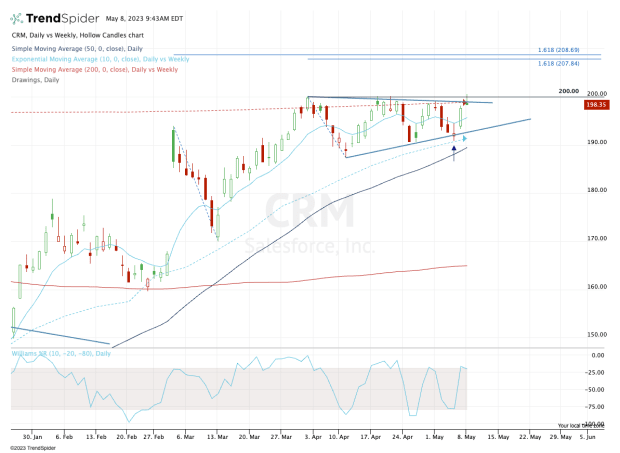

Salesforce (CRM) shares seem to have fallen out of discussion in recent weeks, but they've recently been consolidating year-to-date gains quite nicely.

Investors have seemed focused more on Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA) and others. Earnings and AI-inspired headlines will do that.

Salesforce stock quietly hit new 52-week highs on Monday at $200.50, before reversing lower on the day. The move comes as the stock tries for a major breakout over $200.

Don't Miss: Will Apple Stock Hit 52-Week Highs? Check the Chart.

Despite the software stalwart's unusual combination of solid growth and reasonable valuation, investors didn’t seem to want to own Salesforce.

That’s as the shares didn’t bottom until Dec. 22. Once they bottomed, though, the stock began to perform pretty well. Salesforce shares rallied 29% into its earnings report on March 1, then closed higher by 11.5% the next day as investors cheered the results.

The shares then went on to drop six days in a row -- and set up a run to $200, which has been resistance for seven weeks now.

Trading the Breakout in Salesforce Stock

Chart courtesy of TrendSpider.com

After the sharp post-earnings pullback, Salesforce stock quickly raced to the $200 level. Then it pulled back and again tried to clear $200, and the pattern has now repeated several times.

Here's the key: Each pullback became shallower as each rally up to $200 and the 200-week moving average stalled out. We’re seeing that again this morning.

Ultimately, the bulls are looking for a breakout over this zone, opening the door up to the $207.50 to $210 zone. That’s followed by the $220 area, which is the 50% retracement from the 52-week low up to the all-time high.

Don't Miss: How Far Can Shopify Stock Rally? The Charts Hold a Clue.

Without a close above $200, breakout traders have no reason to be long. Above this level and they’ll have to find an appropriate level for their stop-loss.

One area of interest would be $190.

So far, Salesforce stock has continued to put in a series of higher lows, a bullish technical development. But a close below $190 would put it below the past two pullback lows, negating that trend. It would also put the stock below the 10-day, 10-week and 21-day moving averages.

For now, the focus is on the upside and the $200 level.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.