Salesforce (CRM) has performed well this year, although it seems to have been overshadowed by other megacap tech stocks.

The software giant's shares are pulling back about 4.5% on Thursday after the earnings report. Salesforce stock is still up more than 60% this year.

But surges in the FAANG group, Nvidia (NVDA) and a few others have overshadowed Salesforce, which garnered the spotlight with its impressive rally and the activists who became involved.

Don't Miss: Time to Buy Telecom? Charting Verizon, AT&T and T-Mobile

While revenue grew 10% year over year, it was “the slowest rate of gain since 2011.” That said, Salesforce still beat Wall Street's expectations for earnings and revenue.

Further, despite management forecasting about 10% revenue growth next quarter — a slower growth rate than the previous quarter's — it still topped analysts’ expectations. Full-year guidance was solid too.

Usually a top- and bottom-line beat and above-consensus guidance are enough to spur a stock rally. But Salesforce has already rallied quite a bit, so a mild pullback is a reasonable response.

Buy the Earnings Dip in Salesforce Stock?

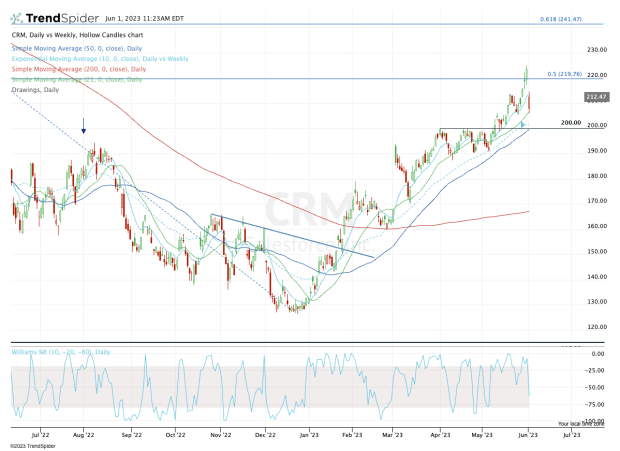

Chart courtesy of TrendSpider.com

Salesforce shares cleanly broke out over the $200 level, then ran to the $220 to $225 zone, where it found resistance. This zone was previous resistance and contains the 50% retracement from the 52-week low up to the all-time high.

Since the numbers were short of a blowout quarter and guidance, this was a reasonable area for the shares to stall out. That’s why we were targeting this area as our upper price target on the breakout trade.

Aggressive buyers are likely nibbling at Salesforce stock here, as it bounces off the 21-day moving average and did nothing wrong from an earnings standpoint.

But the more attractive dip-buying spot is near $200.

Don't Miss: Buffett's Berkshire Hathaway: Another Opportunity to Buy the Dip

Near that mark we find the 10-week and 50-day moving averages, as well as that prior breakout level.

The beauty of this zone? Buyers will quickly know whether they are right or wrong. Either this area holds as support and the shares bounce, or it fails and the stock closes below $200.

If support fails, it could open up the low-$190s as a possible landing spot.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.