Most electric vehicle models on sale today in the United States would be ineligible for a $7,500 federal tax credit under the new climate bill that recently passed the US Senate, a group of automakers claims.

The Alliance for Automotive Innovation that represents General Motors, Toyota and Ford Motor Company, among other carmakers, said a July 27 proposal by Senators Chuck Schumer and Joe Manchin would make 70 percent of 72 US all-electric, plug-in hybrid and fuel-cell vehicles ineligible upon passage. And that's not all.

"None would qualify for the full credit when additional sourcing requirements go into effect."

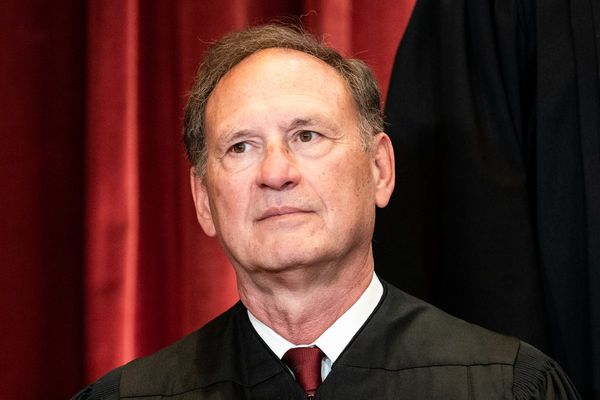

John Bozzella, head of the Alliance for Automotive Innovation

As a result, carmakers want significant changes done to the proposal, which is part of a larger drug pricing, energy and tax bill called Inflation Reduction Act. If they don't qualify for the tax credit, the vehicles become more costly for US customers, which could impact demand and sales. It could also endanger President Joe Biden's target to have half of all new vehicles sold in the US be electric or plug-in hybrid models in 2030.

According to an analysis by the Congressional Budget Office last week cited by Reuters, only 11,000 new EVs would use the credit in 2023 if the Inflation Reduction Act becomes legislation.

Automakers have been expressing concern about the proposal's increasing requirements for vehicles' batteries and critical-mineral contents to be sourced from the United States. The bill includes rising requirements for the percentage of battery components originating from North America based on value. After 2023, the bill would exclude batteries with any Chinese components.

In reply to automakers' concerns, Senator Joe Manchin said he doesn't believe the US "should be building a transportation mode on the backs of foreign supply chains."

Automakers want a more gradual phase-in of the battery component, critical mineral and final assembly requirements "that better reflect current geopolitical, sourcing and mineral extraction realities." They are also demanding that the list of countries from which batteries, battery components and critical minerals can be sourced include NATO members, Japan and others.

According to the Inflation Reduction Act, the new EV tax credits, which would expire at the end of 2032, would be limited to trucks, vans and SUVs with suggested retail prices of no more than $80,000 and to cars priced at no more than $55,000. The credits would also be limited to families with adjusted gross incomes of up to $300,000 annually.