/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

Tesla (TSLA), once a hot stock and one of the favorites in the Magnificent 7 group, has been on a roller coaster ride for the past few years.

Tesla specializes in electric vehicles (EVs), renewable energy solutions, and battery storage, with increasing investments in artificial intelligence (AI) and and robotics. So far this year, the stock has suffered from a backlash against CEO Elon Musk’s politics. Musk’s political engagements, particularly his advisory role in President Donald Trump’s administration, have resulted in global protests and consumer boycotts. This association has harmed the company’s brand image and contributed to decreased sales.

Tesla’s recent 13% drop in first-quarter 2025 deliveries has raised investor concerns about the company’s future performance and the effect of that on its stock price. After rising more than 60% in 2024, Tesla stock is down nearly 40% year to date.

Let’s see if Tesla stock is worth buying, holding, or selling right now.

Tesla’s Sales Plunge Hard in Q1

In the first quarter of 2025, Tesla reported 336,681 vehicle deliveries, a 13% decrease from the same period in 2024 and a 32% sequential decline. This marks the company’s lowest quarterly deliveries in nearly three years. Production numbers also fell, with 363,000 vehicles produced, a 16% decrease year-over-year. Tesla’s current models have received few significant updates in recent years, resulting in decreased consumer interest. Companies such as BYD (BYDDY), Volkswagen (VWAGY), and BMW (BMWKY) have expanded their electric vehicle offerings, capturing market share previously held by Tesla. According to Reuters, BYD has aggressively expanded its market presence, offering high-quality vehicles at competitive prices.

Furthermore, consumer backlash against Musk’s political involvement is hurting Tesla’s brand image and sales. Additionally, recent tariff announcements by the U.S. government have added uncertainty to the market, affecting not only Tesla, but also other major tech companies. The imposition of steep tariffs on imports from key trading partners has sparked fears of a global recession, affecting investor confidence in a variety of sectors.

What to Expect in Q1 2025?

Tesla has faced transformation and challenges over the last two years, including fluctuating sales, leadership controversies, and strategic product updates as the company navigates an increasingly competitive EV landscape.

While automotive remains the company’s primary business, it has struggled. Total automotive revenue fell 6% in 2024 but was offset by a 67% increase in energy generation and storage revenue, as well as a 27% increase in services and other revenue. This resulted in a 1% increase in total revenue in fiscal 2024 to $97.7 billion, with adjusted earnings per share falling 22%.

Tesla’s highly anticipated next-generation vehicles are still set to go into production in the first half of 2025. Management expects its vehicle business to return to growth in 2025, owing to advances in vehicle autonomy and a new lineup of vehicles. Additionally, the company believes that the acceleration of Tesla’s Full Self-Driving (FSD) technology will play an important role in driving demand and adoption.

Analysts who cover Tesla expect revenue of around $21.9 billion in the first quarter, with earnings landing at $0.45 per share. This is in comparison to revenue of $21.3 billion and earnings of $0.45 per share in Q1 2024. For 2025, analysts forecast a 10.3% increase in revenue, followed by a 7.7% increase in earnings. Revenue and earnings could increase by 19.7% and 34.1% in fiscal 2026, respectively.

Is Tesla Stock a Buy, Hold, or Sell Now on Wall Street?

Following the disappointing delivery numbers, Goldman Sachs analyst Mark Delaney reiterated Tesla’s “Neutral” rating while revising his price target to $275.

The analyst noted that for Tesla to meet his previous estimates, March would have needed to be a particularly strong month, fueled by the launch of the refreshed Model Y. However, this did not occur, owing to lower-than-expected demand in Europe and the United States, its key revenue-generating regions. Delaney’s stance on Tesla suggests that, while the stock still has long-term potential, investors may need to brace for near-term volatility as the company works through these issues.

Separately, Truist Financial analyst William Stein has taken a cautious stance and reiterated a “Hold” rating on Tesla. Given the current challenges, Stein has reduced his price target from $373 to $280. Although Tesla’s average selling prices have remained stable, downward pricing pressure is expected as it seeks to increase demand through cost cuts and price adjustments. Despite near-term challenges, Stein remains optimistic about Tesla’s FSD technology, which he believes is critical to the company’s long-term valuation.

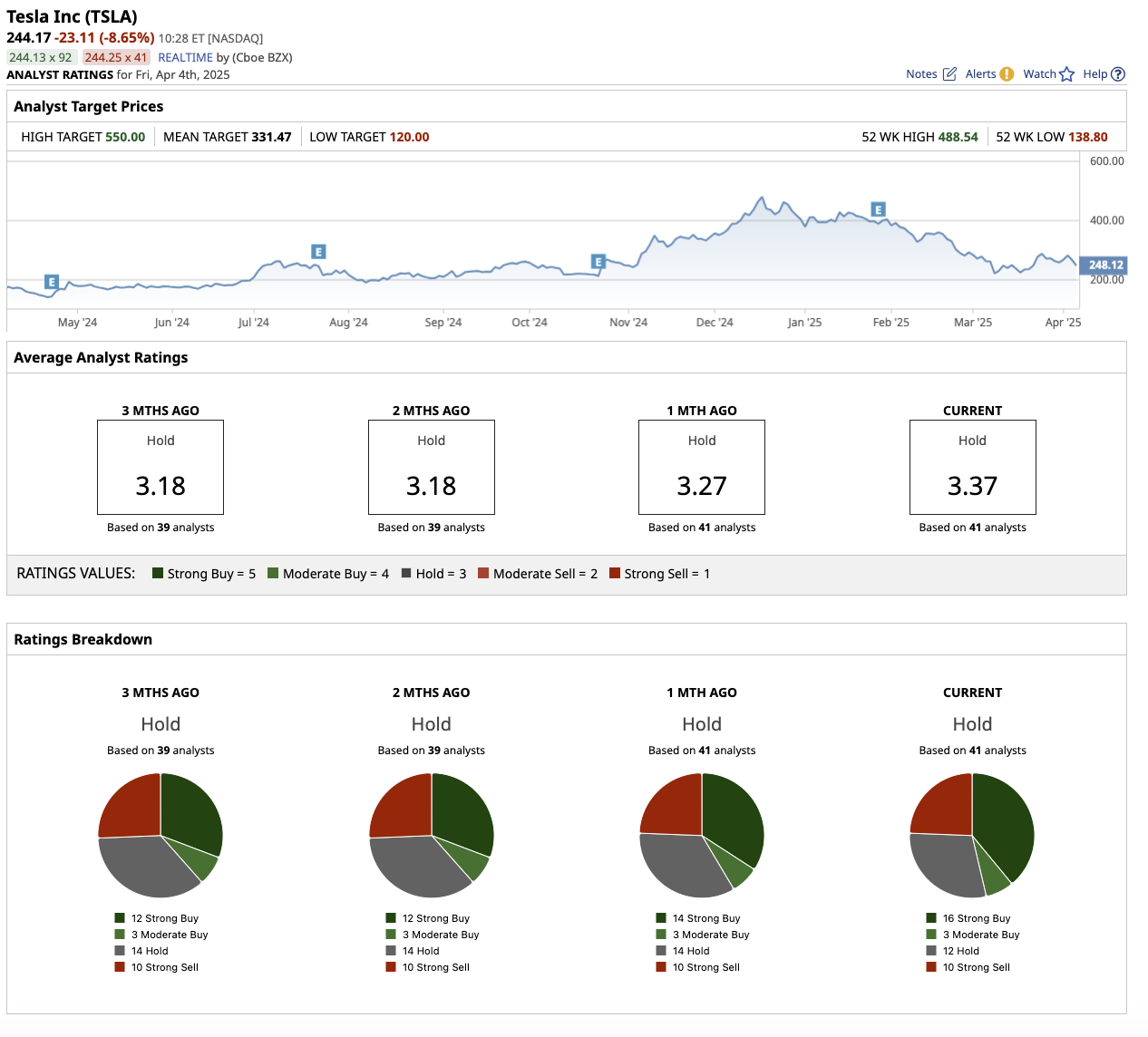

On Wall Street, Tesla stock is rated a "Hold.” Out of the 41 analysts covering the stock, 16 recommend it as a “Strong Buy,” three as a “Moderate Buy,” 12 as a “Hold,” and 10 as a “Strong Sell.” The average analyst target price of $331.47 indicates a 37% increase from current levels. The high price estimate of $550 implies that the stock can rise by 128% in the next 12 months.

The Bottom Line on Tesla Stock

Tesla has ambitious plans for vehicle autonomy, AI, and new product development, but short-term delivery issues may dampen investor sentiment. As competition in the EV market heats up, Tesla will need to execute well on its product pipeline and technological innovations to maintain its industry leadership. Increased competition, an aging product lineup, and consumer backlash over Musk’s political activities have all contributed to recent stock volatility, and they may continue to do so. However, Tesla’s potential for innovation and market adaptation remains an important factor to consider, particularly for investors with a longer investment horizon. Overall, I agree with Wall Street’s recommendation to hold the stock for now.