Shares of Salesforce (NYSE:CRM) are up more than 8% in premarket trading Wednesday after the cloud-based software maker reported better-than-expected Q1 earnings results and hiked its guidance for fiscal 2023.

How Did Salesforce (CRM) Perform in Q1?

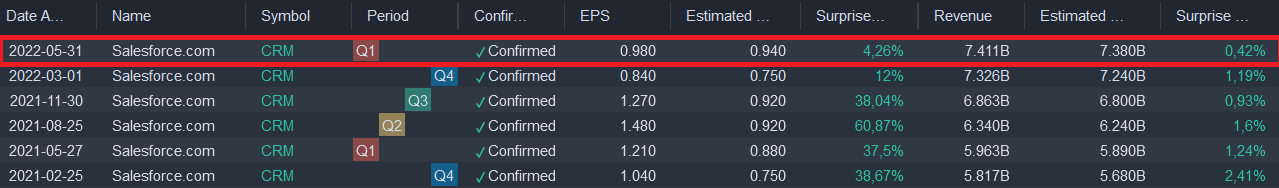

The software company reported adjusted earnings per share (EPS) of 98 cents, topping the consensus estimates of 94 cents, according to Refinitiv. Revenue came in at $7.41 billion, up 24% year-over-year and beating the analyst consensus of $7.38 billion.

Source: Earnings Calendar Benzinga Pro (14-day free trial)

Net income was down 98% at $28 million after the company recorded lower gains on its investments in the three months that ended April 30, while sales and marketing expenses rose.

Salesforce’s Service Cloud business reported $1.76 billion in revenue, up 17% year-over-year. The company generated $1.63 billion in revenue in its core Sale Cloud unit, up 18% from the same period last year. The San Francisco-based company reported $13.64 billion in unearned revenue, driven by subscription billings. The figure was below the consensus estimates of $13.76 billion.

“We’re just not seeing the material impact on the broader economic world that all of you are in,” said Marc Benioff, co-founder and co-CEO of Salesforce.

On the other hand, Salesforce remains aware of the ongoing uncertainty around the macroeconomics, such as the high volatility in Forex rates, noted the company’s CFO Amy Weaver.

Salesforce said it began ending its partnerships with customers in Russia through its retailers after Russia invaded Ukraine in February.

Q2 Guidance

For the second quarter, Salesforce expects adjusted EPS in the range of $1.01 to $1.02, missing the consensus projection of $1.14 per share. The company expects Q2 revenue in the range of $7.69 billion to $7.70 billion, also below the analyst estimates of $7.77 billion.

Salesforce trimmed its revenue outlook for the full fiscal 2023 while elevating its profit guidance. The company now expects full-year EPS in the range of $4.74 to $4.76, compared with the analyst expectations of $4.65 per share.

The company expects full-year revenue in the range of $31.7 billion to $31.8 billion, missing the analyst expectations of $32.06 billion. This compares with Salesforce’s previous adjusted EPS forecast range of $4.62 to $4.64 per share on $32.0 billion to $32.1 billion in revenue for the full year.

Weaver said the improved earnings outlook is “driven by continued focus on disciplined decision-making across the organization, and as a company, we are committed to continuing to improve profitability over the long-term.”

Summary

Source: Earnings Calendar Benzinga Pro (14-day free trial)