Shares of Salesforce (CRM) at last check was double-digits percent higher on June 1 after the customer-relations-management-software icon reported earnings after the close May 31.

Given the horrendous trading in tech stocks this year -- at one point, the Nasdaq was down more than 30% from its high -- the bulls are breathing a sigh of relief with the Salesforce action.

Salesforce wasn’t an exception to the selloff. The shares were halved in five months, a decline that many investors believe was unjustified. They have a point.

When the company previously reported earnings, on March 1, it delivered a top- and bottom-line beat and raised its first-quarter and full-year guidance. The shares rallied less than 1% the day after that report and went on to fall 27% to last week’s low.

Now we have a similar report this week, with the company delivering a top- and bottom-line beat and providing a boost to its operating-margin guidance.

In other words, it was a solid report. As Chairman and Co-Chief Executive Marc Benioff said, “I can tell you that our business -- you can see this in the Q1 numbers, can't you -- is incredibly healthy.”

Trading Salesforce Stock

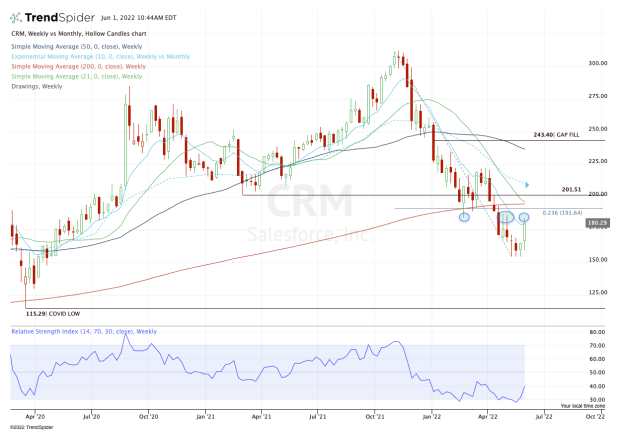

Chart courtesy of TrendSpider.com

Salesforce had a rough stretch as it broke below $200. It fell in six out of seven weeks, then found clear support near $155. In three straight weeks, the stock hammered out a low in this area. In back-to-back weeks, it even had the same weekly low: $154.55.

That consolidation led to Tuesday’s earnings report, where support was either going to be tested again and potentially broken or it was going to be solidified.

With Wednesday’s rally, support has been solidified. Should Salesforce stock come under pressure down the road, we know what area to keep an eye on — $155.

Now that it's moving higher, the stock is struggling with an area it previously has struggled with. The $185 area was support near the February low but resistance in late April and early May.

Today’s high is at $184.42, so it’s clear that this area remains notable even as Salesforce stock pushes through the 10-week moving average.

If it can maintain momentum and clear $185, the bulls will likely turn their attention to the $195 area.

There the stock finds its 21-week and 200-week moving averages. If it can clear all these measures and hold above $200, then the $220s could be in play.

While a rally like that would be impressive, investors must keep in mind just how much this stock — and many of its peers — have corrected in recent months.

At some point, it's due for a sustained rally.