Key takeaways:

- Shenzhen Edge Medical has applied for a Hong Kong IPO, following China’s approval for the sale of one of its key products in January

- Company will face challenges from a growing number of domestic rival products already on the market

By Molly Wen

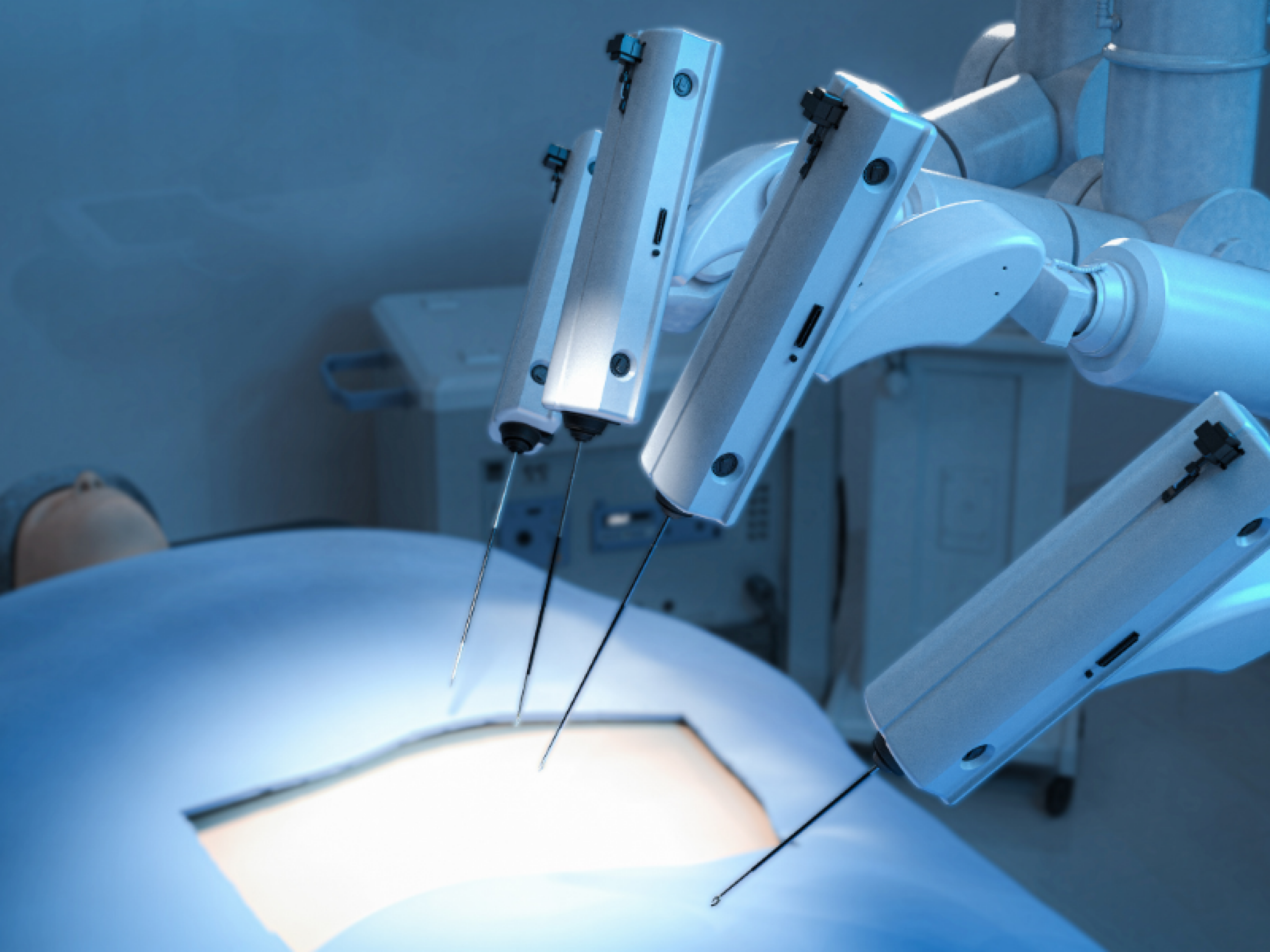

Born in the confluence of medicine, mechanics, biomechanics and computer science, surgical robots have become a crown jewel of sorts for the robotics industry. In China the market has been dominated for years by the Da Vinci Surgical System, developed by U.S.-based Intuitive Surgical (NASDAQ:ISRG). Meantime, domestically made surgical robots are still in their infancy.

But that is starting to change. Last November, the Hong Kong Stock Exchange welcomed its first publicly listed surgical robotic company in Shanghai MicroPort MedBot (2252.HK), whose cornerstone investors included big names like Aspex Management, Hillhouse Capital and Lilly Asia Ventures, which bought a combined $95 million worth of the company’s shares. Now another member is inserting itself into that mix, following Shenzhen Edge Medical Co. Ltd.’s submission of an application for its own Hong Kong IPO last Tuesday.

China approved its first domestically produced laparoscopic surgical robot for marketing last October, while many other surgical robots are entering clinical trials or applying for product registration, as the industry gains momentum.

Established in 2017, Shenzhen Edge Medical specializes in laparoscopic surgical robots that are the most widely-used type in clinical medicine. They allow physicians to perform surgical moves like cutting and sewing, inducing coagulation and conducting autopsies by maneuvering surgical equipment connected to mechanical arms using a remote-control desk. They can be used in urology, gynecology, cardiology and general surgery.

The company has two main products that are through most of their design and development stages. The more advanced is the MP1000, a multi-port laparoscopic surgical robot, which completed its registered clinical trial in the field of urology last December. Its registration application was accepted by the Chinese National Medical Products Administration (NMPA) a month later.

According to the prospectus, MP1000 has shown its efficacy and safety in clinical trials at levels not inferior to the Da Vinci Surgical System, considered a global leader. The other advanced product in the company’s pipeline, the SP1000, began a clinical trial in the field of gynecology last October, becoming China’s first single-port surgical robot to reach that milestone.

Shenzhen Edge has a factory in the southern boomtown of Shenzhen that can produce as many as 80 surgical robots per year. It plans to sharply increase that with construction of a new 60,000-square-meter facility in Shanghai that will have annual capacity of more than 500 surgical robots. According to research cited in its prospectus, the facility is likely to become the biggest surgical-robot production base in China.

Tough market conditions

China is widely seen as an immensely promising market for surgical robots as its many hospitals slowly upgrade with the latest technologies. But various factors, including limited supply of licenses, high prices and lack of well-trained doctors, have kept down installed capacity to date, with China only accounting for 5.1% of the global market in 2020.

The industry’s business model sees hospitals typically buy basic hardware and software up front, and then pay more for supporting hardware and maintenance over the longer term. The model has higher barriers to entry than for companies engaged in simple one-off sales due to the longer times needed to recoup investment, giving earlier arrivals an advantage that can make it more difficult for new competitors to enter.

But the field is also limited in China because surgical robots are usually not covered by medical insurance and require patients to pay out-of-pocket, making them a luxury for both hospitals and patients. Such systems aren’t cheap either. A Da Vinci Surgical System costs as much as $2.5 million, with up to an addition $190,000 annually for maintenance services.

Surgeries performed with such machines are typically around 30,000 yuan ($4,600) more expensive than traditional laparoscopic surgeries, creating a huge barrier to wider use. Despite being in the Chinese market for more than a decade, only 189 Da Vinci Surgical Systems were deployed for laparoscopic surgeries in Chinese hospitals by the end of 2020, covering only 0.5% of such surgeries.

Their advanced nature also means surgical robots require substantial up-front investment and considerable time for clinical trials before they can be sold. Shenzhen Edge Medical logged 79.4 million yuan and 350 million yuan in net losses in 2020 and 2021, respectively, as it lacked any products for sale those two years. At the same time, its R&D spending accounted for 73.9% and 63.5% of total costs in the two years, respectively.

Fundraising frenzy

While mostly young and inexperienced, many of China’s aspiring medical robot makers are being helped by policy support from Beijing, which wants to promote such innovative medical equipment. That has convinced brokerages like Sinolink Securities and Southwest Securities that surgical robots have big potential and the sector could take off exponentially.

The capital market is also embracing such companies, in a show of optimism for the new field. The sector saw at least seven fundraising attempts in this year’s first quarter, including five that raised more than 100 million yuan. Shenzhen Edge Medical’s backers include dozens of major Chinese investors, such as 3H Health, LYFE Capital, Boyu Capital, Temasek, Poly Capital and Sequoia Capital, which have funded the company to the tune of over 2 billion yuan. Its latest funding round was completed last October, valuing the company at over $1.5 billion.

In addition to Shanghai MicroPort MedBot, which is listed in Hong Kong, two other peers, Shandong WeigaoGroup (688161.SH) and Tinavi Medical Technologies (688277.SH), went public on Shanghai’s Nasdaq-style STAR Market last year. Those three are valued at 21.8 billion yuan, 16.8 billion yuan and 4.9 billion yuan, respectively. A simple comparison shows that Shenzhen Edge Medical is valued at the middle to lower end of the industry, based on its valuation at the time of its latest fundraising last October.

It’s worth noting that Shandong Weigao owns the first domestically produced laparoscopic robot approved for sale in China, and Tinavi Medical Technologies has been approved for its robot for orthopedic surgeries. Shanghai MicroPort MedBot has also secured approval for two surgical robots. With those products on the market and many more likely to follow in the coming years, Shenzhen Edge Medical will need to carve out its own space to thrive in a market that is somewhat limited right now but could be full of future potential.