Royal Caribbean (RCL) shares have not been faring well lately, but could support come into play soon?

At last check, the shares were down about 3%. That’s just the tip of the iceberg, though.

Royal Caribbean stock has fallen around 20% from last week’s high, declining in six of the past seven trading sessions, including today. The lone up day came on Tuesday -- and the shares ticked up 0.6%.

Don't Miss: Is Microsoft Stock a Buy? Here's the Hurdle It Must Clear

But for the cruise stocks, Royal Caribbean is actually a bright spot.

Norwegian Cruise (NCLH) and Carnival Cruise (CCL) are both working on their seventh straight daily decline and are down 25% and 26.5% from last week’s high, respectively.

Royal Caribbean may have made an embarrassing mistake, but the selloff in this space is about more than that.

Are investors panicking that consumer travel is about to die down? That’s what the selloff seems to suggest.

Despite persistent inflation and worries about a recession, consumers clearly were continuing to travel. Credit-card companies were talking about it and so were the travel firms themselves.

The stocks of cruise lines, Las Vegas casinos and resorts, airlines and booking companies all but confirmed this strong trend. Lately, though, these stocks have turned lower.

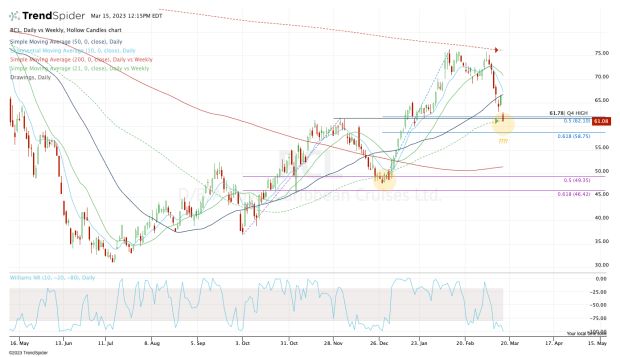

Let’s look at the RCL charts.

Trading Royal Caribbean Stock

Chart courtesy of TrendSpider.com

Royal Caribbean stock is entering a key area. That’s as the shares are trading between the 50% and 61.8% retracements of the recent rally, as well as testing the 21-week moving average.

These are exactly the measures at which the shares found support in late December, helping propel them to a 60% gain. Can they do so again?

The macro backdrop is a bit more intimidating this time around. But if Royal Caribbean can hold up over $59, we could see a move back to the mid- to upper-$60s.

Above that and $70-plus is in play.

On the downside, a break of $58.75 and failure to regain this level could put the low-$50s in play.