Oman’s Rakiza announced that it received a capital commitment of $299 million from the Saudi Public Investment Fund (PIF).

Rakiza is a private equity infrastructure fund co-managed by Oman Infrastructure Investment Management (OIM) and Equitix.

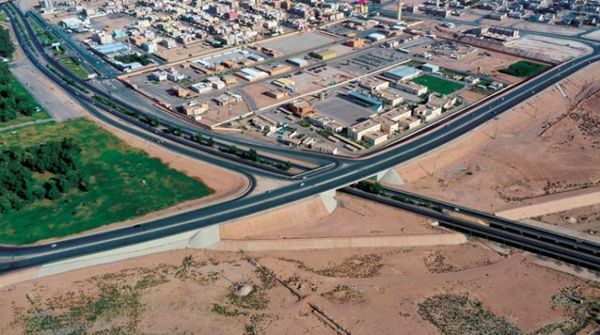

The fund Rakiza invests in Oman and Saudi Arabia and invests in various sectors, namely renewables, power and water, social infrastructure, telecommunications, transport, and logistics.

CEO of OIM Muneer al-Muneeri said that the partnership with PIF, one of the most significant sovereign wealth funds in the world, comes within the framework of sharing the national visions of Oman and Saudi Arabia about supporting the privatization of facilities and infrastructure, which is a crucial factor for the success of the investment strategy.

“Rakiza’s investment strategy fosters capital market growth, foreign direct investment, and privatization. As part of this, the Rakiza Fund is proud to partner with PIF, which greatly enhances strategic value for all stakeholders,” said Muneeri.

The CEO and co-founder of Equitix, Hugh Crossley, explained that the partnership with the world’s most prominent investment institution contributes to achieving Rakiza Fund’s commitments to develop infrastructure projects.

“It is a great addition and development in Rakiza Fund’s history, looking forward to further regional growth.”