BALTIMORE, Md.—As part of Sinclair's ongoing effort to revamp and reorganize the operations in the wake of the bankruptcy of its regional sports networks, Sinclair's CEO has told analysts that it plans to continue to spend heavily on technologies to improve operations and that it is aggressively pushing forward with NextGen TV/ATSC 3.0 launches.

CEO Chris Ripley made the comments during a Q2 2023 earnings call with analysts that saw the company report a 27% decline in revenue, a 16% drop in ad revenue and only $92 million in net income in the first half of 2023. Next income in the first half of 2022 was $2.576 billion.

In terms of NextGen TV, Sinclair said it has already launched 3.0 broadcasts in 41 markets covering 69% the TV homes in its broadcast footprint and that it expects to increase that to 74% by the end of 2023 when stations in more than half of its 86 markets will be offering NextGen TV.

Sinclair’s other tech spending plans include earmarking $75 million this year for cloud technologies, automation and ad sales platforms, data distribution, yield management and a customer data platform, of which about $65 million will be spent in 2023.

During the Q2 2023 earnings call, Sinclair CEO Chris Riply said “we remain firmly committed to the local media industry, which is our legacy and core business. However, increased competition from technology companies, streaming content providers and the networks as well as continued regulatory constraints, means that we must transform to remain relevant and to grow impressions and revenue share.”

As part of that transformation, Ripley said “we must also embrace technology, which is why we're earmarking $75 million this year for cloud technologies, automation and ad sales platforms, data distribution, yield management and a customer data platform. Due to a combination of timing and permanent cost savings, we now anticipate spending approximately $65 million on these efforts during 2023.”

“Over the next 12 months, we intend to allocate capital to marketing services, multi-platform content community interactivity, next-gen broadcast and cloud technologies,” Ripley said. “Our next-gen broadcast plans remain a key focal point of this transformation. The migration [to NextGen TV]....and distributed data products will allow our industry to unlock the value of our significant spectrum holdings through new revenue and cash flow streams. And despite net leverage increasing this year, in part due to our investment in broadcast and net retrans renewal timing, we believe the changes and investments we are making will drive broadcast future returns and free cash flow leading to reduced debt over the coming years.

"Work continues on our next-gen broadcast core network and platform.," he continued. "We currently expect to go live in the first quarter of next year. This network will create an interconnected platform to provide commercial services and solutions for national data distribution and represents what we believe to be the next step in the evolution of the broadcasting industry.”

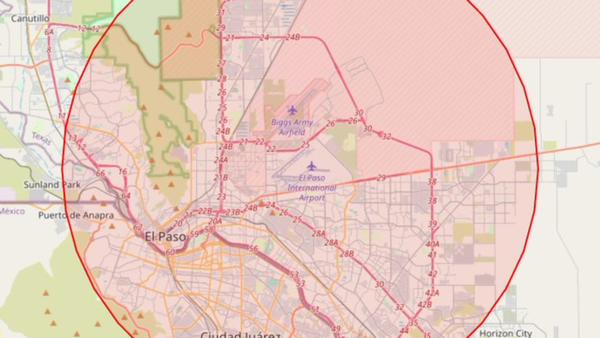

Ripley said that Sinclair is now “live with NextGen broadcast in 41 markets, including recent launches in South Bend and Reno, which represent approximately 69% of the TV households in our licensed footprint. By year-end, Sinclair will have deployed NextGen in over half of our 86 markets covering 74% of our covered population.”

“The industry has also committed to launching an advanced emergency formation pilot project to disseminate crucial information with enhanced broadcast features,” he said. “We currently expect NextGen revenues to begin in 2024 as the technology grows towards BIA's midpoint forecast of $10 billion in industry revenues by 2030.

While advertising revenue declined this year versus the highly contested 2022 election cycle, Rob Weisbord, chief operating officer and president of local media, provided "an early preview of what we believe will be a strong 2024 for political advertising...Sinclair stations in 23 of the 34 states with Senate races in 2024, 7 of the 11 states with [races for state governors]...and 10 of 12 presidential swing states, as defined by a close 2020 presidential race in those states."

"This spending is also heating up with cannabis, immigration, abortion, gun control education and sports gambling all expected to drive incremental political spend over the next 18 months," he added. "We have already booked $9 million in political revenue during the first half of 2023 including $5.5 million during the second quarter, which is almost 10% above our political revenues booked during the second quarter of 2021. Early fundraising totals and political advertising that we are already seeing suggest another record year for overall political advertising in 2024."