Everyone needs a well-thought-out estate plan, no matter their financial status. An estate plan not only dictates the distribution of your assets but also outlines the medical care you want and how your personal affairs will be managed when you're gone. Estate planning is especially important for women and single adults, who often have fewer assets or support as they age.

Unfortunately, many Americans underestimate the importance of estate planning. Only 24% of Americans had a will in 2025 (down from 33% in 2022), and more than 50% of people who don’t have a will say it’s because they don’t have enough assets, according to Caring.com’s 2025 Wills and Estate Planning Study. On top of that, 43% simply say they just haven't gotten around to it, and almost one in four respondents who did have a Will admitted to not updating the document since it was first written.

No one wants to think about death, especially their own. So, if the idea of estate planning has got you down, start with a will. It's the anchor of your estate plan and can help to avoid probate, which forces your heirs to enter a potentially lengthy (and costly) legal process to distribute your assets.

Things you should leave out of your will

Not everything should be included in your will. Here are 10 things to leave out.

1. Gifts or bequests to a child or other individual with special needs

It's important to be very careful when leaving assets to a person with special needs, says Melissa Negrin-Wiener, ESQ, Senior Partner, Cona Elder Law. "Often, that individual receives government benefits that are means-tested (i.e., Medicaid, SSI), and leaving assets outright to them can cause them to lose their government benefits or any inheritance. If you are leaving assets to a person with special needs in your Will, be sure to leave it in a Supplemental Needs Trust.”

2. Pets, and money for their care

"We love our four-legged family members and often want to ensure they are looked after even if we pass before they do," says Russel Morgan, Principal at Morgan Legal Group. "But pets are considered property and can’t be named as beneficiaries or inherit anything from a will."

Morgan adds that you could earmark a certain amount of money and ask a family member to care for the pet, but once the funds are released to them, there is no legal obligation to follow your exact wishes. "So, it is best to leave pets out of the will and instead set up a pet trust to ensure the well-being of your furry friend.”

3. Non-probate assets

"Your Will only controls the transfer of probate assets — property or items that are solely owned by an individual at the time of their death and must go through the probate process for distribution. Non-probate assets are all assets that have a designated beneficiary, such as life insurance, 401(k), brokerage accounts, IRAs, and even bank accounts that can name a beneficiary and be non-probate," says Daniel R. Bernard, Partner at Tully Law Group, PC. "If you name someone to take a non-probate asset in your will, the problem is that the beneficiary designation will supersede your will," Bernard said. "If you have the same named beneficiary on the account and in the will, this is not a problem. If the beneficiaries are different, this can cause contention and invite a challenge to your estate plan."

4. Terms that leave fixed, high or unrealistic dollar amounts to individuals

If your estate ends up being smaller than expected, leaving a large, fixed cash gift in your Will could reduce what your primary beneficiaries receive, says Andrew Rosenberg, Estate Planning Attorney, at Grieve Civil Law.

"For example, if your Will says, 'I leave $100,000 to my friend, Robert, and the rest in equal shares to my children,' and you wind up only having $50,000 in your estate when you pass away, your children likely won’t receive anything because they are stuck with Robert’s large bequest ahead of their residual distribution. It is much better to leave property in shares or percentages to your beneficiaries, which allows the flexibility in your estate to adapt to any size of a portfolio."

5. Conditional gifts

Jonathan Geserick, Estate Planning Attorney, Texas Probate Pros, recommends not including any conditional gifts. For instance, 'If Anna stays married to Ben, Mary shall receive $100,000 from my assets,' says Geserick. "It's best to exclude conditional gifts because they can lead to complications and legal challenges and make the estate more difficult to settle."

6. Secure information

"I regularly explain to clients that social security numbers, financial account information and passwords to accounts should never be provided within the Will itself," says Ashley N. Higginbotham, Supervising Attorney, at Deming Parker, LLP

"The reason is that upon death, the Will is filed with the Court in the State where the decedent lived. At that point, the Will is a “public” document whereby potential heirs and court staff may view it." Besides that, such information opens the possibility for individuals who are not otherwise authorized to access the accounts the opportunity to gain access and wipe out those accounts.

"If you want to ease the burden on your executor to identify your assets, debts, accounts and passwords, consider creating a separate document for that information and safekeeping it with your Will and other important documents, Higginbotham shares. "If it is a separate document, it does not have to be filed like the Will and could be extremely helpful to your executor."

7. Funeral instructions

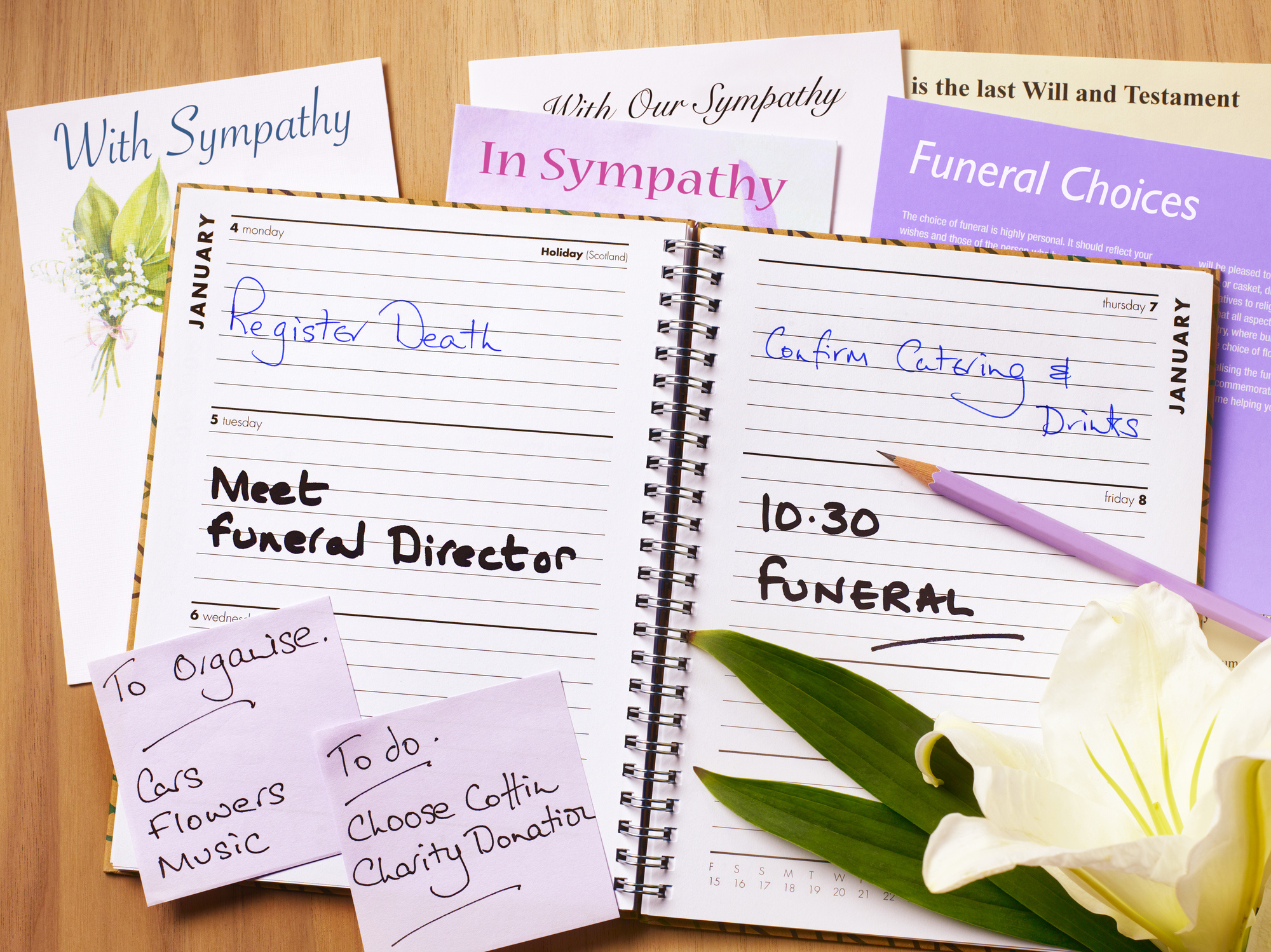

Jamie E. Wright, Founder of The Wright Law Firmwarns that you shouldn't specify funeral arrangements in your Will; they may not be reviewed until after the funeral. "Instead, communicate your wishes directly with your loved ones prior to your passing or include them in a separate document."

8. Guns

“One category of assets I strongly recommend excluding from your Will — firearms. Guns are highly regulated under both state and federal law (age restrictions, background checks, mental competency requirements, etc.). For this reason, we almost always recommend using a separate gun trust (or NFA trust) to transfer firearms safely and legally, rather than distributing them through the Will itself,” states Monique Hayes, Estate Planning Attorney and Partner at DGIM Law

9. Disparagement's to potential beneficiaries

Barnard, Partner at Tully Law Group, PC, also warns about including any disparagement to potential beneficiaries. "I have represented many clients who wanted to disinherit a child and wanted to list the reason. This often causes more hurt feelings and anger, and could lead to a challenge of your Will. It is much better to simply state, 'for reasons best known to me, I make no provision for X."

10. Business interests

Negrin-Wiener, Senior Partner, Cona Elder Law, offers this advice: "Passing business assets within a Trust will allow for more privacy when it comes to business holdings and information."

Michael Dale, Vice President of Investment Services at Navy Federal Investment Services, agrees. "Consider setting up a separate agreement for the distribution of your business assets to avoid probate and ensure a smooth transition."

Final word

Your Will is a powerful tool, but it’s not a catch-all for everything you've accumulated. By excluding these 10 items out of your Will, you’ll spare your family unnecessary delays, taxes and the headaches of probate. A clean, well thought-out Will that only deals with assets that actually need to go through probate is one of the kindest gifts you can leave your heirs.

Move what doesn’t belong in your Will into the right tool — trusts, beneficiary designations, joint ownership, or even a separate personal property memorandum. A little extra planning now means a lot less frustration (and expense) later for you and your loved ones.