While earnings season has been winding down, there are a few names still in the spotlight. Tonight it will be Salesforce (CRM), as the company is set to report its third-quarter results.

Earlier in the year, Salesforce was able to buck the macro pressures as its customers continued to spend. That’s as its platform has become essential in many operations.

However, Salesforce's business wasn’t completely immune. Despite beating expectations when it last reported in August, the stock saw a 13.3% decline over the next week as guidance came in a tad light.

It didn’t help that the stock market was pulling back at that time, as well.

Cybersecurity stocks have been similar with Salesforce, in that this industry has continued to do well despite macro pressures and a bear market.

While Palo Alto Networks (PANW) had a strong post-earnings reaction earlier this month, Crowdstrike (CRWD) is down almost 20% today on its bearish earnings reaction.

Trading Salesforce Stock on Earnings

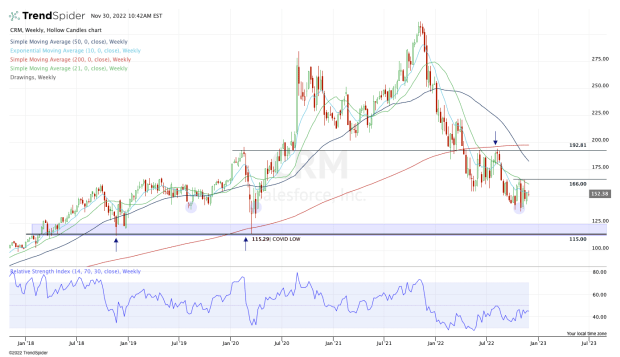

Chart courtesy of TrendSpider.com

For most of the past several years, Salesforce stock has found buyers in the $140 area. More recently, there’s been solid support at the $137.50 area.

On a slightly bearish reaction — which would imply a 7% to 9% post-earnings dip — I want to see if the buyers will again flood into this name and give it a bounce.

Twice in the last two months, this stock has tested into the $137s and both times it led to a rally to $165.

That brings up our next level: $165 to $166. This zone has been resistance for the fourth quarter. It would take a near-10% rally for the stock to get to this level after it reports earnings and an even larger rally to trigger a breakout.

Going into the event, those are the levels to know: $137.50 to $140 on the downside and $165 on the upside.

A breakout over $165 puts the declining 200-day moving average in play near $175, followed by a key pivot near $190.

On the downside, a break below $137.50 that’s not reclaimed could open the door to significant support down in the $115 to $125 zone.

Should we see this zone tested — particularly the lower end of that zone — long-term investors may be inclined to accumulate some sort of position in the name. At that point, Salesforce stock would be down more than 60% from its highs and would be trading in a great risk/reward area.