Among the things that Sandisk discussed last week at its Investor Day were upcoming UltraQLC-based 1PB (1 petabyte) solid-state drives, as well as some unanticipated talks about 3D DRAM, which is not about to happen quite yet, according to Sandisk (the roadmap target lacks a date).

UltraQLC and 1PB SSDs

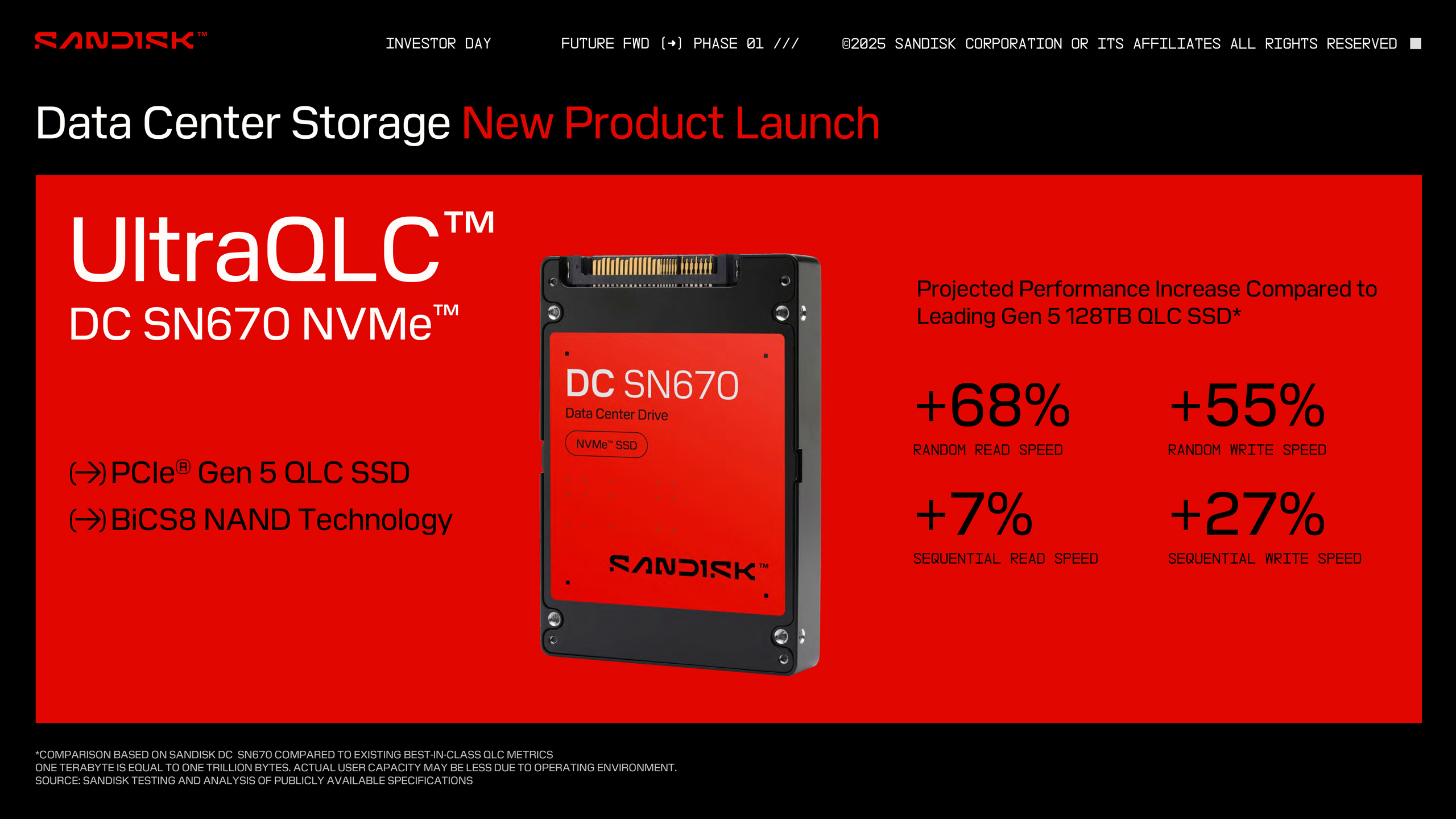

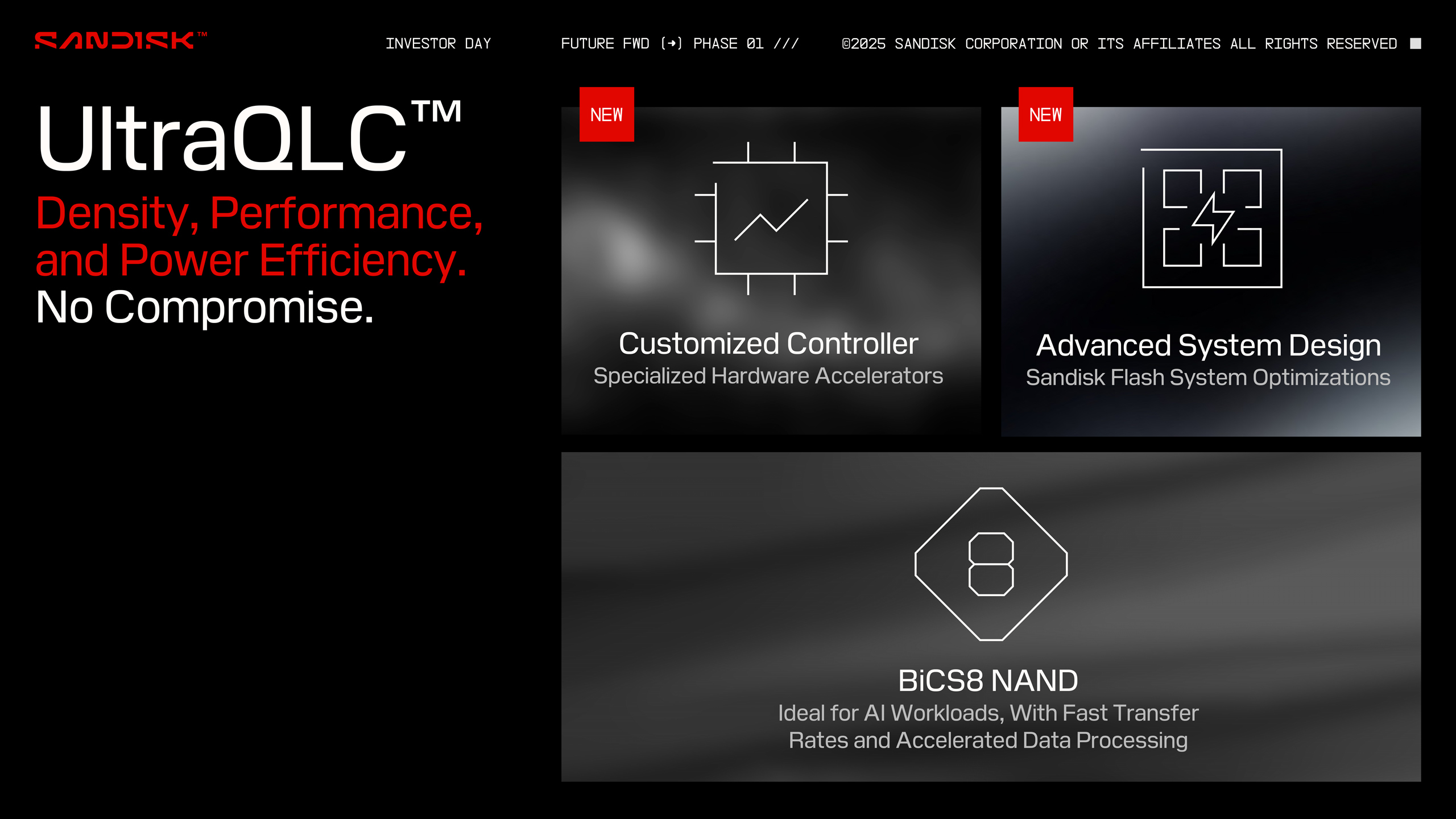

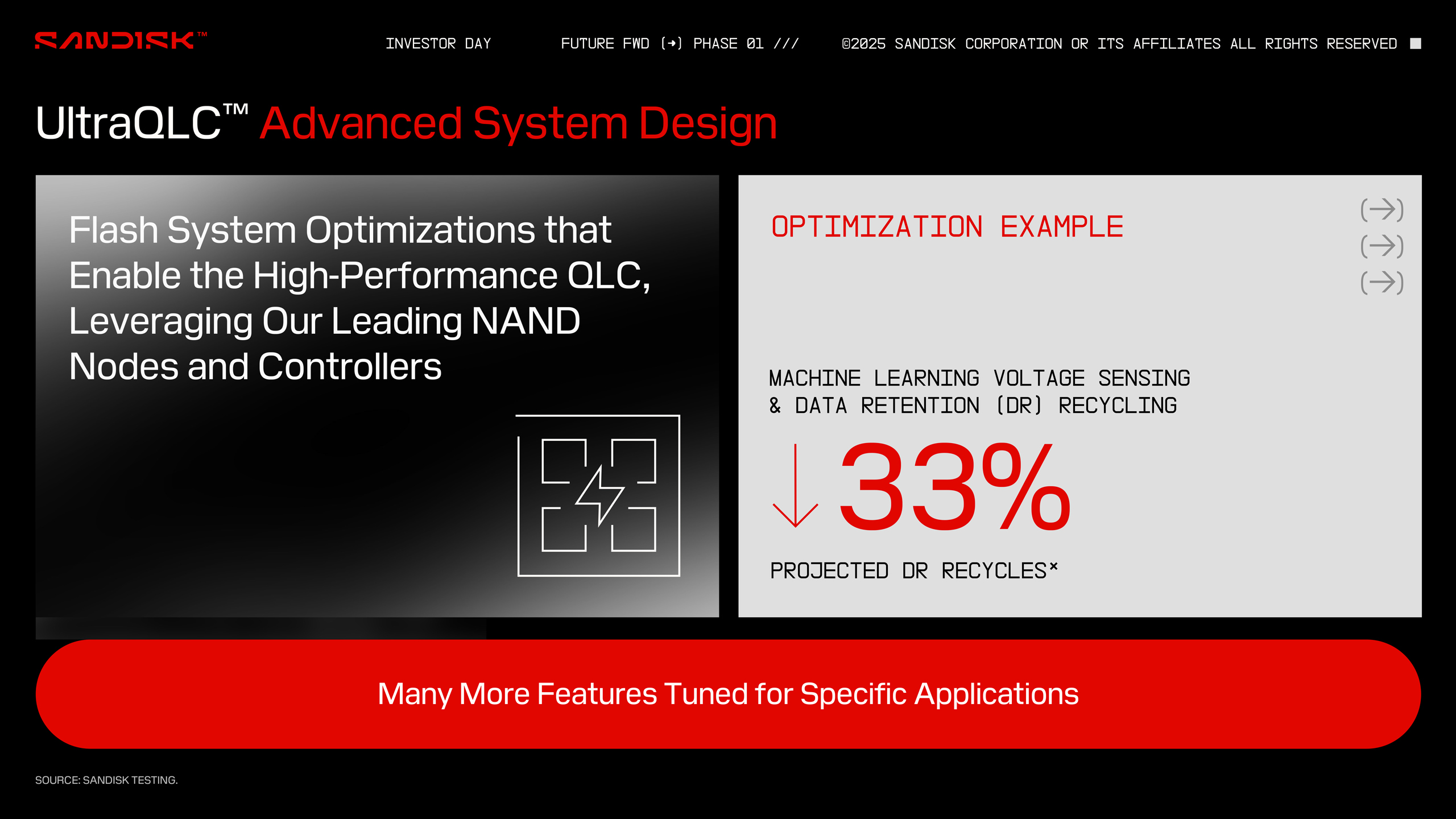

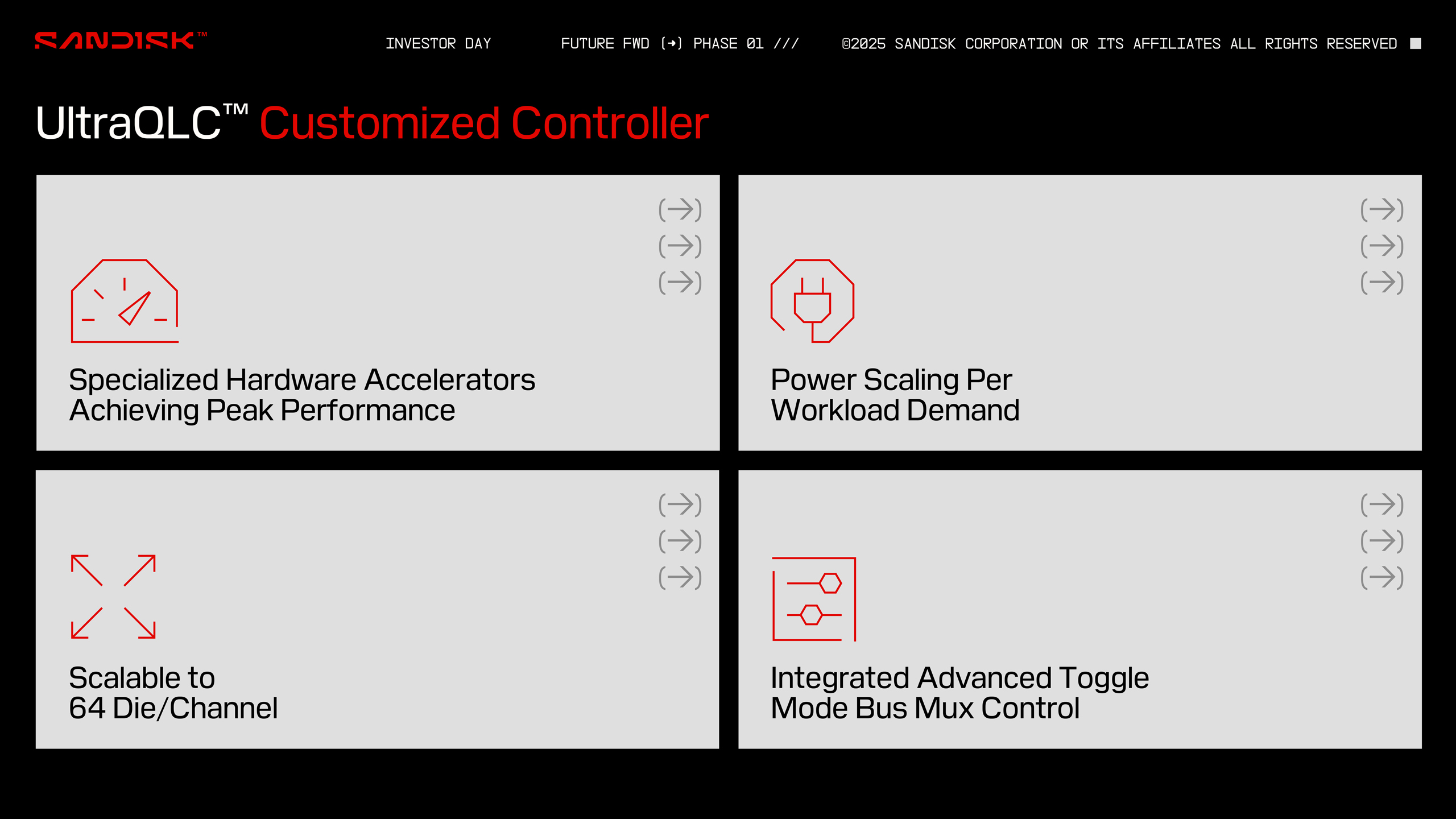

Let us start from the UltraQLC platform that will eventually enable 1PB SSDs. Just as the name suggests, UltraQLC is not a type of memory per se, but a mix of Sandisk's BICS 8 QLC 3D NAND, a very advanced proprietary controller with a whopping 64 NAND channel, and firmware. In fact, the custom-designed controller is central to UltraQLC as it incorporates domain-specific hardware accelerators that offload critical storage functions from firmware, reducing latency, enabling higher bandwidth, and improving reliability for hyperscale storage needs, according to Sandisk. The controller also dynamically scales power based on workload demand, ensuring optimal energy efficiency. The chip also has an advanced bus multiplexer that manages increased data load from high-density 3D QLC NAND memory stacks, allowing full channel utilization without sacrificing performance.

"UltraQLC [is] custom built based on our decades of experience and our current learnings to really be deployed in the modern data infrastructure while not compromising on density, performance, and power efficiency," said Khurram Ismail the incoming chief of Engineering and Product Management at Sandisk. "It is really built around those three things: […] BICS 8 NAND technology [and future NAND too], customized controllers, and advanced system design."

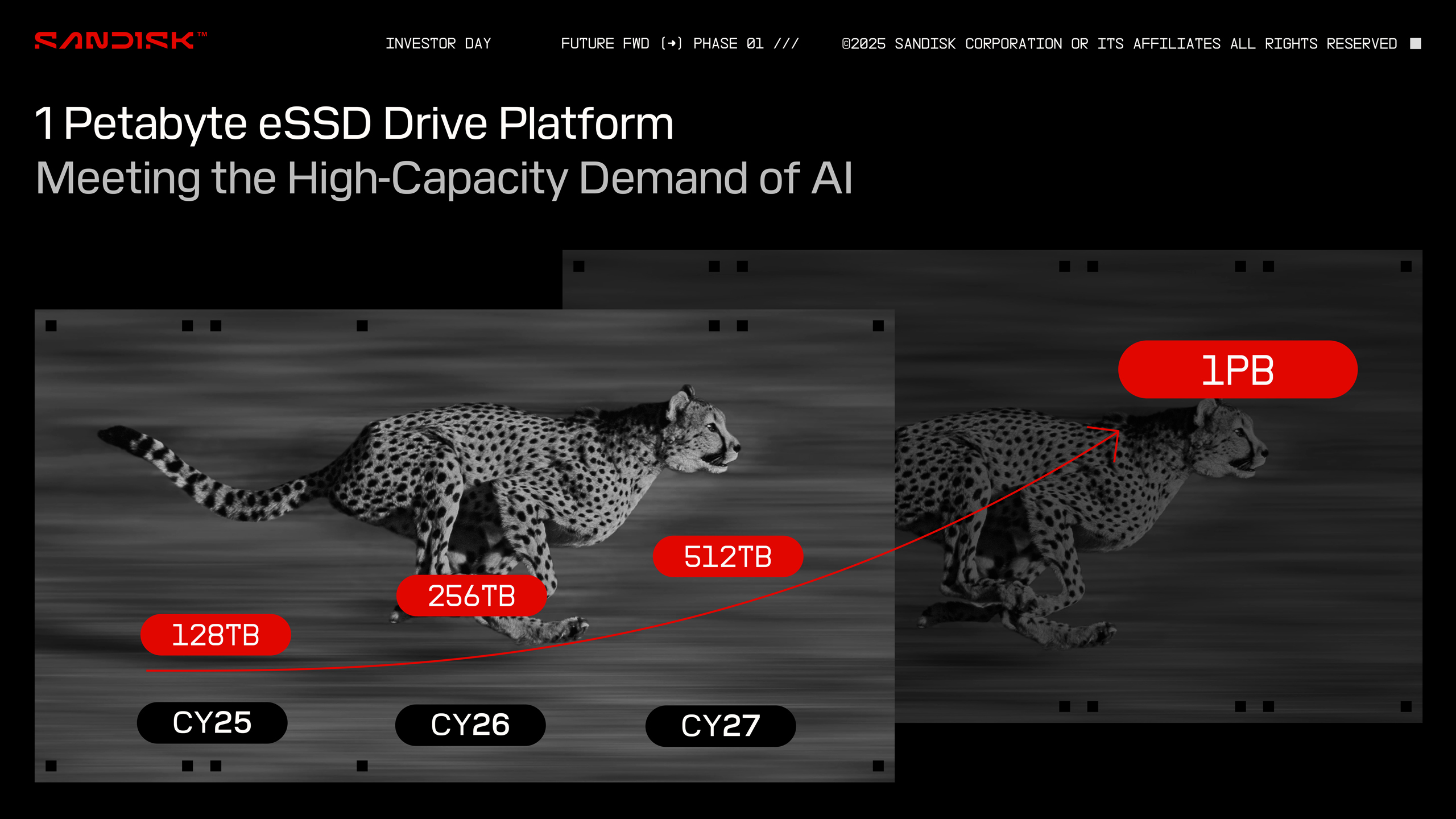

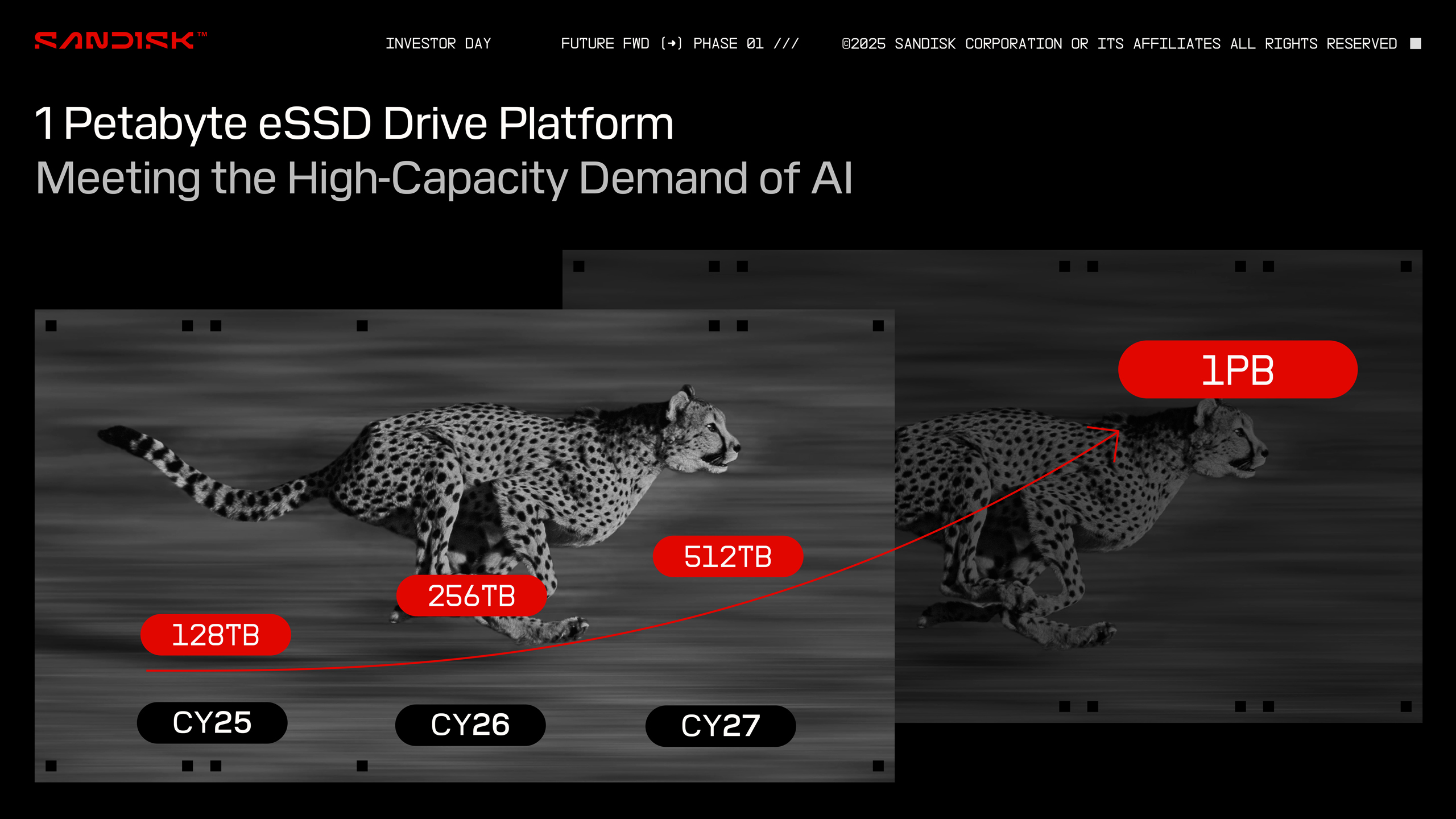

For now, the UltraQLC SSDs are set to leverage 2Tb NAND memory ICs to enable 128TB capacities. Technically, a 64-channel controller could enable higher capacity, but at the cost of performance. But Sandisk has higher-capacity NAND memory devices incoming, so the company envisions 256TB, 512TB, and eventually 1PB drives in the coming years.

3D DRAM, not now

When it comes to AI and other high-performance computing, there is the so-called memory wall as AI training needs abundant memory capacity. Typical DRAM scaling may no longer meet the needs of AI training demands, says Sandisk.

The memory wall problem — the widening gap between what applications need and what technology can deliver — is exacerbating cost pressures in AI and computing. Large language models (LLMs) are growing 10x every 1-2 years, requiring massive increases in memory performance. This is where Sandisk 3D DRAM comes into place.

"This work has been going on for quite some time, but the technological challenges have been pretty daunting and there is no clear line of sight to getting to 3D DRAM right now in the industry," said Alper Ilkbahar, memory technology chief at SanDisk.

To address this issue, three potential solutions were outlined. The first is the brute-force investment approach, which involves throwing more money into DRAM scaling, despite diminishing returns. The second is 3D DRAM, an attempt to scale DRAM vertically, similar to 3D NAND, but significant technological challenges make it an uncertain path. The third and preferred approach is developing new scalable memory technologies (such as HBF), which Sandisk has been actively pursuing as an alternative to traditional DRAM scaling limitations.

As Sandisk and Western Digital are preparing for a split, both brands — which are technically still Western Digital Corp. — both companies held their Investor Days last week, where they revealed a number of unexpected things. We have already covered High Bandwidth Flash from Sandisk and heat dot magnetic recording (HDMR) technology.