In the most recent financial quarter, CalAmp Corp. (CAMP) reported robust Cash Flow from Operations of $7.1 million and achieved Adjusted EBITDA of $5.9 million, thanks to persistent dedication to cost-saving efficiencies. However, quarterly consolidated revenue fell short of projections due to slowed Telematics Products shipments to TSP and Channel customers.

As part of its growth strategy, CAMP continues to roll out significant new product offerings, such as Vision 2.0 and ELD solutions. Yet, the corporation predicts modest sequential declines in third-quarter revenues and Adjusted EBITDA.

Wall Street analysts project that the company's earnings per share (EPS) will remain negative in the about-to-be-reported quarter, with an anticipated 28.8% year-over-year drop in revenue to around $56.20 million.

Investor confidence seems shaken, given that over the last year, CAMP has plummeted by 94.5% and 21.7% over the past month. This volatile trend may continue in the near term, as indicated by its beta of 2.11.

The company is slated to announce its third-quarter financial results on January 9, 2024, and I think potential investors should await these updates before making investment decisions. A detailed study of some of its key performance indicators will provide a more comprehensive evaluation of its financial health.

Analyzing CalAmp Corp.'s Financial Performance: Crucial Trends from February 2021 to August 2023

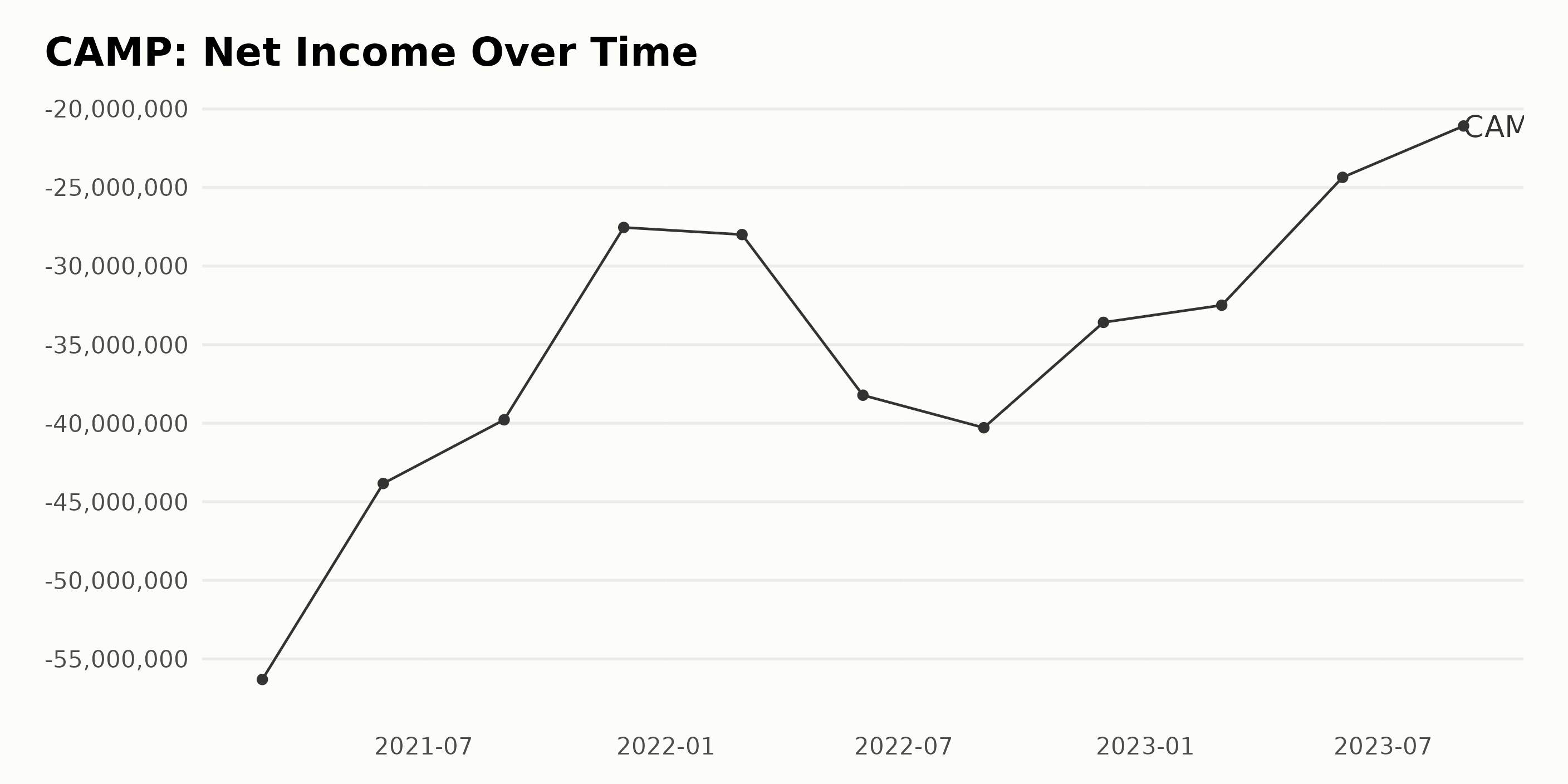

The trailing-12-month Net Income of CAMP experienced a fluctuating downward trend from February 2021 to August 2023. Here's a summary:

- In February 2021, the Net Income was -$56.31 million.

- Some slight improvements were observed in May 2021 to -$43.84 million, August 2021 to -$39.78 million and November 2021 to -$27.54 million. Yet, it worsened again to -$27.99 million in February 2022.

- A notable plunge was experienced in May 2022 to -$38.22 million, and matters further complicated in August 2022 with a Net Income falling to -$40.29 million.

- An improvement occurred in November 2022 and the number stood at -$33.58 million.

- February 2023 saw another drop to -$32.49 million followed by gradual improvements in May 2023 and August 2023 to -$24.35 million and -$21.08 million respectively.

The company's recent improvements are encouraging, but the general trend over this period has been one of net losses, not profits. Greater emphasis is placed on the most recent data, which shows a decrease from the February 2023 values but represents a significant overall improvement from the beginning of the series.

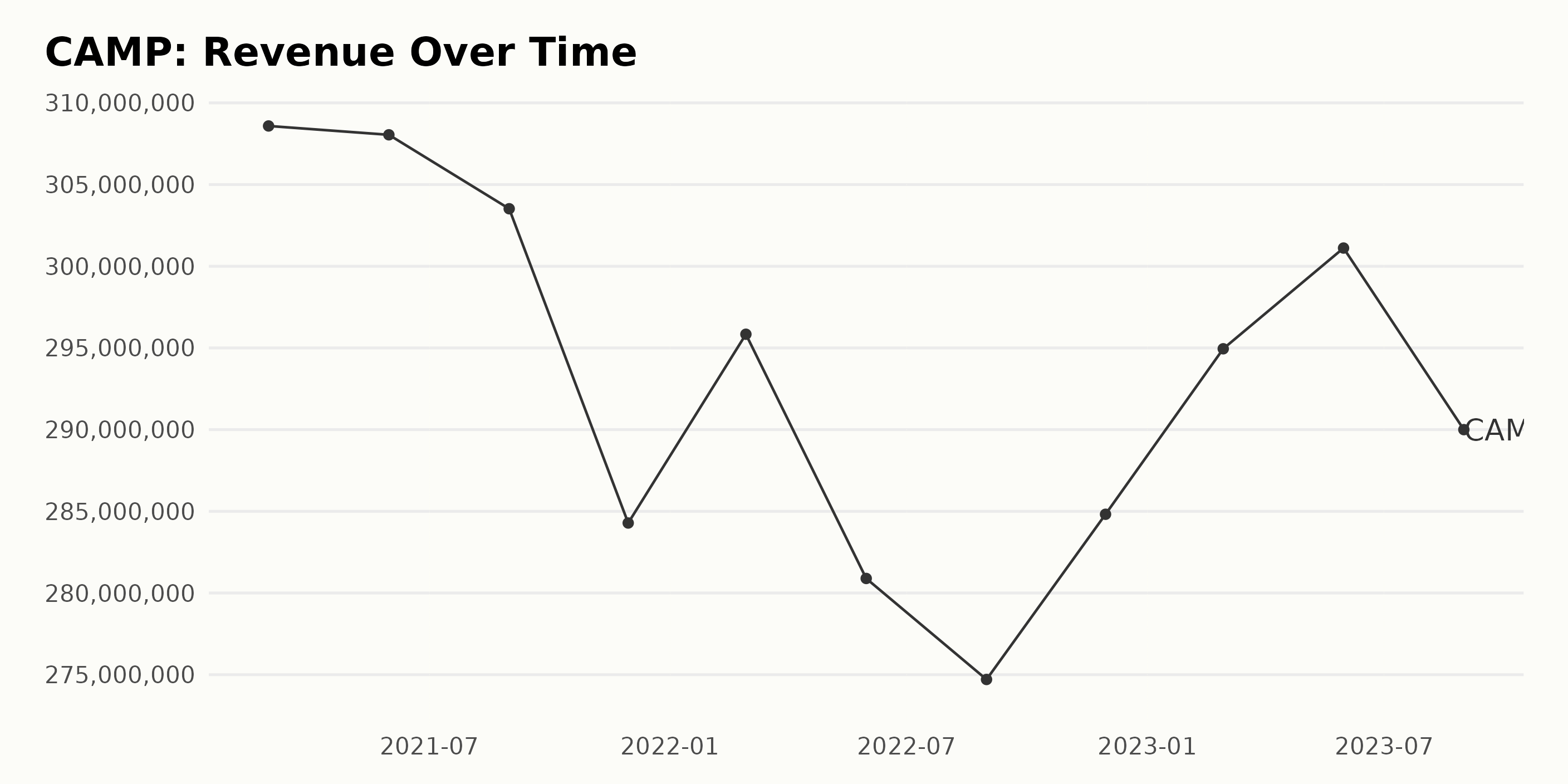

Summary of CAMP trailing-12-month Revenue Trends and Fluctuations:

- In February 2021, the Revenue reported was $308.59 million.

- There was a slight decrease in May 2021, with the Revenue falling to $308.05 million.

- Later, in August 2021, another slight decline was observed, with Revenue at $303.52 million.

- The largest dip within this period happened in November 2021 when the Revenue went down to $284.29 million.

- This trend was reversed in February 2022, as the Revenue increased to $295.84 million.

- However, from May 2022 to August 2022, there was a consistent drop in Revenue, reaching a low of $274.71 million.

- In November 2022, the Revenue rebounded slightly to $284.82 million.

- Another rise was seen in February 2023, with the Revenue hitting $294.95 million.

- The highest Revenue reported within this period was in May 2023 at $301.11 million.

- In August 2023, the data series ended with a Revenue of $290 million, indicating again a slight decline from the previous reported Revenue.

Key Observations:

Overall, the growth rate from the first value ($308.59 million in February 2021) to the last value ($290 million in August 2023) indicates a decrease in Revenue of around 6.02%. This overall trend shows that CAMP’s Revenue has experienced some fluctuations over the observed period, with several noticeable dips and recoveries. The most recent data (2023) shows marginal recovery in Revenue after a period of decline, but the last reported number ($290 million in August 2023) is lower than the revenue from early 2021.

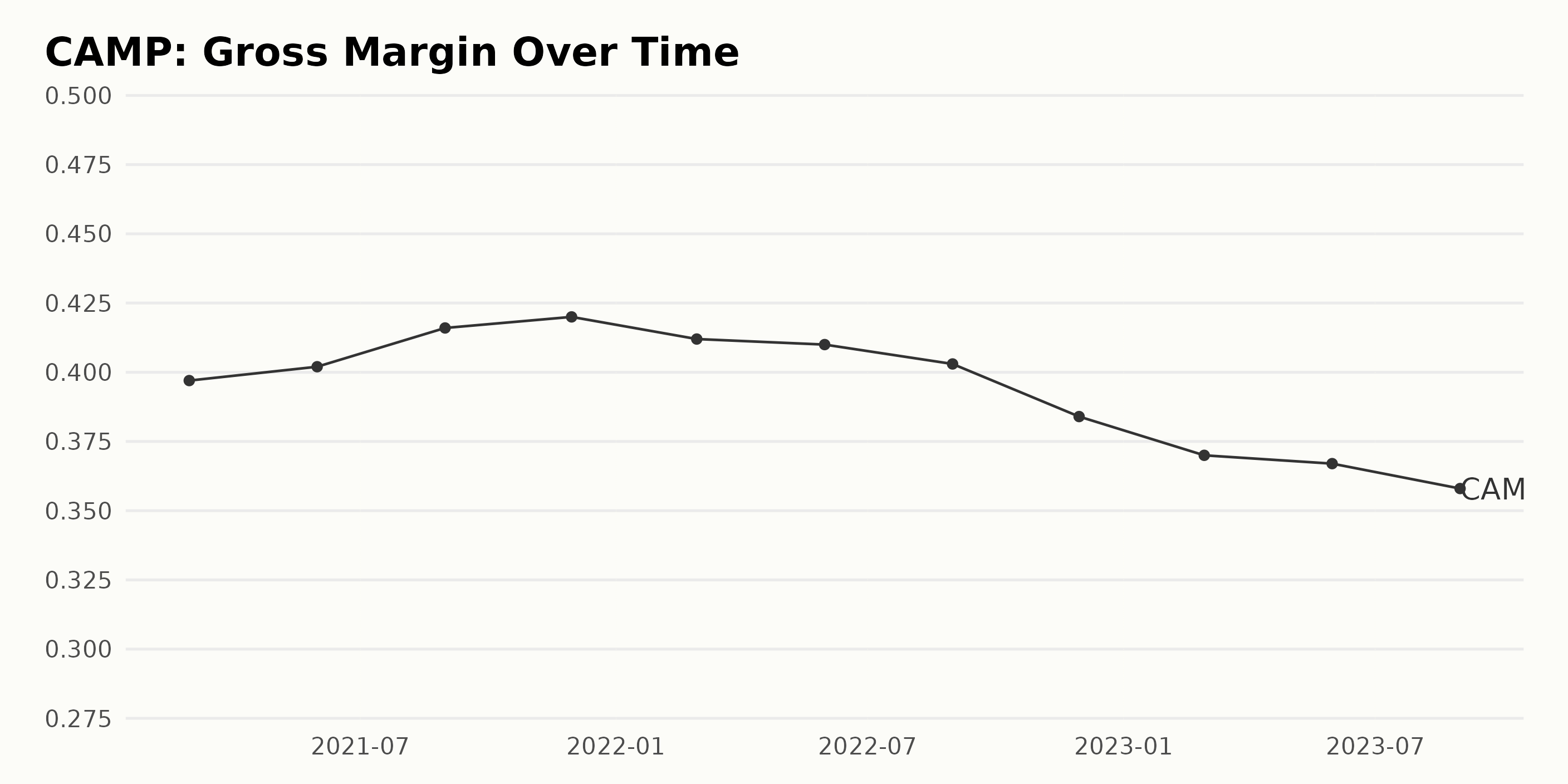

The Gross Margin of CAMP has demonstrated both growth as well as fluctuations over time. Here's an overview:

- As of February 28, 2021, the company's Gross Margin was at 39.7%.

- In the ensuing months up to May 31, 2021, there was a slight increase to 40.2%.

- This growth trend continued until August 2021, where it reached a peak of 41.6%.

- By November 2021, an incremental jump was observed, bringing the Gross Margin to an apex of 42.0%.

- Following this peak, there was a reduced margin of 41.2% recorded in February 2022.

- This downtrend showed continuity till the end of May 2022, when margin dipped further to 41.0%.

- By the end of August 2022, another descent was noticed, bringing the Margin down to 40.3%.

- A more noticeable drop was observed by November 2022's end, with the value standing at 38.4%.

- The fall continued in February 2023, at which point Margin hit 37.0%.

- As of May 31, 2023, the Gross Margin had dropped slightly to 36.7%.

- By August 2023, the downward trend persisted with the Gross Margin reported 35.8%.

To summarize, the Gross Margin for CAMP peaked at 42.0% in November 2021, and since then has generally been on a downturn. From February 2021 to August 2023, there is approximately a 10% decrease. Emphasising recent data, the gravest drop was witnessed from November 2022 (38.4%) to August 2023 (35.8%), indicating a contraction of around 2.6%. Please note, these trends and fluctuations are based on available data and can help inform projections, but they cannot assure future performances.

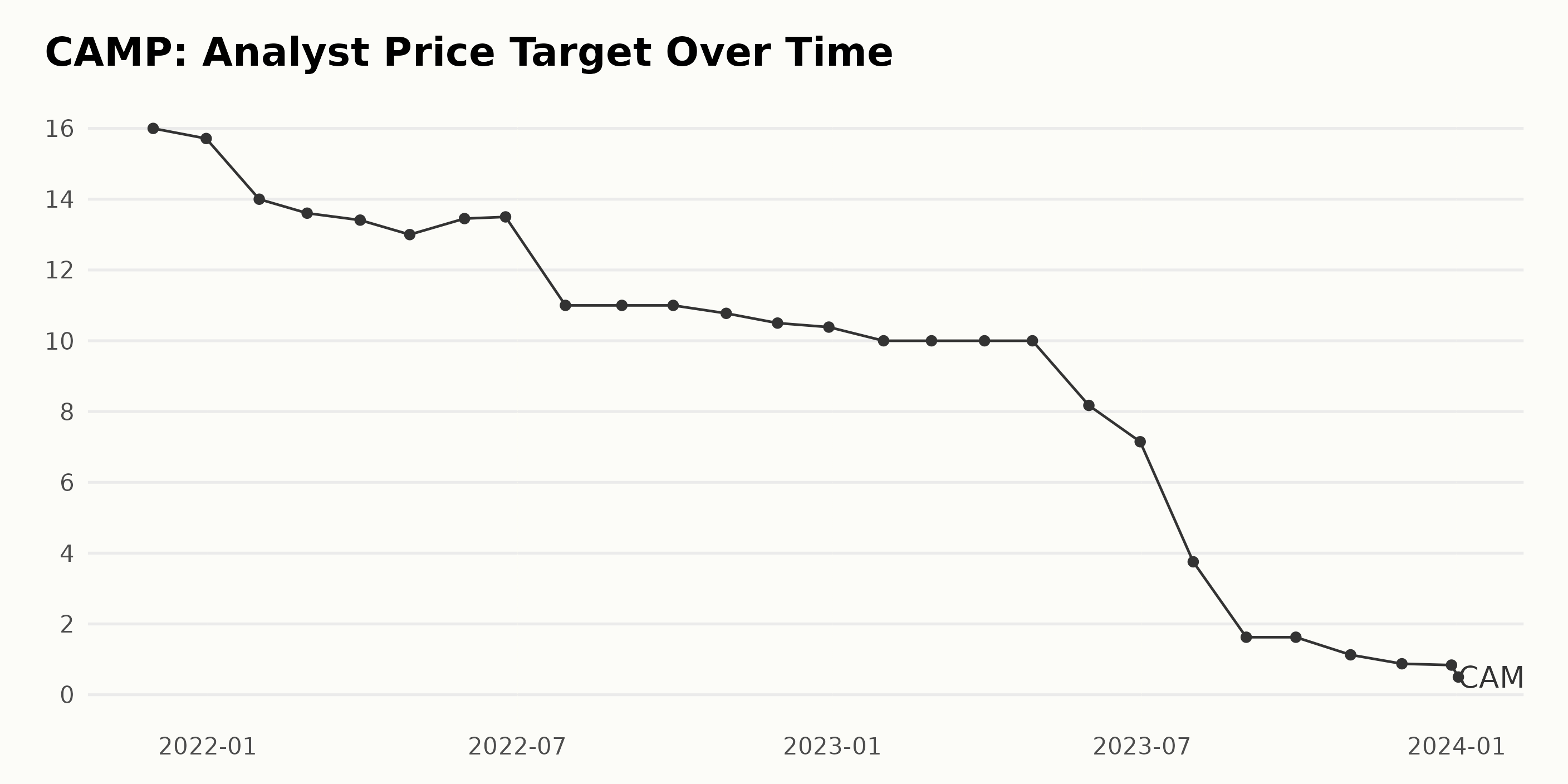

The Analyst Price Target trend for CAMP shows a significant downward trend over the period. This trend can be seen more vividly when putting emphasis on the latest data points. Here are some key observations:

- Prior to July 2022, the Analyst Price Target showed variations, ranging from $16 in November 2021 to a low of $13 in June 2022. Decisive downtrend seemingly starts from this point.

- By the end of 2022, the value experienced a slow but steady drop to $10.39 in December.

- In 2023, the pace of decrease in price target accelerated, falling sharply to just $1.63 by August.

- The last quarter of 2023 witnessed further drop, reaching a considerably low value of $0.84 by the end of December.

- The first reported value for 2024 shows the Analyst Price Target at an all-time low of $0.50.

Broadly, from November 2021 through January 2024, the Analyst Price Target saw a decline from $16 to $0.50 - presenting a negative growth rate of almost 97%. This pattern suggests analysts have been progressively less optimistic about the future prospects of CAMP.

CalAmp Corp.'s Share Price: A Downward Sprint, Brief Pause, and Continued Tumble

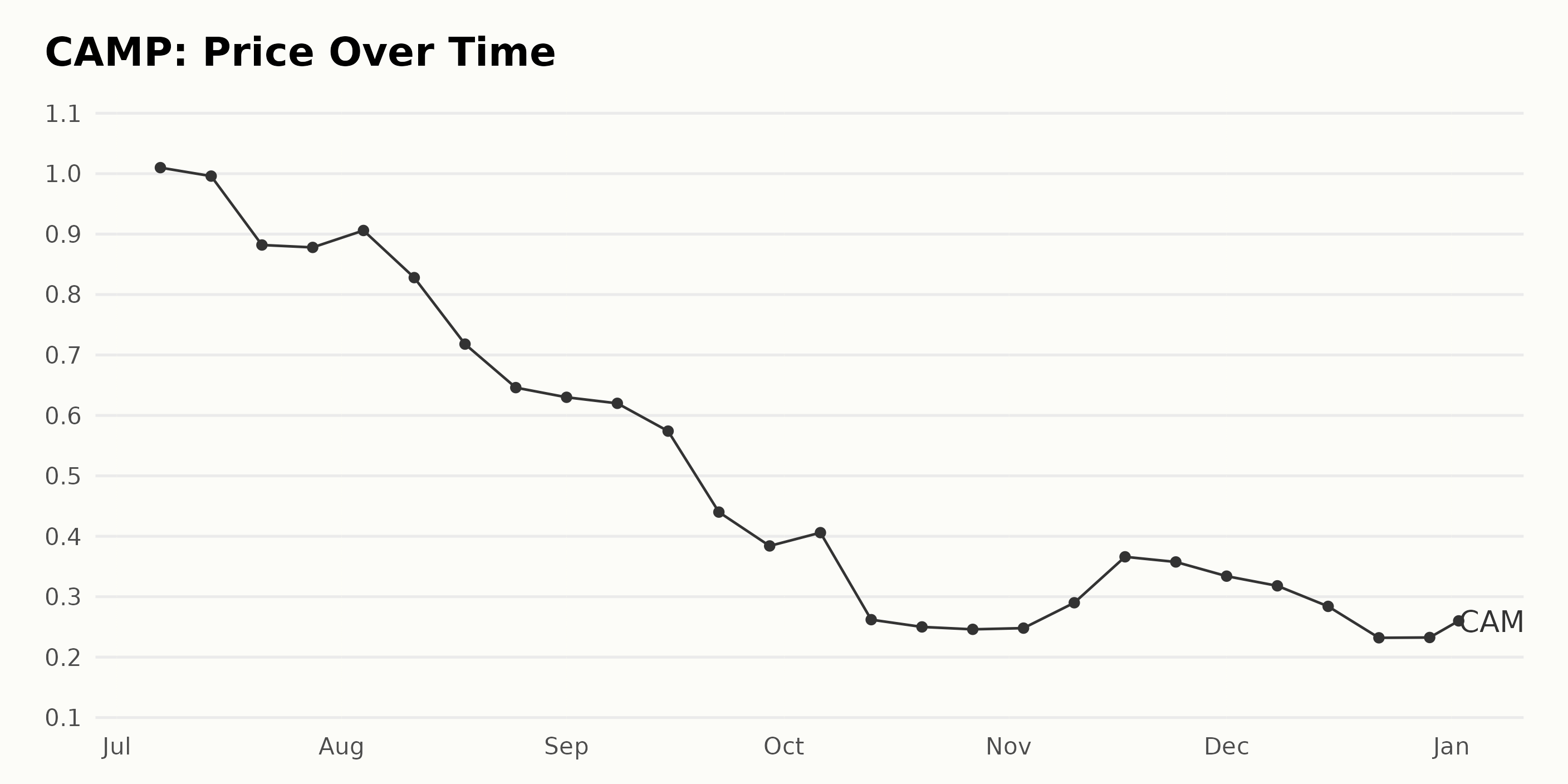

The data for CAMP share prices from July, 2023 to January, 2024 is notable for its consistently clear downtrend with a significant deceleration in the final months.

- On July 7, 2023, the company's share price was at its peak of $1.01.

- By July 21, the share price had decreased to $0.88, indicating a loss of around 13% over two weeks.

- The downward trend continued through August and September, with the share price falling to $0.63 and $0.57 respectively - an overall decrease of 41.39% in just three months. This demonstrates a significant and consistent decline during this period. However, the rate of decrease slowed down significantly towards the end of the year:

- In October, the share price broadly stabilized around the $0.25 mark.

- November witnessed a small uptick, where the share price reached $0.37 by November 17, a roughly 48% increase from the previous month's average.

- However, by December, the trend resumed its downward path, closing the year at $0.23. Lastly, the new year began with a minor rebound:

- As of January 2, 2024, the stock's value had achieved a slight recovery, rising slightly to $0.26.

In summary, the general trend for CalAmp Corp. (CAMP) share prices from mid-2023 to early 2024 appears to be consistently downward. Despite a temporary slowdown in the decrease in October and a minor rebound in November, the overall trend persisted. This pattern away from the usual trend suggests a need for caution among potential investors. Here is a chart of CAMP's price over the past 180 days.

Analyzing CalAmp Corp.'s Growth, Value, and Momentum Dimensions: A POWR Ratings Review

CAMP has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #29 out of the 50 stocks in the Technology - Communication/Networking category.

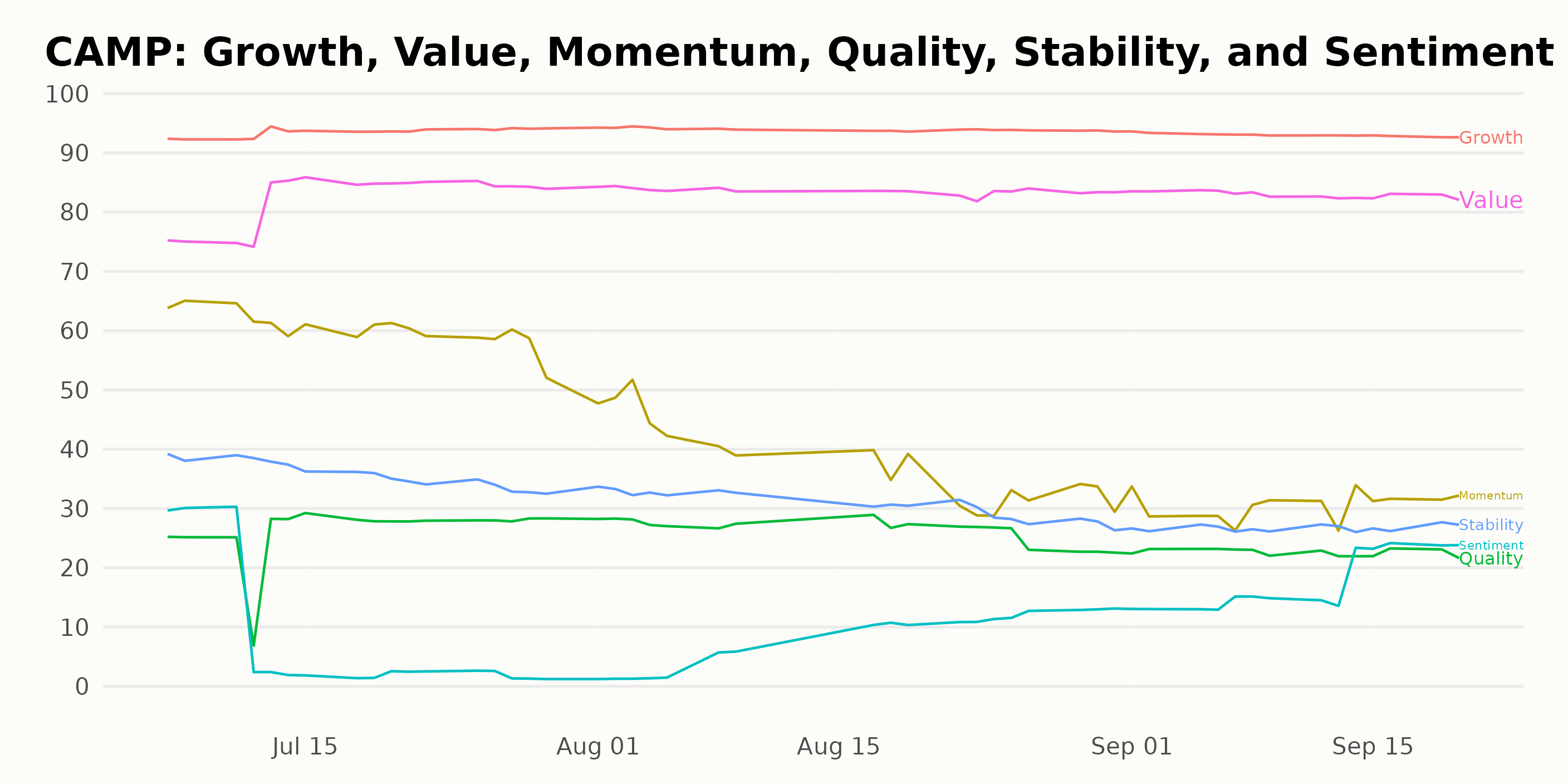

Based on the POWR Ratings for CAMP, the three most noteworthy dimensions are Growth, Value, and Momentum, in that order. Here's a detailed discussion of these.

Growth: With a range span of 92 to 94 across the observed period, this dimension is noticeably the highest, demonstrating a consistently excellent growth rating for CalAmp Corp. It started with a rating of 92 on July 8, 2023, and increased slightly to 93 on July 15, 2023. From July 22, 2023, to September 20, 2023, it remained consistent at 94, barring a slight drop to 93 from September 9, 2023.

Value: The second important dimension is Value, which also showed a significant increasing trend over time. Starting at 75 on July 8, 2023, the value rating gradually increased over time and consistently maintained an 83-85 range from July 29, 2023, onwards.

Momentum: Although the Momentum dimension was not as high as Growth and Value, it had a clear decreasing trend that makes it worth noting. It started with a rating of 64 on July 8, 2023. It witnessed a gradual drop, reducing to 40 by August 9, 2023, and later to 32 by September 20, 2023. This suggests a decreasing momentum over time.

Remember that these are just three important factors from the POWR ratings system. Other factors such Quality, Sentiment, and Stability can also play crucial roles in understanding the overall rating of CAMP.

How does CalAmp Corp. (CAMP) Stack Up Against its Peers?

Other stocks in the Technology - Communication/Networking sector that may be worth considering are Hewlett Packard Enterprise Company (HPE), Gilat Satellite Networks Ltd. (GILT), and Extreme Networks, Inc. (EXTR) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

CAMP shares were trading at $0.25 per share on Wednesday afternoon, down $0.01 (-2.28%). Year-to-date, CAMP has declined -0.40%, versus a -1.20% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Should You Buy, Hold, or Sell CalAmp (CAMP) Stock? StockNews.com