/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) stormed into 2024 as one of the market’s hottest artificial intelligence (AI) trades. The company, known for designing and assembling high-performance servers and rack solutions, was an early adopter of direct liquid cooling (DLC), a breakthrough technology for next-gen data centers. But what started as a red-hot rally quickly turned into a wild ride for SMCI investors.

The stock’s meteoric rise came to a crashing halt as regulatory setbacks and accounting drama eroded investor confidence. The trouble began when short-seller Hindenburg Research accused the company of financial irregularities. The situation only worsened when EY, SMCI’s auditor, resigned, citing serious concerns over internal controls and governance lapses.

To make matters worse, the company delayed filing its 10-K annual report and 10-Q quarterly statements with the SEC, jeopardizing its Nasdaq Exchange listing. Still, despite the chaos, SMCI rebounded after assuring investors it would meet the Nasdaq’s deadline for overdue financial filings, a promise it kept by the Feb. 25 cutoff.

Yet, instead of sustaining its momentum, the stock reversed course, tumbling sharply amid broader market turmoil. Now, with shares deep in the red over the past month, should investors snap up SMCI stock at a discount, or is there more turbulence ahead?

About Super Micro Stock

San Jose-based Super Micro Computer (SMCI) develops high-performance, energy-efficient server solutions catering to the growing demands of AI, cloud computing, and enterprise data centers. With operations spanning the U.S., Taiwan, and the Netherlands, SMCI has a global footprint.

With a market cap of around $22.5 billion, shares of SMCI have plunged almost 56% over the past year, significantly lagging behind the broader S&P 500 Index ($SPX), which has gained roughly 9% over the same time frame. In fact, the stock appears to be on a wild rollercoaster ride ever since the company filed its delayed financial reports on Feb. 25. Shares of the liquid cooling technology company soared more than 12% the following day, only to give up all its gains on Feb. 27. The volatility has been relentless, with the stock tumbling 33% over the past month alone.

On the brighter side, given its recent price swings, Super Micro now appears to be a bargain. The stock currently sits at just 22.55 times forward earnings and 1.67 times sales. And considering the company’s influence in the AI infrastructure space, SMCI could be an intriguing pick for investors eyeing beaten-down tech plays.

Super Micro Files Delayed Financials

Last month, Super Micro finally put its delayed filings saga to rest by submitting its long-overdue fiscal 2024 10-K alongside fiscal 2025 10-Q first and second quarter reports by the Nasdaq’s deadline. And on Feb. 26, the company announced that it had regained compliance with Nasdaq Listing Rule 5250(c)(1), which mandates timely SEC filings. With the issue officially resolved and the “matter now closed,” SMCI has cleared a major regulatory hurdle, offering a glimmer of hope for rattled investors.

For the second quarter of fiscal 2025, Super Micro delivered impressive top-line growth, with sales surging almost 54.9% year over year to $5.7 billion, but still fell short of the consensus estimate of $5.9 billion. However, the company’s soaring revenue came at a cost. Rising operating expenses and a sharp increase in the cost of sales took a heavy toll on profitability, triggering a significant margin squeeze.

Gross margin tumbled to 11.8%, down from 15.4% a year ago, while operating margin shrank to 6.5% from 10.1% in the prior-year quarter. Yet, despite the margin pressure, SMCI managed to post EPS of $0.51 per share. Although the reported figure remained flat year-over-year, it still topped analyst expectations by roughly 8.5%.

In early February, management dialed back its fiscal 2025 revenue outlook in its preliminary Q2 update. The company expects sales to range between $23.5 billion and $25 billion, lower than its previous forecast of $26 billion to $30 billion. However, despite the near-term downgrade, SMCI remains optimistic about its long-term prospects, projecting a massive $40 billion in revenue for fiscal 2026.

What Do Analysts Expect for Super Micro Stock?

Analysts appear divided on Super Micro’s future prospects. For instance, Barclays analyst George Wang maintained his "Hold" rating with a $59 price target but warned that the company’s competitive edge in the AI server space is slipping. The analyst also flagged lingering concerns over SMCI’s accounting troubles, including EY’s resignation and financial mismanagement claims from Hindenburg.

While the company has since hired BDO as its new auditor, and an independent investigation found no evidence of fraud, Wang believes the shadow of past issues could continue to weigh on SMCI’s valuation. Meanwhile, Loop Capital struck a more bullish tone, raising its price target to $70, signaling growing confidence in SMCI’s potential rebound.

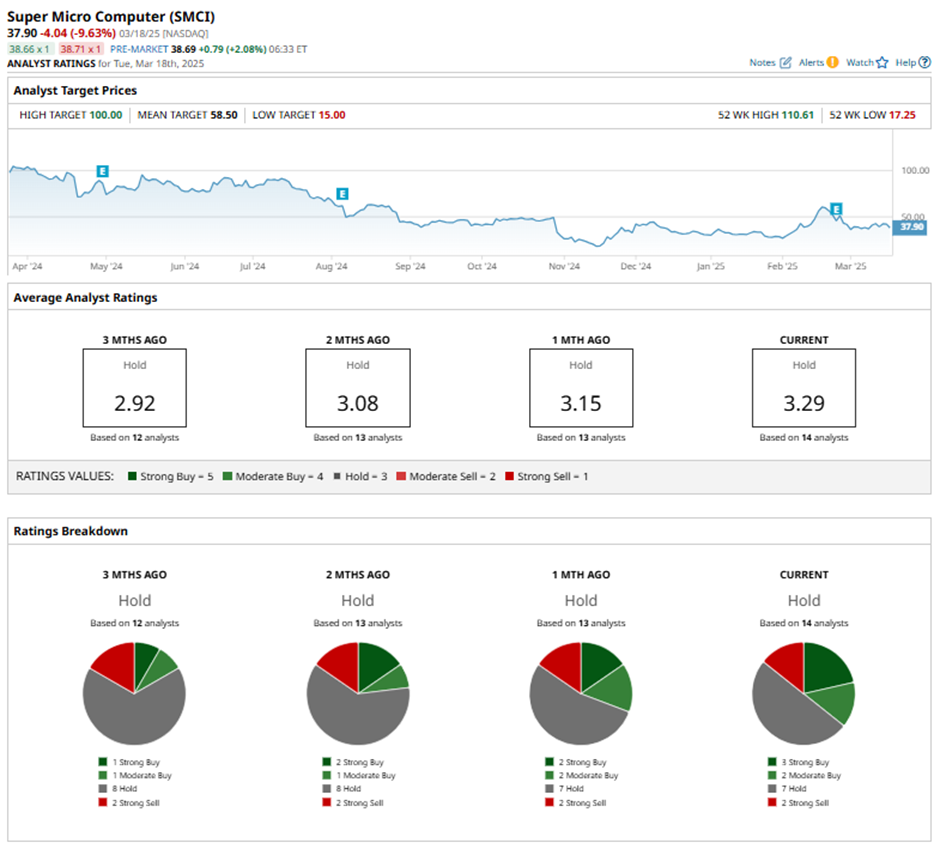

Overall, Wall Street is keeping a cautious stance on the stock, sticking to a reserved "Hold" rating. Of the 14 analysts offering recommendations, three advise a “Strong Buy,” two advocate “Moderate Buy,” seven suggest a “Hold,” and the remaining two maintain a “Strong Sell.” The average analyst price target of $58.50 indicates nearly 50% potential upside from the current price levels, while the Street-high price target of $100 suggests that SMCI could rally as much as 150% from here.