There was lots of fretting all week among traders. Interest rates were rising. The economy seemed to be slowing. Stock markets were experiencing more volatility than in prior weeks.

But Friday produced a huge rally in the Dow Jones Industrial Average, a small gain for the S&P 500 Index and tiny losses for the Nasdaq Composite and Nasdaq-100 Indexes.

Rates drifted back. And oil prices moved lower.

Related: The Fed doesn't want to talk about stagflation. It might not have a choice.

When the dust settled, there were just small weekly declines for the major stock averages:

- 0.5% for the S&P 500 after five weeks of gains.

- A 1.1% fall in the Nasdaq Composite Index also after five weeks of gains.

- The Dow was off 1% for the week. Its 575-point gain on Friday was offset, however, by a loss of 958 points over the prior three days.

The market was higher overall in May after a slip in April for all the averages.

For the year, the S&P 500 is up 10.6%. The Nasdaq is up 11.5%, but the Dow's gain for the year is just 2.6%.

The unease surrounding a bull market

Notwithstanding that the stock market won't fall apart, there's a fretting that will not go away. The economy may be slowing as higher interest rates weigh on businesses and consumers, especially home buyers.

That's why one should keep an eye on the iShares 20+ Year Treasury Bond exchange-traded fund (TLT) . The ETF tracks the 20-year Treasury bond.

If the price is falling, interest rates are rising. The ETF fell 7.1% in May as investors feared the Federal Reserve might not cut rates at all this year. The ETF fell 3.4% between May 15 and May 30 as the fretting about interest rates got louder. It rose on Friday on relief an important inflation report was benign.

Expect more worrying this week over just one event: The jobs report for May, arriving on Friday.

The report is the most important economic event of the month, and most economists see the unemployment rate holding at 3.9%, with payroll job growth coming in at 180,000, up slightly from May.

A weak payroll employment number will freak out many investors. So will a sudden jump in the unemployment rate and weak numbers in components of the report, including hours worked and employment weakness in specific areas of the economy, like manufacturing and construction.

A big reason for the worry is that the consumers don't appear to be ebullient about the economy despite encouraging economic data.

Related: Is big change about to hit Caesars Entertainment?

Food price inflation has been stubborn. Income gains have been offset by increasing costs, especially insurance and the combination of sticky rates for mortgages and cars and high housing costs.

Initial estimates of U.S. economic growth were trimmed this past week.

You can see the concern in one of the components of Friday's Personal Consumption Expenditures Price Index report.

The report is intensely followed because of what it says about inflation generally. As important, it offers details on the health of Americans' incomes and how they choose to spend.

Economists are most worried about spending because many companies -- from auto dealers to clothing retailers to fast-food restaurants -- have been saying on earnings calls that Americans are increasingly judicious.

They're skipping afternoon lattes at Starbucks, looking for sales at the supermarket, and getting the old car fixed rather than buying a new one.

One sees this dynamic clearly in home sales data. Last week's pending home sales report showed sales were down 7.7% in April alone and 7.4% from a year ago. The report is issued by the the National Association of Realtors.

The trade group blamed high interest rates. Prices and housing supplies are also serious problems. Prices and housing supply are intertwined. Boomers with low-rate mortgages are reluctant to move. Younger families can't move because they can't afford a home.

And supplies are further limited by the reluctance of many communities to embrace greater housing density to help make housing more affordable.

Fact is, many sectors of the economy are built around consistent American mobility.

More Economic Analysis:

- Bonds are freaking out about inflation

- Key bond market signal sounds inflation alarm

- Fed rate cuts face big reset on renewed inflation risks

And when Americans move, they buy stuff for the new home: bookcases, sofas, appliances, lighting, and the like.

They're just not buying at levels that cheer store managers.

Investors may see some of those concerns in the jobs report.

Most certainly, they will hear the Federal Reserve talk about it at their June 11-12 meeting in Washington, D.C., when the Fed's rate-making body decides its next move on interest rates.

Ahead of the jobs report are some additional reports this week. Two are worth noting:

- The Labor Department's JOLTS reports, measuring the state of job openings and how often people change jobs.

- The Challenger-Gray Layoff report, due Thursday. An indication of whether companies are trimming more staff to cope with rising costs and other issues. The rate was very low in April and may prove to be "the calm before the storm,” said Andrew Challenger, senior vice president of the outplacement firm.

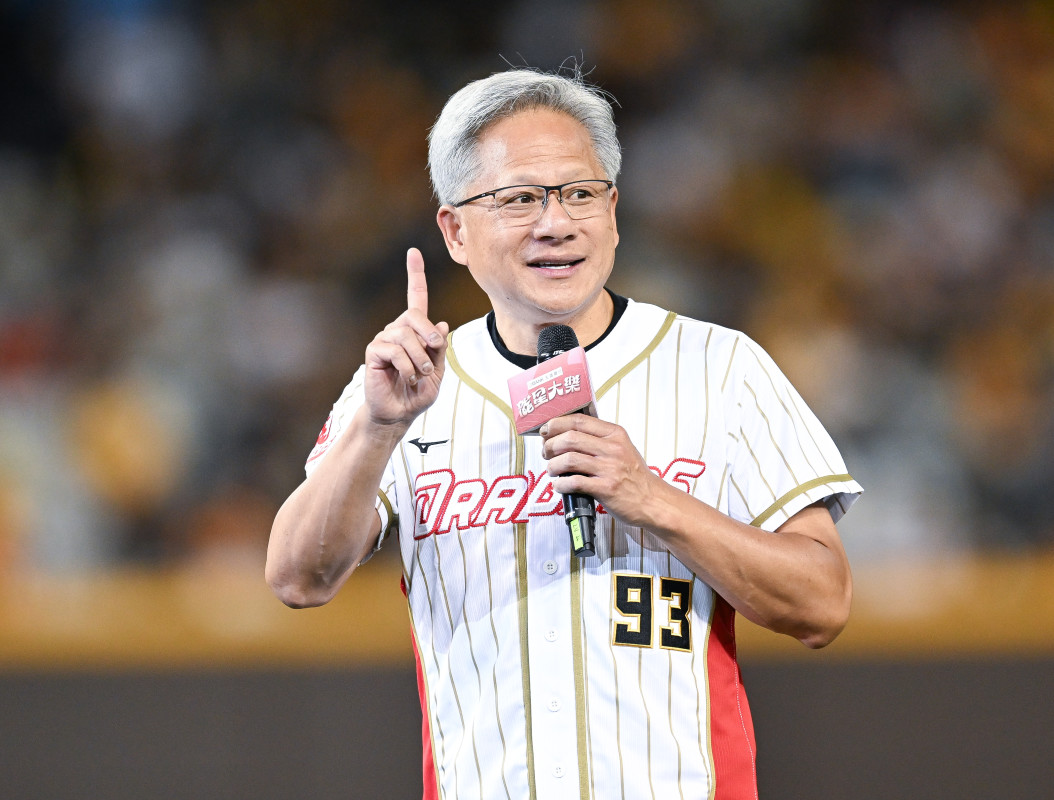

Can you say technology?

The S&P 500 was up 4.8% in May. Of the index's 11 sectors, tech was the leader up nearly 10% in May, mostly because of investor interest in all things having to do with artificial intelligence.

Chip giant Nvidia (NVDA) was up 27% for the month and is up 121 % for the year. It's now up 327% since the end of 2022. Also up? HP Inc. HPQ, up 30%; and chip maker Qualcomm (QCOM) , up 23% for the month and 41%for the year.

Apple (AAPL) was up 12.9% for the month. Facebook parent Meta Platforms (META) was up 8.5%. Tesla (TSLA) fell 2.8% and is off 28% this year.

Let's describe the market for tech stocks: hyper-bullish. The market caps for the top 10 stocks in the S&P 500 now account for 34.1% of the market cap for the index. In 2018, the top 10 accounted for just 21% of the index's market cap.

Six of these are tech stocks, accounting for 29% of the index's market cap alone. At some point, there will be a break for the tech shares. If the dot.com bust in 2000 and the 2008-09 crash are any indication, the break will sneak up on traders and investors.

Utilities put on a show

The second-best performing sector was utilities, partly because of the strong belief utilities will be investing in new power generation facilities and the infrastructure needed to send power to customers.

First Solar (FSLR) , maker of solar panels, was the top S&P 500 stock in the month, up 54% in May alone. It's up 58% for the year.

Also on the list: Vistra (VST) , which supplies energy from natural gas, nuclear, solar and battery sources. It was up 31% for the month and only joined the S&P 500 on May 7, replacing Pioneer Natural Resources, bought by Exxon Mobil (XOM) .

The weakest S&P 500 sector in May was energy, down 1% for the month, as oil prices surprised many analysts by moving lower. The global oil market seems to be amply supplied, and gasoline demand has slipped in the United States because gasoline-fueled cars are more efficient or consumers are buying electric vehicles.

Crude oil was down 5.3% in May to $76.99, on top of a 2.3% decline in April. It's up 7.5% for the year after jumping 16.1% in the first quarter.

In recent years, oil and gasoline prices have risen in the summer until mid-September. Be ready.

Related: Veteran fund manager picks favorite stocks for 2024