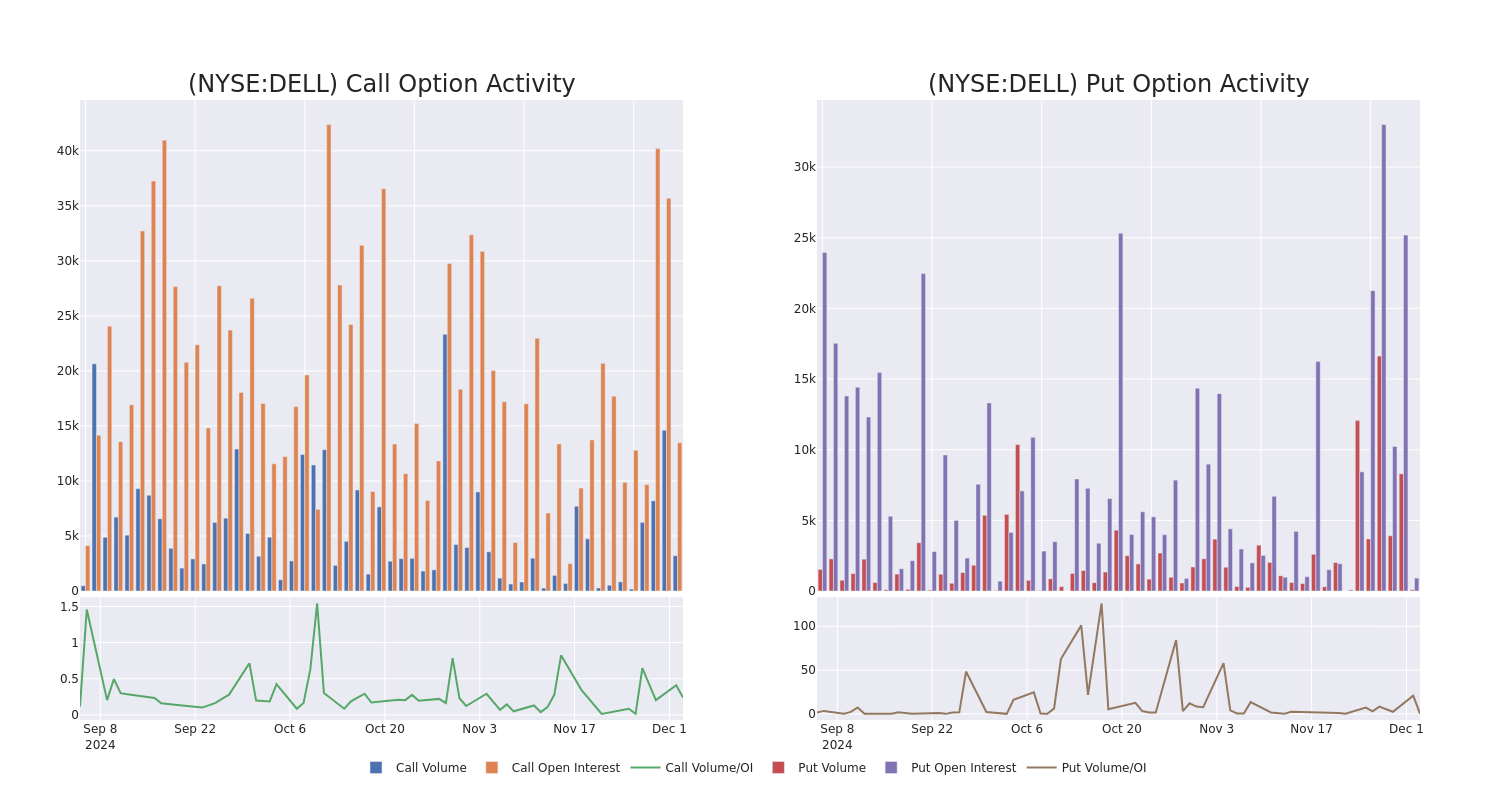

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Dell Technologies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Dell Technologies's whale trades within a strike price range from $105.0 to $135.0 in the last 30 days.

Dell Technologies 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | SWEEP | BULLISH | 02/21/25 | $9.15 | $8.8 | $9.15 | $125.00 | $215.0K | 1.4K | 406 |

| DELL | CALL | SWEEP | BULLISH | 02/21/25 | $9.0 | $8.8 | $9.0 | $125.00 | $123.3K | 1.4K | 817 |

| DELL | CALL | SWEEP | BULLISH | 02/21/25 | $9.05 | $8.9 | $9.0 | $125.00 | $110.3K | 1.4K | 678 |

| DELL | CALL | TRADE | BULLISH | 01/15/27 | $35.6 | $35.25 | $35.6 | $120.00 | $106.8K | 1.2K | 30 |

| DELL | CALL | SWEEP | BEARISH | 12/20/24 | $4.35 | $4.1 | $4.1 | $125.00 | $82.0K | 5.2K | 213 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Dell Technologies's Current Market Status

- With a trading volume of 1,477,269, the price of DELL is down by -0.73%, reaching $124.92.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 86 days from now.

What Analysts Are Saying About Dell Technologies

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $144.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Citigroup persists with their Buy rating on Dell Technologies, maintaining a target price of $156. * Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Dell Technologies with a target price of $115. * An analyst from Wells Fargo persists with their Overweight rating on Dell Technologies, maintaining a target price of $160. * Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Dell Technologies, targeting a price of $142. * An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dell Technologies, Benzinga Pro gives you real-time options trades alerts.