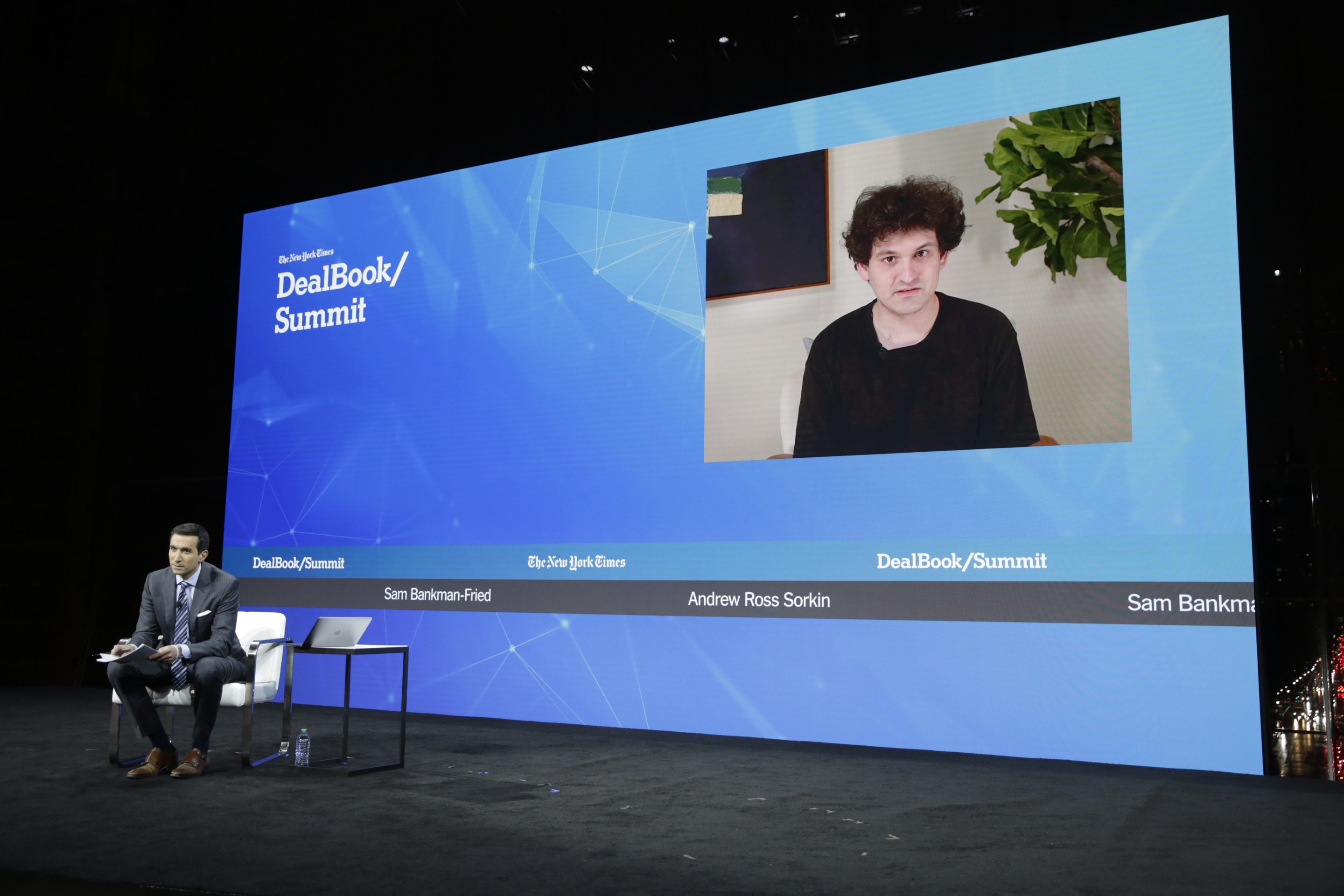

FTX founder Sam Bankman-Fried went on an “I screwed up” media blitz this week, highlighted by his video appearance at the New York Times DealBook summit on Wednesday and continuing into the Sunday talk shows.

U.S. securities lawyer James Murphy, speaking to CNN’s Quest Means Business on Thursday, said Bankman-Fried “did a very good job of sticking to his talking points.”

Murphy said: “His talking points were, ‘I didn’t do anything wrong intentionally. I may have been negligent. I may have breached fiduciary obligations.’ But those two things get you sued, get you penalized. They don’t get you to jail. And so he steered clear of anything that sounded like intentional misconduct.”

FTX imploded in spectacular fashion last month, spurring calls for tighter regulation and shaking confidence in the crypto sector. The $32 billion cryptocurrency exchange had established itself as a leader in the field, enlisting star athletes like Stephen Curry and other celebrities to bolster its image.

A key accusation leveled against Bankman-Fried is that he used customer funds from his crypto exchange to fund risky bets at affiliate trading arm Alameda Research.

‘Did not ever try to commit fraud’

In the DealBook interview, Bankman-Fried peppered his statements with legalese, stating that he “did not ever try to commit fraud on anyone,” didn’t “know of times when I lied,” and “didn’t knowingly comingle funds.”

Said Murphy of Bankman-Fried sticking to the script: “He’s a very, very bright man and managed to do that for an hour.”

In a Financial Times interview published Sunday, Bankman-Fried stuck with the theme, saying, “I f****d up big and people got hurt.”

On ABC’s This Week on Sunday, Bankman-Fried said, "Look, I screwed up. Like I was CEO, I had a responsibility here and a responsibility to be on top of what was going on the exchange. I wish I had done much better at that.”

ABC legal analyst Dan Abrams said afterwards, “His basic defense, it sounds like, is, ‘I didn't have the intent. I wasn't trying to do it.’ That's not enough in a lot of cases. That's not going to protect him necessarily from getting indicted. But it is something we hear from CEOs who get tried, and it almost never works.”

‘People will go to jail, and should go to jail’

Abrams added that Bankman-Fried could be facing a long time in jail.

“We’re talking about, by the way, the possibility of up to life in prison,” he said. “When you're talking about this much money, in the federal sentencing guidelines, you're talking about the possibility of enhancement after enhancement after enhancement based on the dollar amounts that could lead to something up to life.”

Earlier this week Coinbase CEO Brian Armstrong said of Bankman-Fried, "It’s “baffling to me why he’s not in custody already.”

Mark Cuban, billionaire owner of the Dallas Mavericks and a prominent crypto investor, recently told TMZ that Bankman-Fried should be worried about prison time.

Mike Novogratz, CEO of crypto firm Galaxy Digital Holdings, told Bloomberg TV on Thursday, “Sam and his cohorts perpetuated a fraud...He took our money. And so he needs to get prosecuted. People will go to jail, and should go to jail.”

Securities lawyer Murphy added that prosecutors don’t have to prove that there was securities fraud. "They can go with mail and wire fraud," he said. "If the money of customers was misappropriated and given to this affiliated company Alameda, that is a fraud and should qualify under the statues. I sincerely hope our Department of Justice is looking at it very hard.”

Fortune reached out to Bankman-Fried for comments but did not receive an immediate reply.