Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 18 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $104,500, and 14 were calls, valued at $568,748.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $820.0 to $1200.0 for ServiceNow over the recent three months.

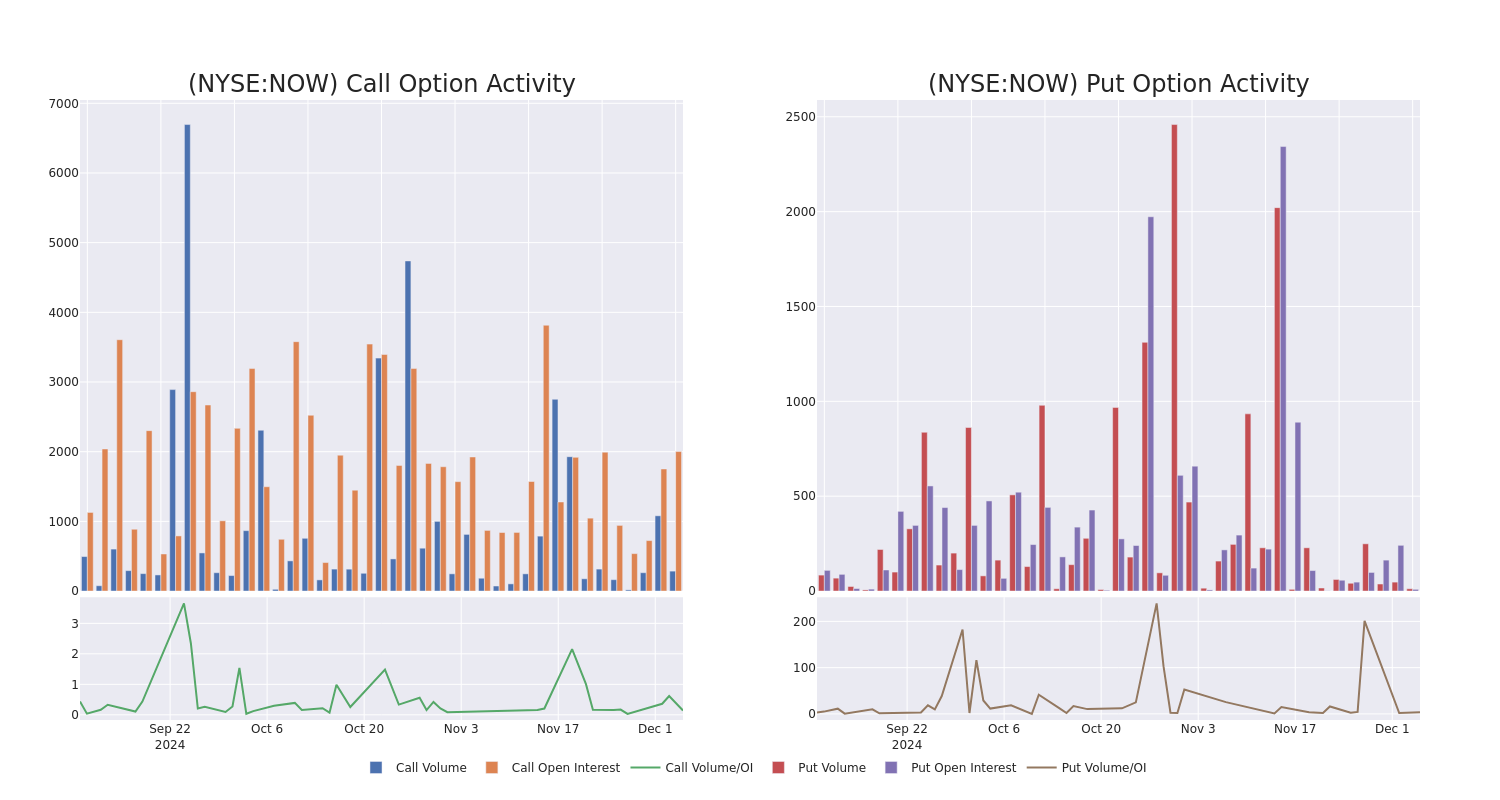

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $820.0 to $1200.0 in the last 30 days.

ServiceNow Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | SWEEP | NEUTRAL | 12/06/24 | $56.5 | $50.7 | $53.57 | $1075.00 | $80.2K | 85 | 18 |

| NOW | CALL | TRADE | BEARISH | 06/20/25 | $270.4 | $264.7 | $264.65 | $910.00 | $79.3K | 46 | 3 |

| NOW | CALL | SWEEP | BEARISH | 12/06/24 | $47.7 | $42.7 | $42.7 | $1085.00 | $64.0K | 618 | 18 |

| NOW | CALL | TRADE | NEUTRAL | 03/21/25 | $80.0 | $76.6 | $78.0 | $1140.00 | $39.0K | 34 | 5 |

| NOW | CALL | SWEEP | BULLISH | 12/06/24 | $25.0 | $23.8 | $25.0 | $1100.00 | $37.5K | 406 | 75 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

Following our analysis of the options activities associated with ServiceNow, we pivot to a closer look at the company's own performance.

Current Position of ServiceNow

- Trading volume stands at 556,592, with NOW's price down by -0.2%, positioned at $1120.89.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 48 days.

Expert Opinions on ServiceNow

In the last month, 5 experts released ratings on this stock with an average target price of $1190.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for ServiceNow, targeting a price of $1250. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on ServiceNow with a target price of $1150. * An analyst from Oppenheimer has decided to maintain their Outperform rating on ServiceNow, which currently sits at a price target of $1150. * An analyst from Wells Fargo has decided to maintain their Overweight rating on ServiceNow, which currently sits at a price target of $1250. * An analyst from Needham has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $1150.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ServiceNow with Benzinga Pro for real-time alerts.