/Amazon_com%20Inc_%20%20logo%20on%20building%20by-%20HJBC%20via%20iStock.jpg)

Amazon (AMZN), the e-commerce and cloud giant, rose from an online bookstore to a global powerhouse, shaping how the world shops and computes. But even the giants stumble.

AMZN stock has slid nearly 12% in a month, mirroring investor anxiety over looming trade battles. President Donald Trump’s escalating tariff threats have markets on edge.

Beyond trade fears, inflation adds to the storm. Rising costs threaten to weaken consumer spending and slash corporate profit margins, fueling concerns about slower economic growth. With investors fearing the Federal Reserve may keep rates higher for longer, growth stocks like AMZN – already pressured by trade tensions – became an easy target for selling.

With Amazon caught in the crossfire of tariffs, inflation, and shifting market sentiment, is this a rare chance to buy the dip or a sign of deeper trouble ahead?

About Amazon Stock

Washington-based Amazon (AMZN) dominates e-commerce, claiming 38% of the U.S. digital retail market. Prime Video, Amazon Music, and Twitch fuel its entertainment dominance, while Amazon Web Services (AWS) powers the digital backbone of businesses worldwide. With ventures in AI, logistics, smart homes, and even healthcare, Amazon doesn’t just follow trends, it creates them.

The e-commerce titan, boasting a $1.78 trillion market cap, spent years building its empire, and the payoff has been massive. The mega-cap powerhouse surged 693% over the last decade.

But 2025 has been rough, with shares down 21% on a YTD basis and off nearly 29% from their February high of $242.52 as weak guidance hit sentiment. The stock peaked before its Q4 earnings and hasn’t recovered. Yet, for sharp-eyed investors, this pullback might just be the golden ticket.

Amazon Tops Q4 Earnings Forecasts

Amazon wrapped up 2024 on a high note, reporting Q4 earnings results on Feb. 6 that outpaced Wall Street’s expectations. While revenues grew 10% year-over-year to $187.8 billion, its adjusted EPS of $1.86 almost doubled annually, beating forecasts by 22.4%. The strong performance was driven by operational efficiencies and margin improvements across its business segments.

AWS remained the backbone of Amazon’s tech dominance, growing 19% annually to $28.8 billion, while its digital advertising business pulled in $17.3 billion, up 18% year-over-year. The e-commerce behemoth’s free cash flow surged to $38.2 billion in Q4, reinforcing its ability to invest in artificial intelligence and strategic acquisitions. With $78.8 billion in cash and cash equivalents as of Dec. 31, 2024, Amazon remains financially well-positioned for future expansion.

Amazon’s strong Q4 couldn’t stop a 4.1% stock drop on Feb. 7, as cloud computing growth concerns rattled investors. The sting deepened with weaker-than-expected Q1 guidance for 2025, dampened by currency headwinds and a missing Leap Year Day.

Management projects Q1 revenue between $151 billion and $155.5 billion, factoring in a $2.1 billion forex hit. Operating income is expected to land between $14 billion and $18 billion. Analysts tracking Amazon expect $155 billion in revenue, while Q1 EPS is projected to surge by 22.1% year over year to $1.38.

Over the longer term, analysts project 2025 profit to reach $6.33 per share, up 14.5%, and rise another 14.7% to $7.26 per share in 2026.

What Do Analysts Expect for Amazon Stock?

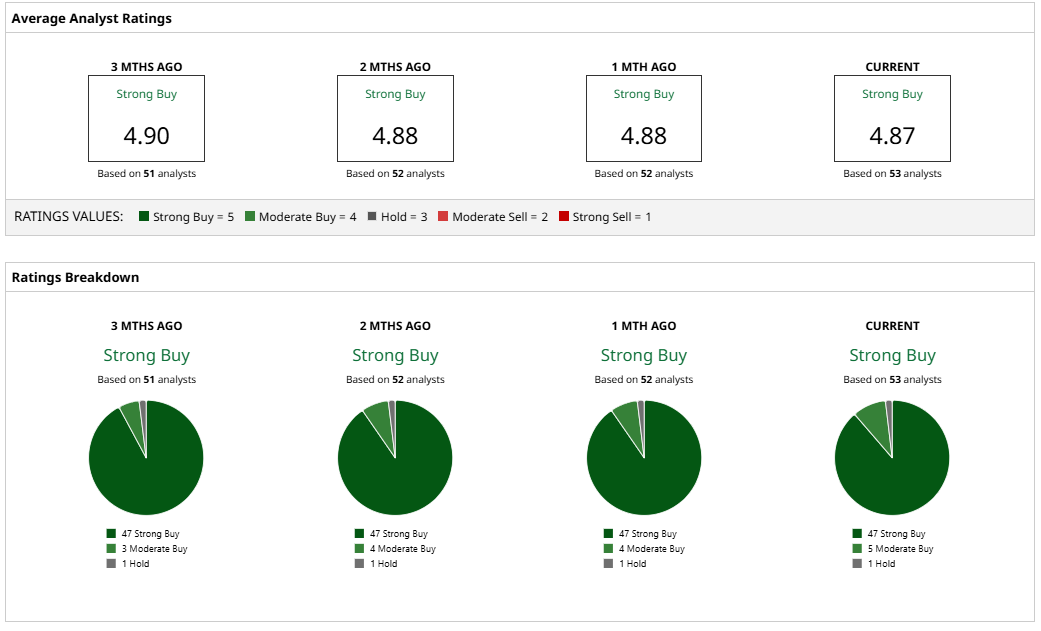

AMZN has a consensus “Strong Buy” rating overall. Of the 53 analysts in coverage, 47 recommend a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining one gives a “Hold.”

The mean price target of $252.21 suggests upside potential of 46% from the current price levels. The Street-high target price of $290 for Amazon implies that the stock could rally as much as 67.6%.